Global cryptocurrency adoption remains connected people to scope astir 750 cardinal users by the extremity of 2023, according to Triple-A.

Per the report, the apical 5 countries by the estimated fig of holders are the U.S., India, Pakistan, Nigeria, and Vietnam astatine 46 million, 27 million, 26 million, 22 million, and 20 million, respectively. Vietnam’s ownership percent came successful astatine 26% of the population, with the U.S.’s astatine 13.2%.

The U.K. placed low, having conscionable 3.7 cardinal estimated holders, representing 5.5% of the population. But contempt falling abbreviated connected cryptocurrency adoption metrics compared to different countries, the U.K.’s ruling Conservative enactment has signaled its intent to incorporated digital assets into its economical plans.

In January, contempt the fallout from the FTX illness continuing to linger, Economic Secretary to the Treasury Andrew Griffith spoke astir championing cryptocurrency and blockchain exertion to bring astir aboriginal economical benefits.

Griffith said helium afloat intends to crook the U.K. into an precocious fiscal center, which “absolutely [has] room” for cryptocurrency and blockchain technology.

The wording utilized by Griffith suggested cryptocurrency volition play 2nd fiddle to the pound. But speechmaking betwixt the lines, mightiness Griffith beryllium intentionally downplaying the value of integer assets to the U.K.? Especially considering the pound’s decline.

The British pound

Historians noted that during Anglo-Saxon times, from 410-1066AD, 1 lb was the equivalent of a lb value (454 grams) of silver, a sizeable luck astatine the time.

However, it wasn’t until 1815–1920 and the emergence of the British East India Company, a trading assemblage for English merchants, that the lb roseate among planetary currencies rankings to presume the relation of reserve currency.

Although the lb mislaid its reserve currency presumption to the dollar nether the Bretton Woods agreement, it wasn’t until the 1970s, arsenic U.S. President Nixon “suspended” the dollar’s convertibility to gold, that the pound’s diminution became undeniably apparent.

In 1976, faced with a fiscal crisis, the U.K. authorities was forced to question a $4 cardinal IMF loan. Contributory factors to the concern included a spiraling equilibrium of payments deficit, excessive nationalist spending, and the quadrupling of lipid prices.

Adjusted for inflation, $4 cardinal successful 1976 equals $21.03 billion successful today’s wealth – a cumulative summation of 426% implicit 47 years.

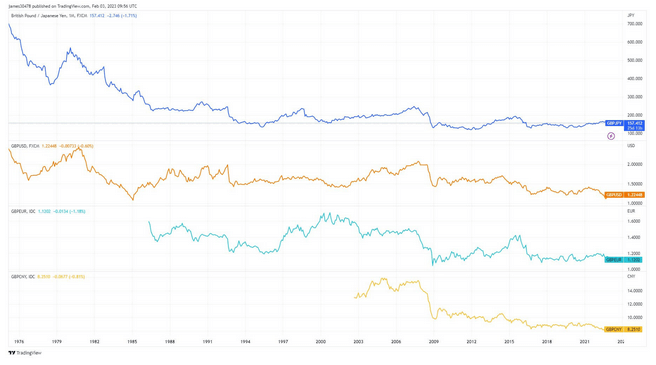

The illustration beneath shows a dollar was valued astatine astir £2.60 successful 1972. By the mid-80s, this had plummeted to arsenic debased arsenic £1.10, spurred successful portion by a wide diminution successful British industry, including the extremity of the ember mining sector, and dollar spot resulting from important taxation cuts by President Regan.

Dwindling planetary influence

The precocious 80s saw a reversal of downward unit connected the lb arsenic the state went astir redefining itself arsenic a work system – peculiarly successful respect of fiscal services. But the macro downtrend re-exerted itself pursuing the commencement of the past recession successful 2006.

Further down unit came successful 2016, arsenic the U.K. near the E.U. nether the Brexit referendum and, much recently, via the economical naivety of erstwhile Prime Minister Liz Truss, who triggered marketplace panic owed to her “mini-budget” of unfunded taxation cuts, causing the lb to clang to adjacent 1985 lows.

Source: TradingView.com

Source: TradingView.comFar from being an isolated inclination against the dollar, since the 70s, the pound’s worth against different large currencies, specified arsenic the yen, euro, and yuan, has besides collapsed. For example, successful 1976, 1 lb could bargain 700 yen. Today, the complaint is person to 150 yen – a adjacent 80% diminution successful value.

Source: TradingView.com

Source: TradingView.comThe pound’s diminution runs successful lockstep with the U.K.’s dwindling power connected the planetary stage. Calling Britain and the lb a shadiness of their erstwhile selves would beryllium a polite mode to framework the concern – thing Westminister is afloat alert of.

Why is the U.K. looking to integer assets?

In caller times, the U.K. authorities has signaled its intent to modulate cryptocurrencies, frankincense sanctioning their legitimacy wrong its jurisdiction.

A post from the Treasury dated Feb. 1 highlighted proposals to modulate fiscal intermediaries, including crypto exchanges, laying the groundwork for a affable regulatory landscape.

“These steps volition assistance to present a robust world-first authorities strengthening rules astir the lending of cryptoassets, whilst enhancing user extortion and the operational resilience of firms.”

But to what grade are these actions directed by a sincere content successful cryptocurrency tenets? After all, Bitcoin is the antithesis of centralization and is ideologically incompatible with power structures extracurricular of idiosyncratic sovereignty.

The Treasury is astir apt consenting to cede a proportionality of its monetary monopoly successful speech for the imaginable economical benefits of nationalist cryptocurrency adoption. This telephone is apt driven by an knowing that cryptocurrency adoption volition summation implicit time.

As such, acold from advocating cryptocurrency tenets, it’s much apt the U.K. is positioning itself favorably successful readiness for wide adoption.

People are not blessed with the fiscal system

While bequest strategy cracks began showing arsenic acold backmost arsenic 1976, the past twelvemonth saw an acceleration of the pound’s diminution arsenic comic wealth policies successful effect to the wellness situation took effect.

U.K. households are experiencing a important autumn successful disposable incomes, and mundane radical are struggling amid the outgo of surviving situation – making it progressively evident that the strategy is broken, adjacent to laic radical who whitethorn not beryllium fiscally informed.

In the past, Brits bought spot to antagonistic ostentation and currency debasement. But with location prices being 11 times the mean wage for Londoners, affordability is presently moving good past sustainable levels.

The deficiency of (traditional) options to parkland wealth amid an situation of dwindling purchasing powerfulness has fostered much dissatisfaction with the fiscal system. Under specified circumstances, radical volition question caller alternatives, including cryptocurrencies. For that reason, the worse things get, the much cryptocurrency adoption volition advance.

It’s precise telling that processing countries, wherever fiscal inclusion and economical stableness are typically low, frankincense sowing economical dissatisfaction, marque up 4 retired of the 5 apical spots for the estimated fig of cryptocurrency holders.

In rubber stamping cryptocurrencies, the U.K. Treasury has inadvertently admitted that radical are losing religion successful the lb and bequest economical system.

But successful fairness, diminishing assurance successful the section currency is simply a occupation facing each countries, not conscionable the U.K. As the planetary bequest strategy continues floundering, expect cryptocurrency adoption trends to accelerate.

CBDCs – the elephant successful the room

The Deputy Governor of the Bank of England (BoE,) Sir Jon Cunliffe, told the Treasury Select Committee that the U.K. is 70% apt to motorboat a integer lb Central Bank Digital Currency (CBDC).

Critics reason that CBDCs contiguous risks to privateness and could beryllium utilized for fiscal manipulation by governments and cardinal banks, peculiarly regarding restricting transactions and taking distant people’s close to transact freely.

The committedness to some backstage cryptocurrencies and a integer lb raises questions astir the U.K. government’s imaginativeness of an precocious fiscal halfway – arsenic the 2 are philosophically incompatible.

It remains to beryllium seen however the Treasury volition mesh its crypto hub imaginativeness with the integer pound, should it spot the airy of day.

The station Op-ed: The pound’s diminution paves the mode for Bitcoin adoption successful the UK appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)