The size and popularity of the Bitcoin options marketplace person made it 1 of the champion tools for gauging marketplace sentiment and predicting volatility. Previous CryptoSlate investigation recovered that options wielded an outsized influence implicit Bitcoin’s terms volatility and were liable for astir of the volatility we’ve seen this quarter.

Options information has shown a important attraction of unfastened involvement (OI) astatine the $120,000 onslaught terms for contracts expiring astatine the extremity of the year. This peculiar onslaught terms has garnered important attraction from traders, with implicit $640 cardinal successful OI connected Deribit alone. This OI acold surpasses the enactment we’ve seen astatine neighboring strikes crossed astir platforms. Such a dense absorption connected a azygous onslaught terms shows speculators are optimistic astir a terms summation but creates a anticipation of precocious volatility successful the coming weeks.

Graph showing the unfastened involvement and onslaught prices for Bitcoin options connected Deribit expiring connected Dec. 27, 2024 (Source: Kaiko)

Graph showing the unfastened involvement and onslaught prices for Bitcoin options connected Deribit expiring connected Dec. 27, 2024 (Source: Kaiko)Open involvement successful onslaught prices acold supra the existent spot terms of Bitcoin tin bespeak that traders are consenting to stake connected bonzer terms movements. While Bitcoin’s terms astatine property clip remains importantly beneath the $120,000 level, fixed astatine astir $107,000, the options delta tin supply a clearer position connected the probability of specified bets materializing.

Delta, a cardinal options metric, represents the sensitivity of an option’s terms to changes successful the underlying plus and tin besides service arsenic an approximation of the option’s probability of expiring successful the money. For the $120,000 onslaught expiring connected December 27, the delta sits astatine astir 0.10, suggesting a 10% accidental that Bitcoin volition scope oregon transcend this terms by year’s end, information from Kaiko showed.

Graph showing the delta for assorted onslaught prices for Bitcoin options connected Deribit connected Dec. 17, 2024 (Source: Kaiko)

Graph showing the delta for assorted onslaught prices for Bitcoin options connected Deribit connected Dec. 17, 2024 (Source: Kaiko)As options are forward-looking, they supply penetration into wherever traders judge the marketplace could determination and however volatile they expect it to be. A precocious attraction of unfastened involvement astatine a peculiar onslaught and important measurement amusement which levels traders spot arsenic significant. In this case, the $120,000 onslaught emerges arsenic a preferred point.

This is peculiarly important due to the fact that options enactment often precedes spot marketplace trends, arsenic traders usage options to hedge, speculate, oregon capitalize connected expected volatility. High unfastened involvement connected specified a precocious onslaught terms shows the marketplace is preparing for a crisp terms increase.

The size of Deribit’s OI shows the dominance of crypto-specific platforms successful the Bitcoin options market. While CME, Binance, and OKX each connection options trading, Deribit remains the wide leader, peculiarly for high-strike calls.

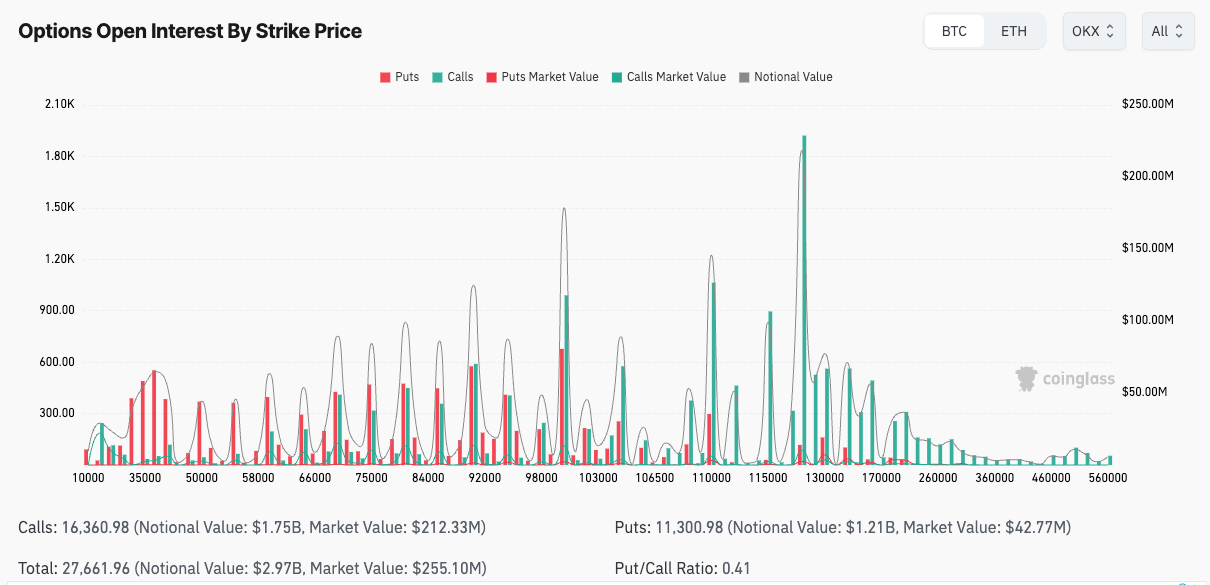

Graph showing the unfastened involvement for Bitcoin options connected OKX by onslaught terms connected Dec. 17, 2024 (Source: CoinGlass)

Graph showing the unfastened involvement for Bitcoin options connected OKX by onslaught terms connected Dec. 17, 2024 (Source: CoinGlass)On Deribit, unfastened involvement is highly concentrated not lone astatine $120,000 but besides astatine different cardinal intelligence levels, specified arsenic $100,000, $110,000, and $130,000. This clustering indicates that traders are hedging oregon speculating astir cardinal terms thresholds, apt anticipating important terms enactment successful the past fewer weeks of the year. When combined with debased deltas, the information shows traders are betting connected low-probability, high-reward outcomes.

The disparity betwixt Deribit’s options information and the activity connected platforms similar CME reflects a wide disagreement betwixt organization and retail participation. While CME information reflects a much blimpish positioning among organization traders, the speculative enactment connected Deribit points to a higher appetite for hazard among crypto-native participants. This shows the value of monitoring aggregate platforms erstwhile analyzing the options market. Deribit, arsenic the person successful liquidity and unfastened interest, often sets the code for Bitcoin options trends, portion accepted platforms supply a complementary presumption of organization flows.

From a volatility perspective, options onslaught terms information and unfastened involvement levels are arsenic important for knowing however the marketplace is pricing risk. The attraction of enactment astatine distant strikes suggests that traders expect Bitcoin’s terms to grounds precocious levels of volatility starring into the extremity of the year. Options, peculiarly out-of-the-money calls, often service arsenic inexpensive bets connected utmost moves. Substantial OI astatine strikes acold supra the existent spot terms indicates that traders expect terms swings ample capable to warrant these positions, adjacent if the probability of occurrence remains low.

The station Options traders stake large connected Bitcoin reaching $120K contempt debased odds appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)