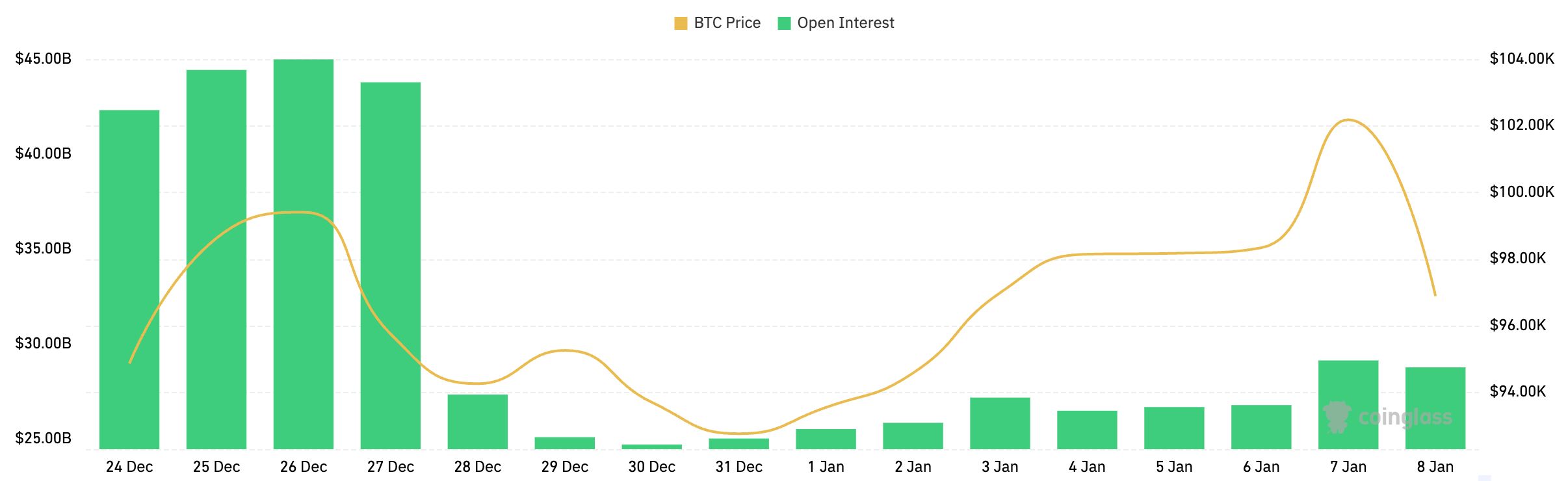

The Bitcoin options marketplace saw important volatility successful December, arsenic the full unfastened involvement dropped from $44.99 cardinal to $29.13 cardinal betwixt Dec. 26 and Jan. 7. This 35% diminution marked 1 of the largest unfastened involvement flushes successful the past year, fundamentally changing the market’s positioning heading into 2025.

The superior catalyst for this monolithic unwinding was Bitcoin’s terms volatility. After reaching $99,405 connected Dec. 26, Bitcoin dropped sharply to $92,759 by Dec. 31, marking a 6.69% diminution successful conscionable 5 days. While the 6.69% driblet mightiness not look ample fixed Bitcoin’s humanities volatility, the marketplace has precocious go highly delicate to drops beneath the intelligence $100,000 level. The velocity and magnitude of Bitcoin’s determination apt triggered a cascade of presumption closures, affecting leveraged traders who built up vulnerability during the erstwhile rally supra $100,000.

Chart showing Bitcoin options unfastened involvement from Dec. 24, 2024, to Jan. 8, 2025 (Source: CoinGlass)

Chart showing Bitcoin options unfastened involvement from Dec. 24, 2024, to Jan. 8, 2025 (Source: CoinGlass)However, information shows that this terms driblet wasn’t conscionable a bearish crook but a structural displacement successful however traders attack risk. While unfastened involvement fell sharply, Bitcoin’s terms recovered and adjacent broke supra $102,000 earlier returning to $95,000. This divergence betwixt recovering prices and reduced unfastened involvement indicates that traders are much cautious contempt bullish terms action.

Data from CoinGlass showed calls represented 60.51% of unfastened involvement but lone 41.54% of trading volume, with puts taking 58.46% of regular measurement connected Jan. 7. This organisation suggests traders are maintaining their longer-term bullish positions portion actively trading puts for protection, a notable alteration from mid-December erstwhile calls dominated some unfastened involvement and volume.

The interaction of December’s terms volatility connected options positioning becomes adjacent much evident erstwhile examining marketplace behaviour during the decline. The crisp downward determination benefited enactment holders and apt caused important losses for bare telephone sellers, starring to presumption adjustments crossed the market. The mean regular terms determination of 1.56% during this play would person peculiarly affected gamma exposure, forcing marketplace makers to set their hedging positions much frequently.

The operation of reduced wide vulnerability with accrued enactment trading suggests blase marketplace participants are implementing much analyzable strategies alternatively than taking axenic directional bets. This behaviour is indicative of a maturing marketplace wherever hazard absorption takes precedence implicit speculation.

Instead of assertive leveraged bets, marketplace participants look to usage options structures offering defined hazard parameters. This attack allows for upside information portion protecting against crisp reversals, a acquisition apt learned from December’s volatility.

This marketplace positioning reset could enactment much sustainable terms appreciation successful the agelong run. However, contempt little unfastened interest, the implicit level of options vulnerability inactive remains important astatine implicit $29 billion. This means that the imaginable for volatility is inactive contiguous successful the market.

The station Options OI sees historical plunge arsenic marketplace shifts to cautious trading appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)