Perpetual futures are a unsocial derivative merchandise successful the crypto market. Unlike accepted futures contracts, which person a acceptable expiration date, perpetual futures person nary expiration and purpose to mimic spot marketplace prices. They execute this done a mechanics known arsenic the backing rate, which ensures that the futures terms stays successful enactment with the spot price. Given their adjacent necktie to the spot markets and their quality to connection traders leverage, knowing the dynamics of perpetual futures becomes paramount erstwhile analyzing Bitcoin’s terms performance.

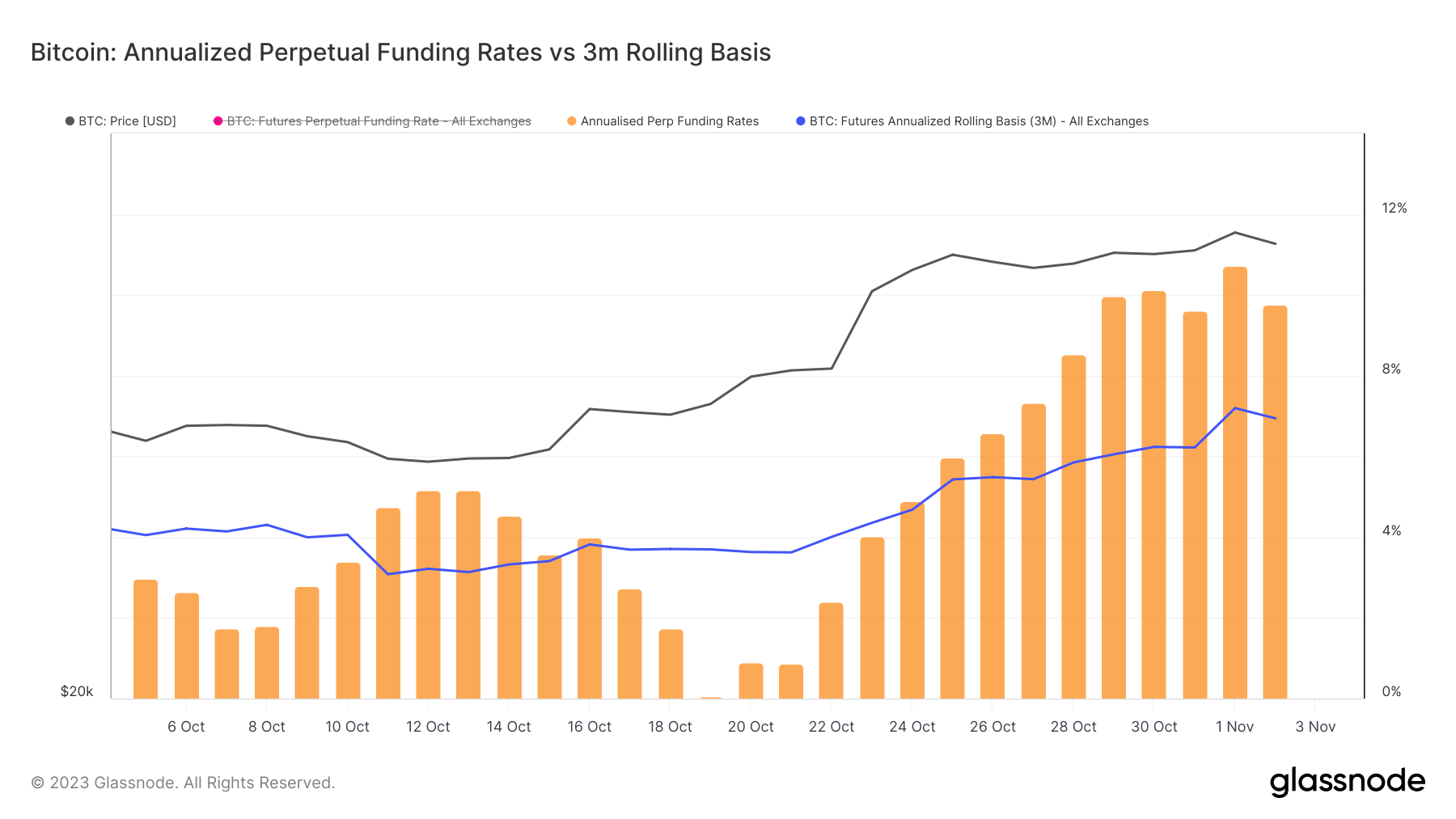

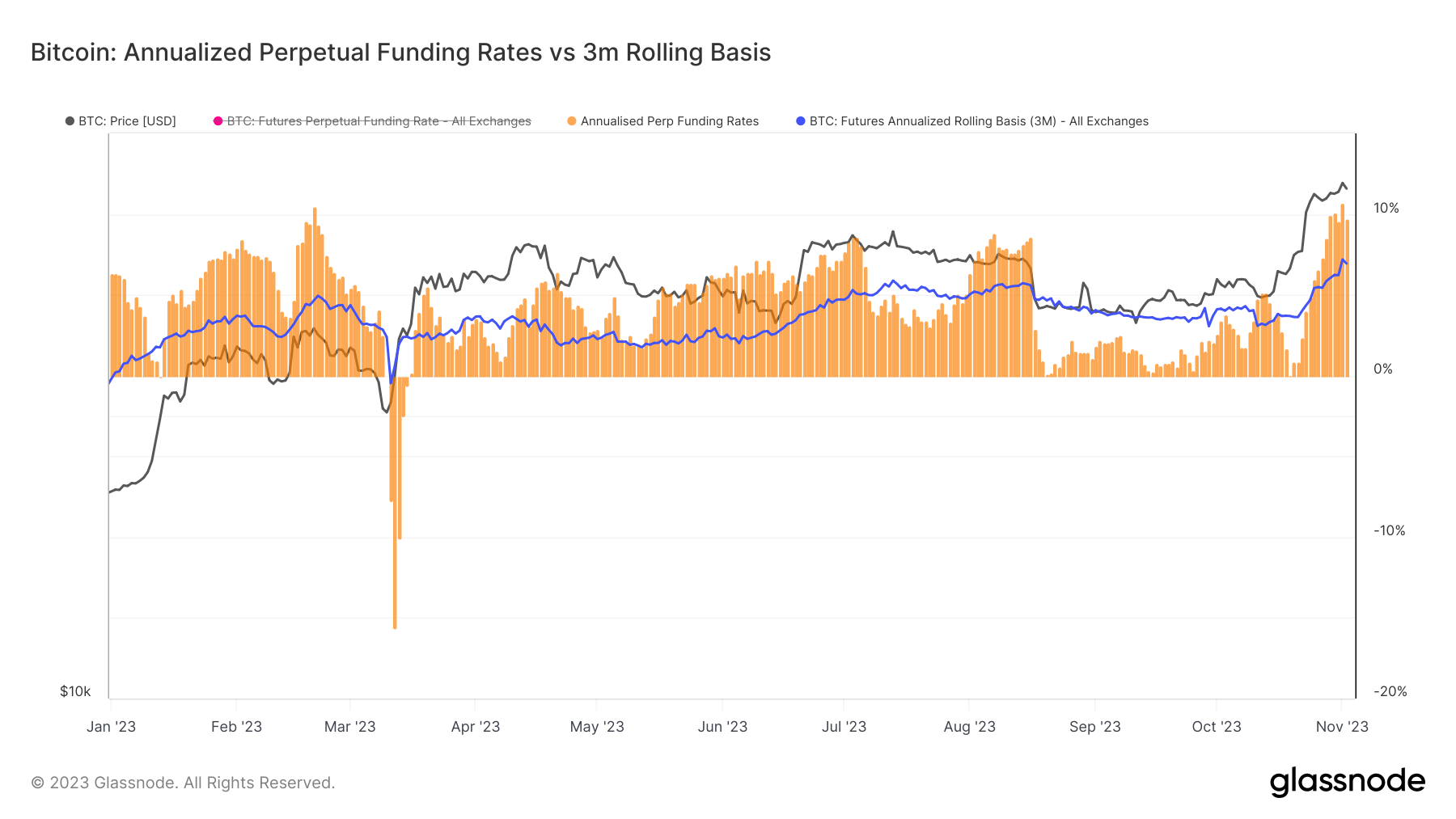

Graph showing the yearly perpetual backing rates and the 3-month rolling ground for Bitcoin futures from Oct. 5 to Nov. 3, 2023 (Source: Glassnode)

Graph showing the yearly perpetual backing rates and the 3-month rolling ground for Bitcoin futures from Oct. 5 to Nov. 3, 2023 (Source: Glassnode)Between Oct.14 and Nov. 3, Bitcoin’s terms experienced a sizeable surge, moving from $26,800 to $34,900. It adjacent concisely touched $35,400 connected Nov. 2. Accompanying this bullish move, the Bitcoin futures annualized three-month rolling ground roseate from 3.322% connected Oct. 14 to a year-to-date all-time precocious of 7.194% connected Nov. 2. Simultaneously, the annualized perps backing complaint escalated from 4.541% to 10.74% by Nov. 1, settling astatine 9.774% connected Nov. 2—also its highest since the commencement of the year.

Graph showing the yearly perpetual backing rates and the 3-month rolling ground for Bitcoin futures from Oct. 5 to Nov. 3, 2023 (Source: Glassnode)

Graph showing the yearly perpetual backing rates and the 3-month rolling ground for Bitcoin futures from Oct. 5 to Nov. 3, 2023 (Source: Glassnode)A rising three-month ground signifies bullish sentiment for Bitcoin’s medium-term prospects. Traders look consenting to wage a premium connected the futures, anticipating the terms of Bitcoin to proceed its upward trajectory implicit the upcoming quarter. On the different hand, a crisp summation successful the perpetual backing complaint indicates utmost short-term bullishness. This could beryllium attributed to a precocious request for leverage by bullish traders successful the perpetual markets. The existent important differential betwixt the perps complaint and the three-month ground suggests an over-leveraged market. Historically, periods wherever the perpetual ground soars supra the 3-month ground often hint astatine utmost optimism among marketplace participants.

While the existent information underscores a prevailing bullish sentiment, it besides hints astatine imaginable vulnerabilities. A heightened request successful some perpetual and three-month futures mightiness suggest that traders expect Bitcoin’s terms to surge further. The robust ground summation underpins this sentiment, showing beardown assurance successful Bitcoin’s aboriginal performance. However, the disparities observed, particularly successful the perps rate, mightiness besides acceptable the signifier for imaginable terms corrections if marketplace sentiment shifts.

The station Perpetual futures marketplace paints a rosy medium-term representation for Bitcoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)