Bitcoin options are a captious portion of the broader cryptocurrency market, arsenic the dynamics wrong these derivatives contracts tin supply invaluable insights into marketplace trends and imaginable aboriginal movements.

Bitcoin options are fiscal contracts that springiness investors the close but not the work to bargain oregon merchantability Bitcoin astatine a predetermined terms wrong a specified clip frame.

They service arsenic indispensable hedging and speculative tools, allowing marketplace participants to negociate hazard and marque informed concern decisions. Changes successful the derivatives marketplace tin straight interaction Bitcoin’s spot price, reflecting broader marketplace sentiment and capitalist behavior.

Puts and calls are the 2 superior types of options contracts. A enactment enactment gives the holder the close to merchantability an plus astatine a circumstantial price, portion a telephone enactment grants the close to buy.

Monitoring the ratio of puts to calls is captious arsenic it tin awesome marketplace sentiment. A precocious put/call ratio whitethorn bespeak bearish sentiment, portion a debased ratio whitethorn suggest bullish sentiment.

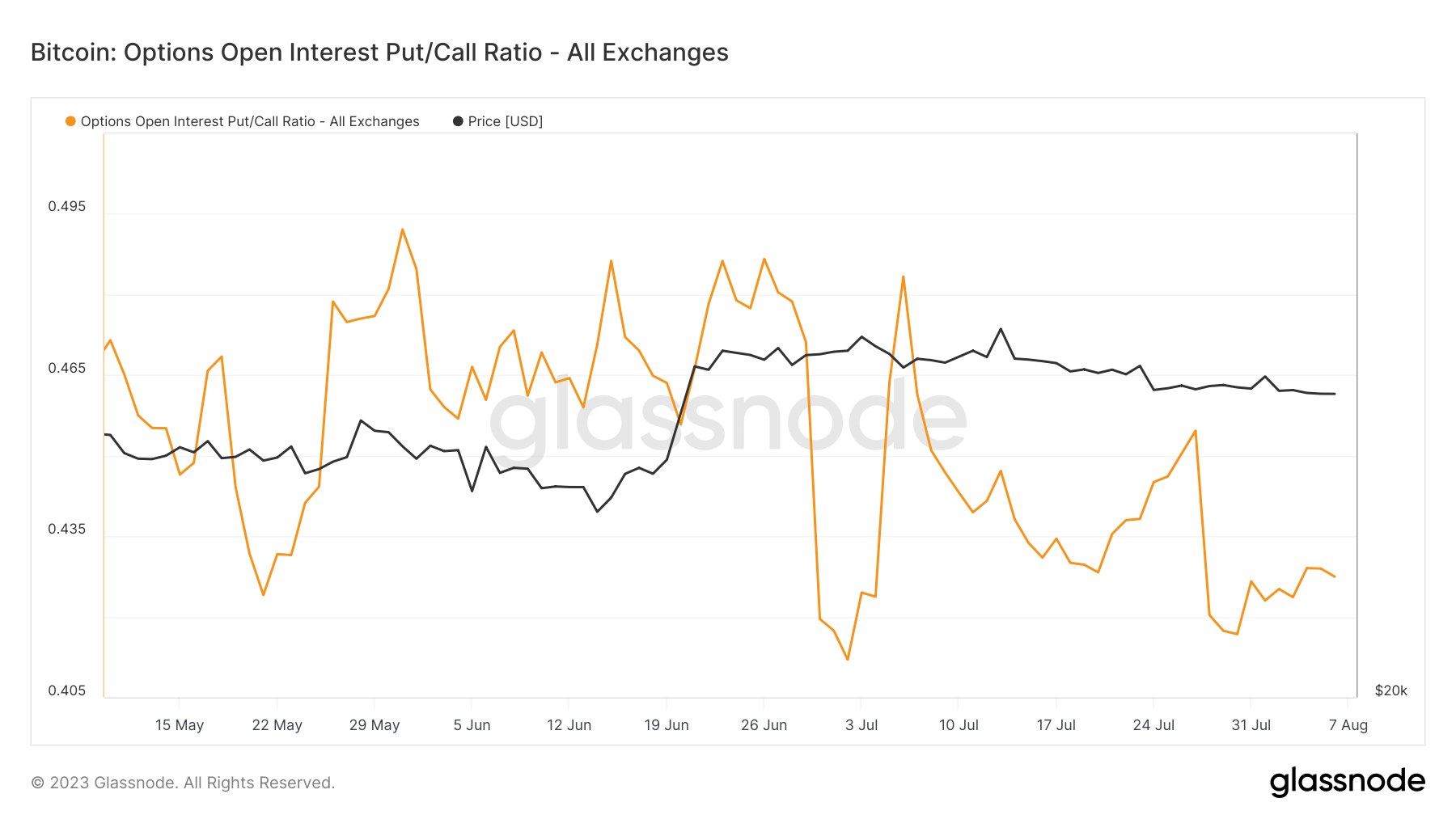

The Bitcoin Options Open Interest Put/Call Ratio is simply a metric that measures the full fig of unfastened enactment options to telephone options successful the market. This ratio dropped sharply connected July 27, reaching this year’s lows.

The diminution successful this ratio whitethorn awesome a displacement successful marketplace sentiment, perchance indicating accrued assurance successful Bitcoin’s terms rise.

Graph showing the Options Open Interest Put/Call Ratio from May 7 to Aug. 7, 2023 (Source: Glassnode)

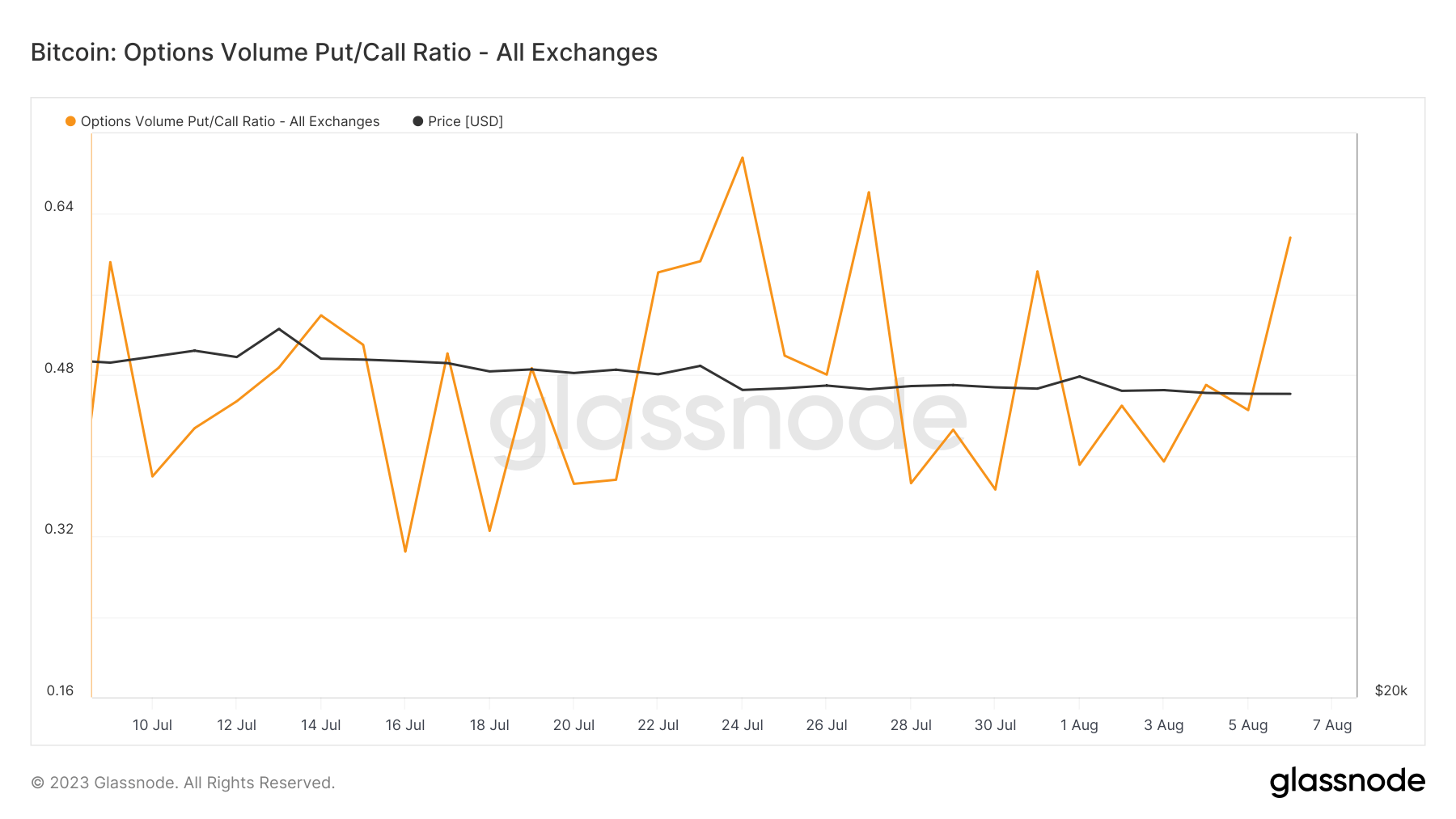

Graph showing the Options Open Interest Put/Call Ratio from May 7 to Aug. 7, 2023 (Source: Glassnode)Another indispensable metric is the Bitcoin Options Volume Put/Call Ratio, which measures the trading measurement of enactment options to telephone options. Unlike the unfastened put/call ratio, the measurement ratio experienced a akin driblet connected July 27 but has since recovered, experiencing a 64% increase.

This betterment mightiness bespeak a much balanced marketplace sentiment, reflecting some optimism and caution among traders.

Graph showing the Options Volume Put/Call Ratio from July 7 to Aug. 7, 2023 (Source: Glassnode)

Graph showing the Options Volume Put/Call Ratio from July 7 to Aug. 7, 2023 (Source: Glassnode)The steep diminution successful the unfastened put/call ratio and the betterment successful the measurement ratio mightiness bespeak a analyzable marketplace scenario.

While the driblet successful the unfastened ratio whitethorn awesome bullish sentiment, the consequent betterment successful the measurement ratio suggests that traders are besides hedging against imaginable downside risks.

When analyzed together, these 2 ratios supply a nuanced presumption of the market, reflecting optimism and caution.

The station Options Put/Call Ratio suggests cautious optimism among traders appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)