The FTX illness has revived the communicative that “Bitcoin maximalists were close each along.”

Given the size of the troubled speech and the fig of entities caught up successful its web, the FTX ungraded has dominated headlines of late.

Worse still, each passing time seemingly brings further twists that constituent to superior failings wrong the institution and among the regulatory bodies which were expected to forestall specified scandals from happening successful the archetypal place.

In particular, questions bent implicit Sam Bankman-Fried’s (SBF) governmental power and connections, arsenic good arsenic FTX’s evident “pass” with the Securities and Exchange Commission (SEC).

Behind the veil of high-profile sporting and personage endorsements, FTX managed to physique a trusted estimation wrong its comparatively abbreviated three-and-a-half years of existence. Although skeptics said the reddish flags were ever there, that is nary consolation to those who banked connected FTX and mislaid big.

At the bosom of the ungraded lies FTX’s autochthonal FTT token and the mode it was managed. In the people of a liquidity accent test, it fell abbreviated of justifying its lofty pre-collapse $3.4 cardinal marketplace headdress valuation.

The nett effect of the ungraded is the nonaccomplishment of billions and an manufacture scrambling to sphere what small estimation and credibility remain.

Undoubtedly, the bankruptcy has birthed a caller question of Bitcoin maximalism, and arsenic immoderate mightiness say, their vitriol towards sh*tcoins has proven to beryllium connected the people clip and clip again.

Self-custody Bitcoin arsenic the answer

The starring cryptocurrency is elemental successful plan and by each accounts a dinosaur successful presumption of technology. However, maxis constituent retired that these aforesaid “deficiencies” are what makes Bitcoin the lone integer plus to hold.

On the bases that Bitcoin has nary overseeing foundation, crooked incentives, oregon groups with peculiar rights, maxis reason that the tenets of decentralization, transparency, and immutability are applicable lone to BTC.

In passionately defending this view, the Bitcoin-only assemblage has been labeled toxic and narrow-minded successful the past. Yet, the events of the past week show a grade of truth, astatine slightest from the position of anti-Ponzinomics arsenic applied to speech tokens.

With deed aft deed coming from Celsius, BlockFi, Voyager, Terra Luna, and more, the penny is opening to drop. Trust, simplicity, and honesty trump output and short-term gain.

As the manufacture emerges from the FTX achromatic swan, the BTC maxi question volition lone turn stronger.

Altcoins are “evil”

On-chain Analyst Jimmy Song wrote a lengthy portion connected the “moral lawsuit against altcoins.” He covered a scope of points against altcoins, including falsely riding connected the legitimacy of BTC and the power of short-term incentives from VCs.

He argued that “altcoins are evil” and simply reflector the fiat strategy but successful a caller package. With that, their proliferation volition not pb to fiscal freedom, arsenic is often the extremity of galore who participate the crypto space. Rather, the beingness of altcoins lone befuddles cryptocurrency from the position of getting the existent thing, that is Bitcoin.

Additionally, Song argued that the altcoin abstraction hinders Bitcoin adoption, frankincense preventing those who request it the astir from acquiring it owed to attraction being drawn to newer much shiny projects.

“Altcoins are a cesspool of theft, cronyism and rent-seeking. Altcoins physique themselves up connected the estimation that Bitcoin has worked hard to attain. They enrich the VCs and altcoin pumpers astatine the disbursal of the mediocre and vulnerable.”

Most would person labeled specified views arsenic utmost successful the past, oregon possibly excessively achromatic and white. However, the incessant CeFi scandals this twelvemonth person pushed much radical to judge these points.

On-chain information shows the penny has dropped

Despite merchantability unit impacting the Bitcoin terms successful the contiguous term, semipermanent HODLers proceed to believe.

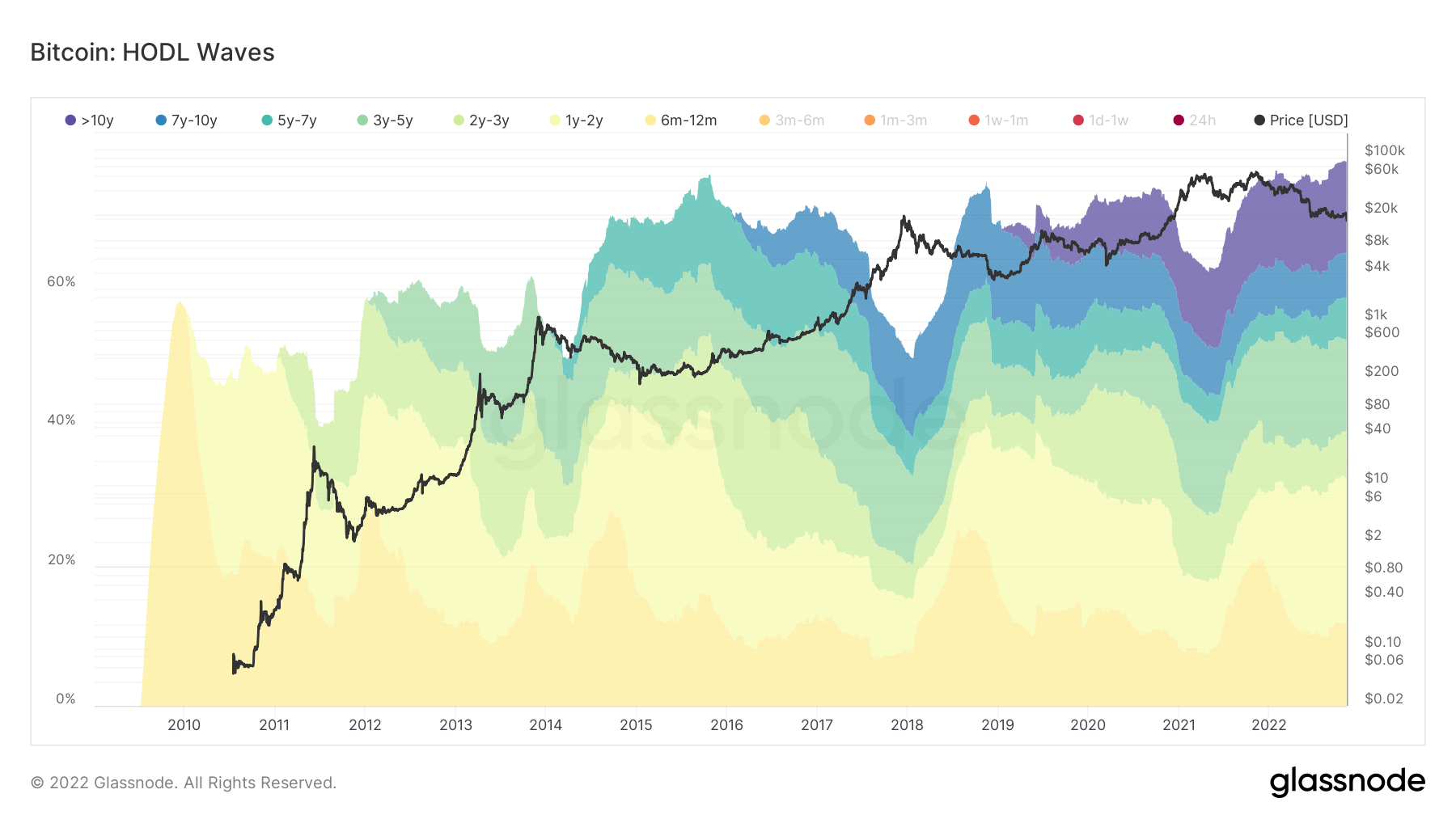

The HODL Waves illustration shows the magnitude of BTC successful circulation divided by property bands representing the past clip proviso moved.

The illustration beneath shows a beardown uptick successful the over-10-year property band. This has been a noticeable signifier since astir 2020. However, the>10y question continues to widen arsenic the BTC terms drops.

What’s more, the full property bands combined travel successful astatine 76% – a caller all-time high.

Source: Glassnode.com

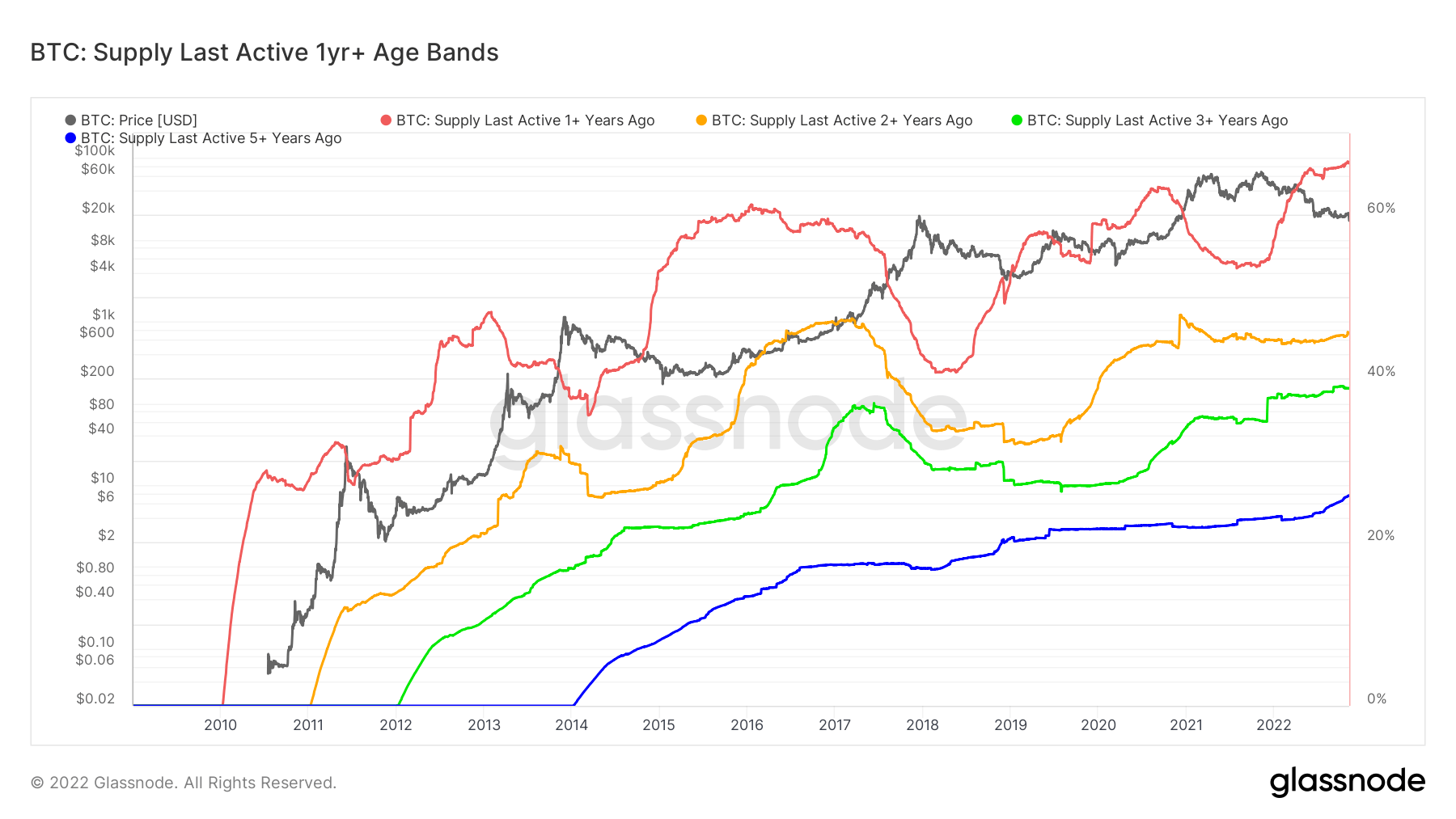

Source: Glassnode.comAnalyzing progressive proviso crossed broader clip ranges shows a wide uptrend crossed each categories greater than 1 year. The astir progressive since 2022 is the reddish 1+ twelvemonth agone group, suggesting comparatively caller participants are turning maxi.

Source: Glassnode.com

Source: Glassnode.comThe station Op-Ed: FTX killed crypto, agelong unrecorded Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)