The cryptocurrency marketplace has been a whirlwind of enactment implicit the past week, with Bitcoin (BTC) seeing the astir notable uptick, climbing implicit the $30,000 people for the archetypal clip successful 2 months, a important intelligence milestone that could instrumentality much-needed assurance to the market.

At property time, Bitcoin is trading astatine $30,343.

Over the weekend, Bitcoin managed to support the $30,000 level, adjacent concisely surpassing $31,000. This terms leap was fueled by a question of quality regarding organization adoption, which has been a cardinal operator of Bitcoin’s terms since the opening of the twelvemonth arsenic it indicates increasing mainstream acceptance and imaginable accrued request for the integer asset.

This surge successful Bitcoin’s terms has accrued the profitability of astir holders. This is evident erstwhile analyzing on-chain data, particularly UTXOs successful profit. Unspent Transaction Outputs (UTXOs) are the outputs of Bitcoin transactions that person not been spent and tin beryllium thought of arsenic idiosyncratic ‘coins’ oregon pieces of coins that reside successful a Bitcoin wallet. They are important erstwhile analyzing the marketplace due to the fact that they supply a snapshot of the economical enactment connected the Bitcoin network.

Estimating the nett and nonaccomplishment of Bitcoin’s proviso is important arsenic it provides penetration into the marketplace sentiment and imaginable aboriginal terms movements. One mode to measure this is by analyzing the fig of existent UTXOs that are successful nett oregon loss.

Glassnode calculates the fig of UTXOs successful profit/loss by counting each existing UTXOs whose terms astatine instauration clip was little oregon higher than their existent price. To relationship for the expanding fig of UTXOs implicit time, the information is normalized by the size of the UTXOs to get the comparative fig of UTXOs successful profit/loss, i.e., the percentage.

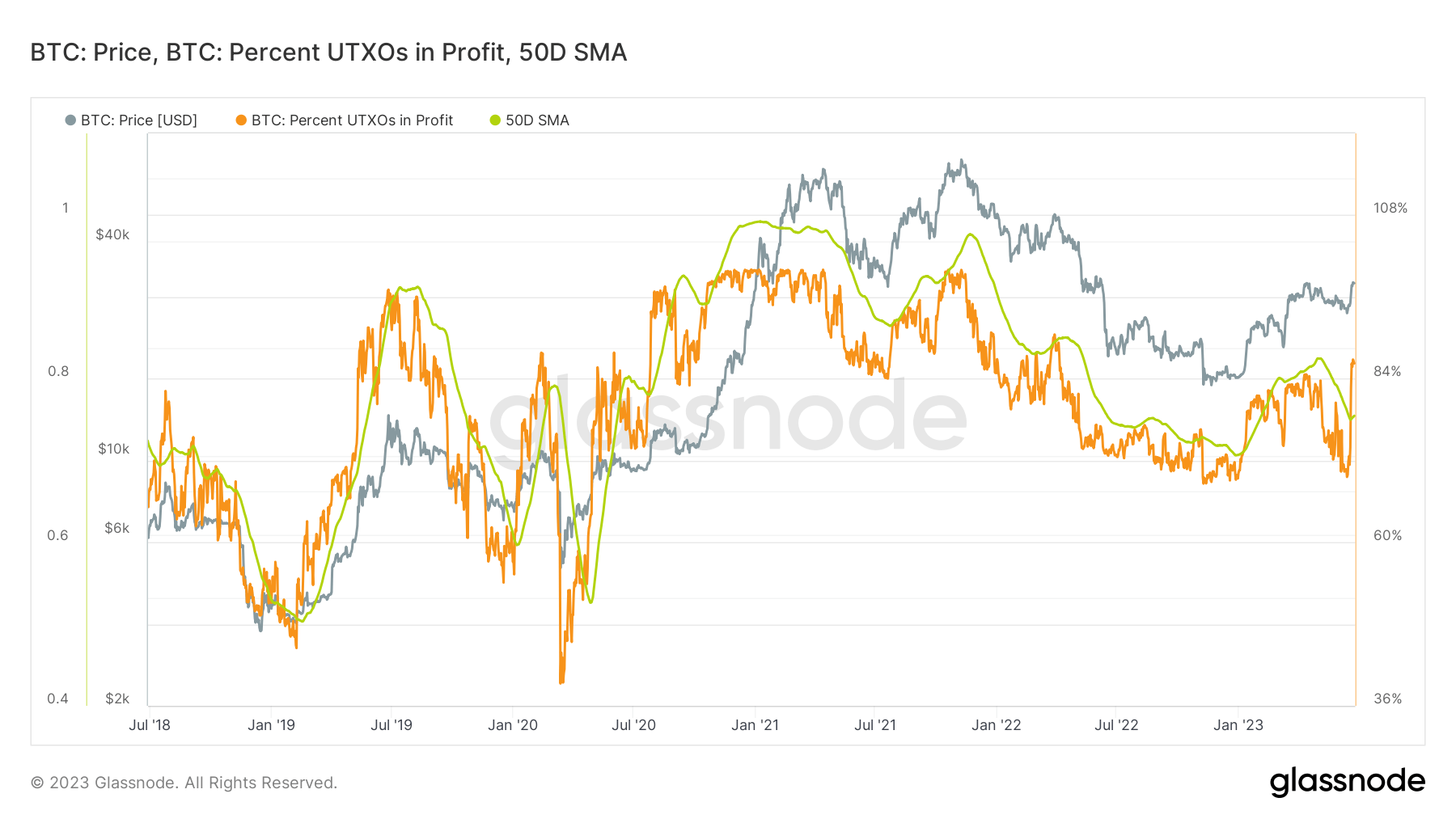

The percent of UTXOs successful nett approaches 100% each clip a erstwhile all-time precocious is broken. According to Glassnode, applying the 50-day elemental moving mean (SMA) to the information fits the historical information optimally and creates a overmuch amended awesome that indicates some planetary and section Bitcoin rhythm tops.

Graph showing the percent of Bitcoin UTXOs successful nett from 2018 to 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin UTXOs successful nett from 2018 to 2023 (Source: Glassnode)CryptoSlate investigation recovered that 86.24% of Bitcoin UTXOs are presently successful profit. This is simply a crisp spike from 69.59% recorded connected June 14 and a flimsy driblet from the 14-month precocious of 86.8% recorded connected June 23. This indicates that astir Bitcoin holders are presently profitable, which could importantly impact the market’s aboriginal trajectory.

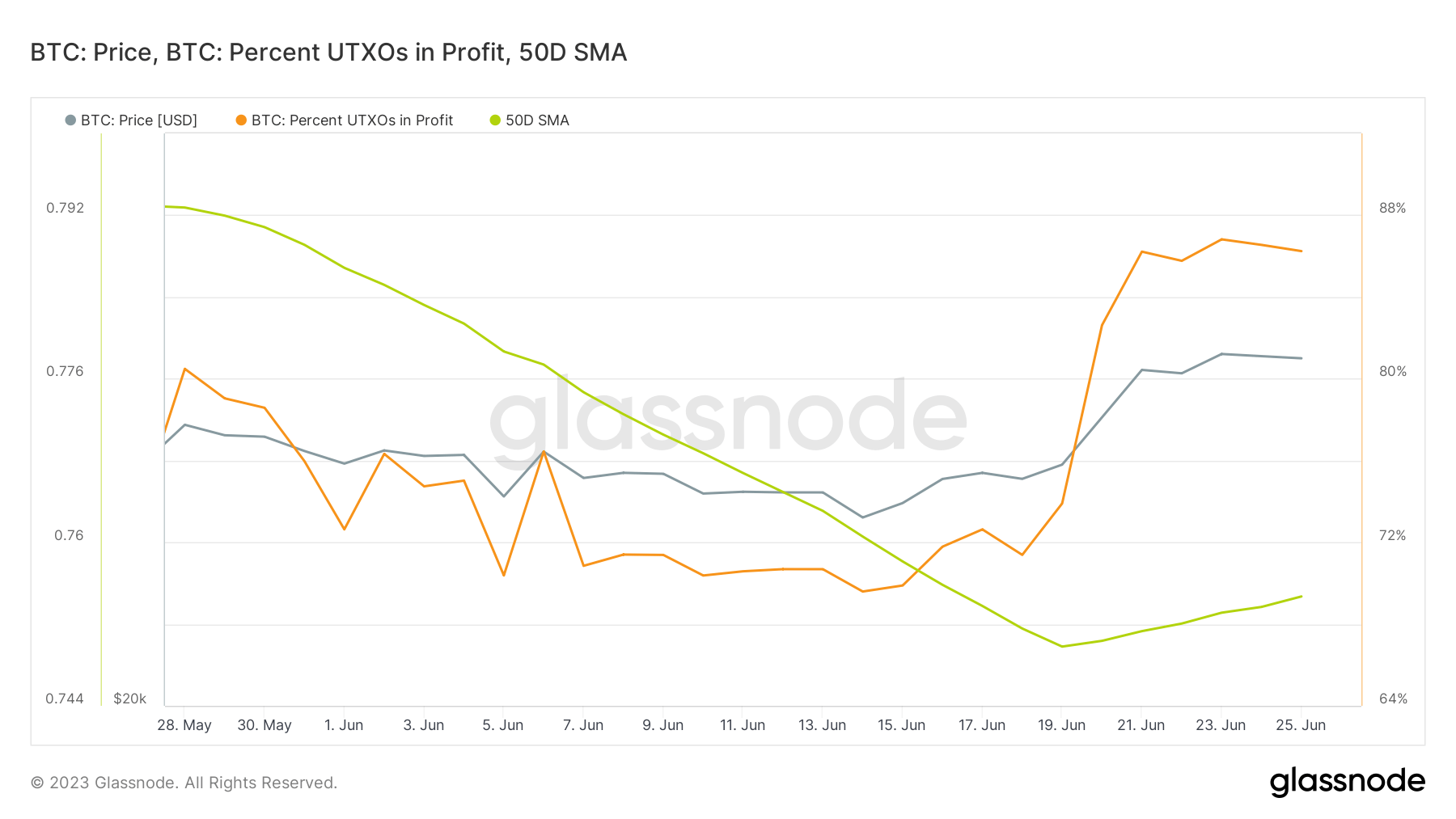

Graph showing the percent of Bitcoin UTXOs successful nett from 26 May to 26 June 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin UTXOs successful nett from 26 May to 26 June 2023 (Source: Glassnode)However, the 50-day elemental moving mean (SMA) for Bitcoin UTXOs successful nett presently stands astatine 75%, a important driblet from the 82.4% level recorded successful May.

The SMA is simply a commonly utilized method indicator that helps creaseless retired terms information by creating a perpetually updated mean price. In this context, it provides a clearer representation of the wide inclination successful the profitability of Bitcoin UTXOs implicit the past 50 days. The driblet successful the SMA suggests that contempt the caller surge successful Bitcoin’s price, the wide profitability of UTXOs has been connected a downward inclination implicit the past 2 months.

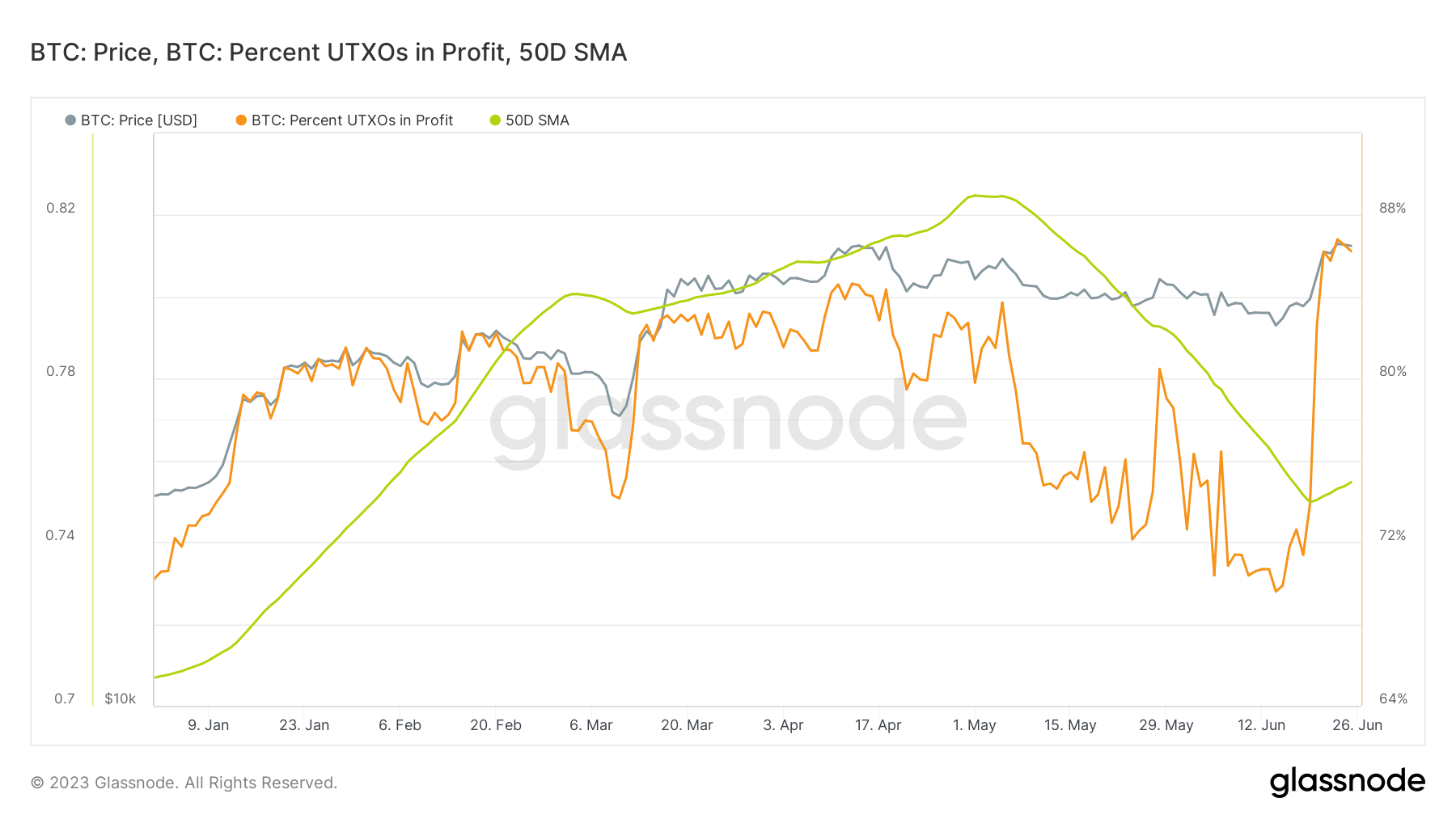

Graph showing the percent of Bitcoin UTXOs successful nett YTD (Source: Glassnode)

Graph showing the percent of Bitcoin UTXOs successful nett YTD (Source: Glassnode)This could beryllium owed to a fig of factors, including Bitcoin holders selling astatine a nonaccomplishment oregon the instauration of caller UTXOs astatine higher terms levels. However, with the caller terms surge pushing the percent of UTXOs successful nett to implicit 86%, it remains to beryllium seen whether this inclination volition continue.

The station Over 86% of unspent Bitcoin successful nett arsenic BTC continues to commercialized supra $30k appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)