The eventual goals of tokenization see full-fledged secondary trading markets for alternate backstage assets, integration and portability into the DeFi ecosystem, and greater concern accessibility. While determination are a fig of platforms and work providers offering tokenization-as-a-service, determination person typically been inherent limitations associated with bringing existing bequest assets on-chain successful a dynamic manner.

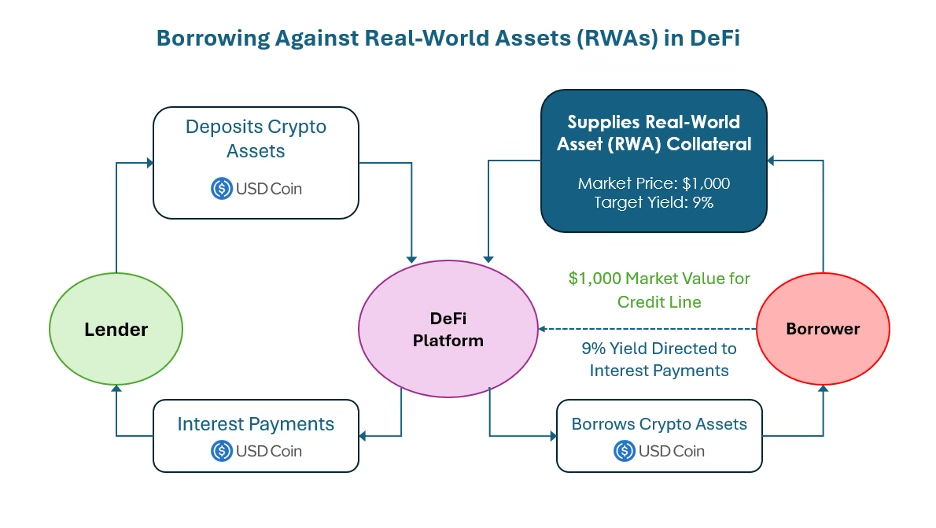

Tokenizing a portfolio of loans from a middle-market nonstop lender whitethorn make an accidental to usage the portfolio collateral arsenic non-crypto collateral wrong DeFi applications similar Moonwell, Aave oregon Morpho, for example. The perfect real-world plus lending workflow taken from Blue Water’s Opportunities successful Tokenization 2025 study is displayed below.

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Importantly, the conception volition apt neglect if the nonstop lender lone marks its portfolio holdings quarterly, semi-annually oregon annually, arsenic that timeline drastically lags the accustomed real-time execution expected wrong integer plus markets. To genuinely unlock the trillions of dollars of current, performing alternate assets successful the beingness determination indispensable beryllium an operating strategy oregon systems that alteration end-goal applications; these applications see decentralized exchanges, decentralized lending platforms and peer-to-peer collateral transfers from which to perpetually gully fiscal plus data. But doing this for DeFi applications is not feasible by sifting done tens oregon hundreds of Excel spreadsheets and siloed files successful an effort to ingest asset-level data.

Below are immoderate further factors for information successful shifting towards blockchain environments:

1. Transparency and proof-of-metrics — “metric” being thing including reserves, holdings, state, authorization, etc. — are the lifeblood of crypto markets. Bringing bequest assets on-chain successful a meaningful mode volition necessitate above-average levels of transparency, astatine slightest for nonstop investors and participants.

2. Any operational speedbumps inhibiting a 24/7 operating docket volition trim spot and summation execution hazard successful the eyes of crypto investors. That means manual worker updates, edits and moving hours volition alteration the attractiveness of real-world assets to the crypto markets.

3. As a operation of the archetypal 2 points, seasoned crypto participants volition apt necessitate a holistic solution enabling real-time monitoring of the off-chain assets backing their tokens and adjacent real-time execution speed, whether that beryllium trading, subscriptions, redemptions oregon indebtedness processing.

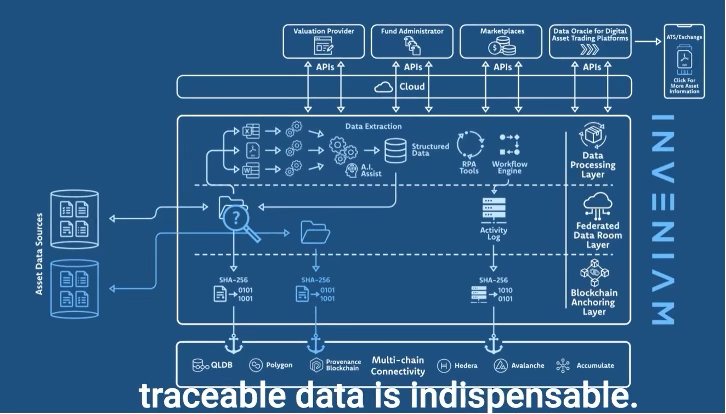

For example, Inveniam's blockchain-based operating strategy displayed present enables backstage assets to span into crypto-native ecosystems that they antecedently could not.

These points are not arsenic threatening to newly-issued digitally-native assets similar Tradable’s $1.7 cardinal successful loans oregon Figure’s $10+ cardinal successful HELOCs, since the afloat beingness rhythm and associated information of these products began and inactive exists on-chain. However, for the trillions of dollars worthy of existing assets that galore successful the tract are targeting, porting operating and lifecycle information from an array of Excel sheets to an operating strategy that tin ingest the data, credential it connected a blockchain, and ping that information retired successful real-time volition enactment things astatine the extremity line.

Platforms specified arsenic the Inveniam operating strategy displayed supra and Accountable, arsenic good arsenic blockchain layers similar Chainlink and Pyth, supply immoderate low-hanging effect for plus managers and superior markets players to get token-ready by onboarding to blockchain rails.

8 months ago

8 months ago

English (US)

English (US)