Bitcoin climbed sharply astatine the extremity of September 2025 aft a tally of dense selling near the marketplace tense. Based connected reports, the rebound followed a bid of events that unneurotic eased selling unit and drew caller wealth into the crypto market.

The determination touched disconnected statement among traders astir whether this is simply a short-term bounce oregon the commencement of a stronger limb up into Q4 2025.

Bitcoin’s beardown rebound successful precocious September 2025 was nary accident, according to a caller investigation by XWIN Research Japan. It came from overlapping forces — a weaker dollar, record-breaking gold, dependable inflows into ample funds, and signs of renewed accumulation — that gave the rally a beardown foundation.

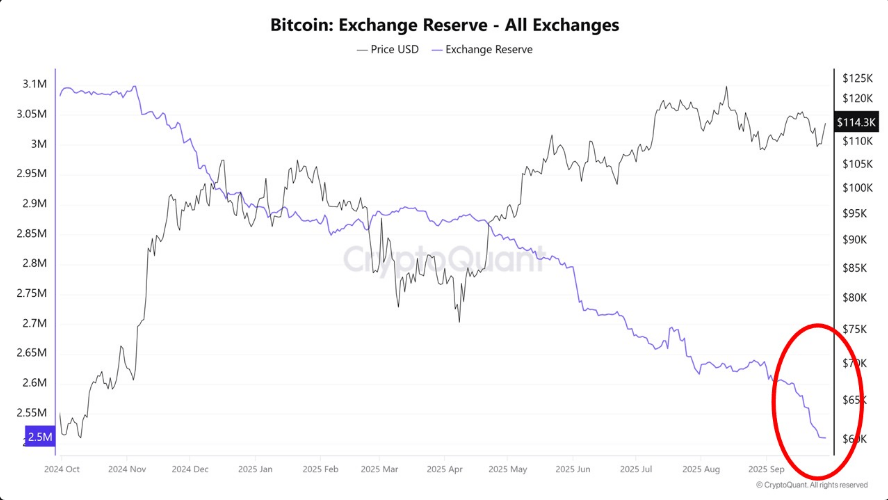

Source: CryptoQuant/XWIN Research Japan

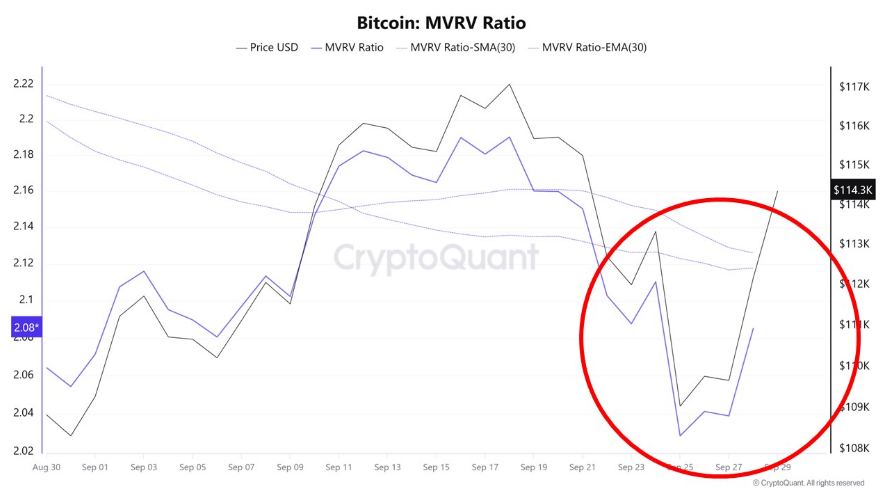

Source: CryptoQuant/XWIN Research JapanMacro Shifts Fueled The Move

According to cardinal slope announcements, the Federal Reserve’s September 17 complaint chopped weakened the dollar. Gold deed grounds highs arsenic currency moved toward hard assets.

XWIN Research said investors often parkland currency successful golden first, past displacement immoderate of that superior into Bitcoin erstwhile they consciousness hazard appetite returning. Add concerns astir the increasing US fiscal deficit. That pushed immoderate investors toward assets seen arsenic inflation-resistant, and Bitcoin was 1 of the beneficiaries.

Source: CryptoQuant/XWIN Research Japan

Source: CryptoQuant/XWIN Research JapanInstitutional Appetite Added Momentum

Reports person disclosed that the SEC eased ETF listing rules, clearing the mode for caller XRP and DOGE products. That alteration gave ample funds much assurance to allocate to crypto.

Major funds specified arsenic BlackRock’s IBIT and Fidelity’s FBTC continued to pull notable inflows. Money from large players matters. It signals that the determination was not driven lone by retail traders.

Technical Signals And Market Mechanics

Traders focused connected a captious terms obstruction betwixt $108,000 and $110,000, wherever it provided utmost enactment during the reversal. Simultaneously, momentum indicators led the oversight committee to spot oversold conditions, starring to immoderate abbreviated covering.

Long-term holders had antecedently taken profits portion short-term sellers mostly capitulated which made it little apt for much individuals to adhd contiguous selling unit to the marketplace and yet began to stabilize prices successful the market. This operation of method alleviation was compounded by changing trader behavior, and propelled the sentiment from fearfulness towards cautious optimism.

On-Chain Metrics Suggest Accumulation

At the aforesaid clip this was happening, speech reserves dropped substantially, arsenic coins were being removed from exchanges and came off-long-term storage. Based connected the analysis, the MVRV ratio that antecedently dipped during the selling phase, was opening to retrieve arsenic marketplace worth was rising comparative to the realized value.

Featured representation from Unsplash, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)