Stablecoins, the crypto assets crafted to reflector the stableness of fiat currency, person encountered implicit 600 important instances of terms instability successful 2023, arsenic per Moody’s Analytics. A ‘depeg’ oregon ‘depegging’ lawsuit is characterized by a stablecoin’s worth swinging beyond a 3% borderline from its modular $1 people wrong a day, according to Moody’s Analytics’ latest report.

Stablecoins Wobble successful 2023

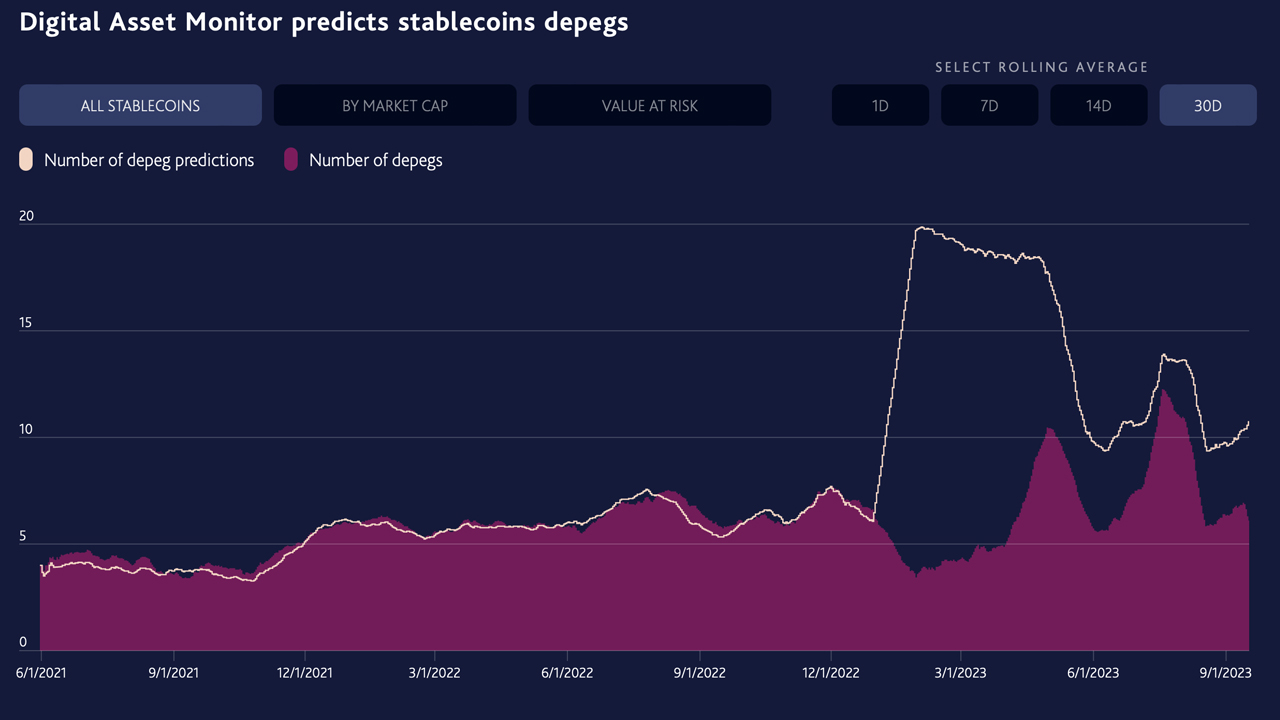

In an effort to support a adjacent ticker connected stablecoin fluctuations, Moody’s Analytics has introduced its Digital Asset Monitor (DAM), focusing connected cardinal players specified arsenic tether, usd coin, and binance usd. This instrumentality has tallied a full of 1,914 depegging events crossed assorted stablecoins, with high-value fiat-pegged tokens experiencing 609 specified instances alone.

The analysts astatine Moody’s Analytics revealed a full of 707 depegging events for stablecoins successful 2022. Stablecoins are engineered to anchor their worth to a fixed rate, commonly $1 per unit, backed by a reserve of fiat currencies oregon different assets to support a azygous value. Despite this, immoderate of the astir sizable stablecoins successful presumption of marketplace worth person fallen abbreviated of their $1 benchmark, arsenic was the lawsuit with USDC during the downfall of Silicon Valley Bank (SVB).

“We person seen the stablecoin marketplace turn into a multibillion-dollar plus people accounting for astir 10 percent of the crypto marketplace and astir on-chain activity,” Yiannis Giokas, the elder manager of Product Innovation astatine Moody’s Analytics wrote. “However, fixed ongoing volatility successful the plus class, we saw important request from our customers to capable a spread successful this abstraction with a broad hazard appraisal instrumentality for integer assets.”

Moody’s latest analytical instrumentality scrutinizes the movements, reserves, and transparency of 25 starring fiat-anchored stablecoins. Leveraging a premix of exclusive data, precocious instrumentality learning, and blockchain scrutiny, the show besides evaluates imaginable aboriginal “depegs.” The study emphasizes that the integer plus monitoring solution does not link to Moody’s recognition ratings business.

Fluctuations successful the broader economical landscape, specified arsenic spikes successful involvement rates, often precipitate a detachment from the stablecoins’ pegged value. Nonetheless, Moody’s findings bespeak that stablecoins regularly acquisition depegging for assorted reasons. The monitor’s intent is to shed airy connected the inherent perils of stablecoins for entities delving into the decentralized concern (defi) sector.

This inaugural by Moody’s to illustration stablecoin enactment follows important depegging episodes that rattled the crypto system successful 2022. Notably, the crash of the algorithmic stablecoin terrausd (UST) on with its sister token LUNA successful May 2022 wiped retired monolithic marketplace capital. Stablecoins service arsenic the cornerstone for cryptocurrency lending and borrowing, and the escalated volatility has sent waves done integer plus values passim 2023.

Moody’s DAM reports that alongside USDC’s depegging incidental during the SVB illness successful the week of March 10, 2023, 5 further stablecoins besides experienced depegging. On May 2, 2023, DAM captured 10 abstracted depegging events. A sizeable fig of fiat-linked tokens person utterly failed to support their trading worth astatine $1.

The volatility of salient stablecoins mightiness travel arsenic a astonishment to many, with tokens specified arsenic USDC, TUSD, FRAX, DAI, BUSD, LUSD, USDT, MIM, and USDP undergoing significant worth fluctuations implicit time. In the second fractional of October, Tangibledao’s USDR plummeted to astir 50 cents and hasn’t recovered since. In different instance, Aave’s GHO stablecoin has ne'er matched the dollar since its inception, presently trading astatine 96 cents contempt the liquidity team’s promises of a resolution.

Paypal’s stablecoin, PYUSD, has dipped to a debased of 97.9769 cents, narrowly avoiding a depegging by the threshold of a 3% driblet from its peg. On August 17, 2023, the caller stablecoin FDUSD deed a grounds low, trading astatine 94.2129 cents per portion — its astir important driblet from the 1:1 dollar parity to date.

What bash you deliberation astir Moody’s Digital Asset Monitor (DAM) and stablecoin report? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)