Movement Labs, the scandal-plagued crypto startup backed by Donald Trump’s World Liberty Financial, softly promised ample stakes of its token to aboriginal insiders—undisclosed deals that present rise caller questions astir who truly holds powerfulness down the scenes.

Even earlier its token launch, Movement Labs committed ample portions of MOVE’s proviso to a fistful of aboriginal advisers — arrangements that were ne'er disclosed to investors and lone surfaced done interior documents reviewed by CoinDesk.

Two concern memos obtained by CoinDesk — 1 promising a azygous advisor astir $2 cardinal a twelvemonth — amusement however Movement, founded successful 2023 by 2 20-year-old Vanderbilt dropouts, leaned heavy connected these advisers to summation a foothold successful the crypto industry.

Movement Labs said the agreements, dated soon aft the project's founding, were exploratory successful quality and non-binding.

The beingness of the agreements nevertheless casts caller airy connected the chaotic interior workings of Movement, which came nether occurrence aft CoinDesk reported past month that insider market-making deals enabled token dumping by insiders.

The fallout has sparked waves of finger-pointing wrong the company, centering connected who steered Movement into a predatory statement with a Chinese marketplace shaper nether presumption that analysts accidental incentivized predatory selling.

The hostility has boiled implicit into a nationalist rift betwixt co-founders Rushi Manche, who was terminated by Movement Labs this month, and Cooper Scanlon, who stepped backmost from his CEO relation but remains astatine the company.

“When we started Movement, I was the CTO — starring the engineering team. I near astir concern decisions, including the contracts, to Cooper,” Manche told CoinDesk successful an interrogation for this report. “When priorities changed, our roles changed, but Cooper’s decisions successful the aboriginal days heavy shaped the mode the motorboat went.”

Shadow advisers

CoinDesk spoke to much than a twelve radical acquainted with Movement implicit the people of its investigation, including existent and erstwhile employees who were granted anonymity truthful they could talk freely.

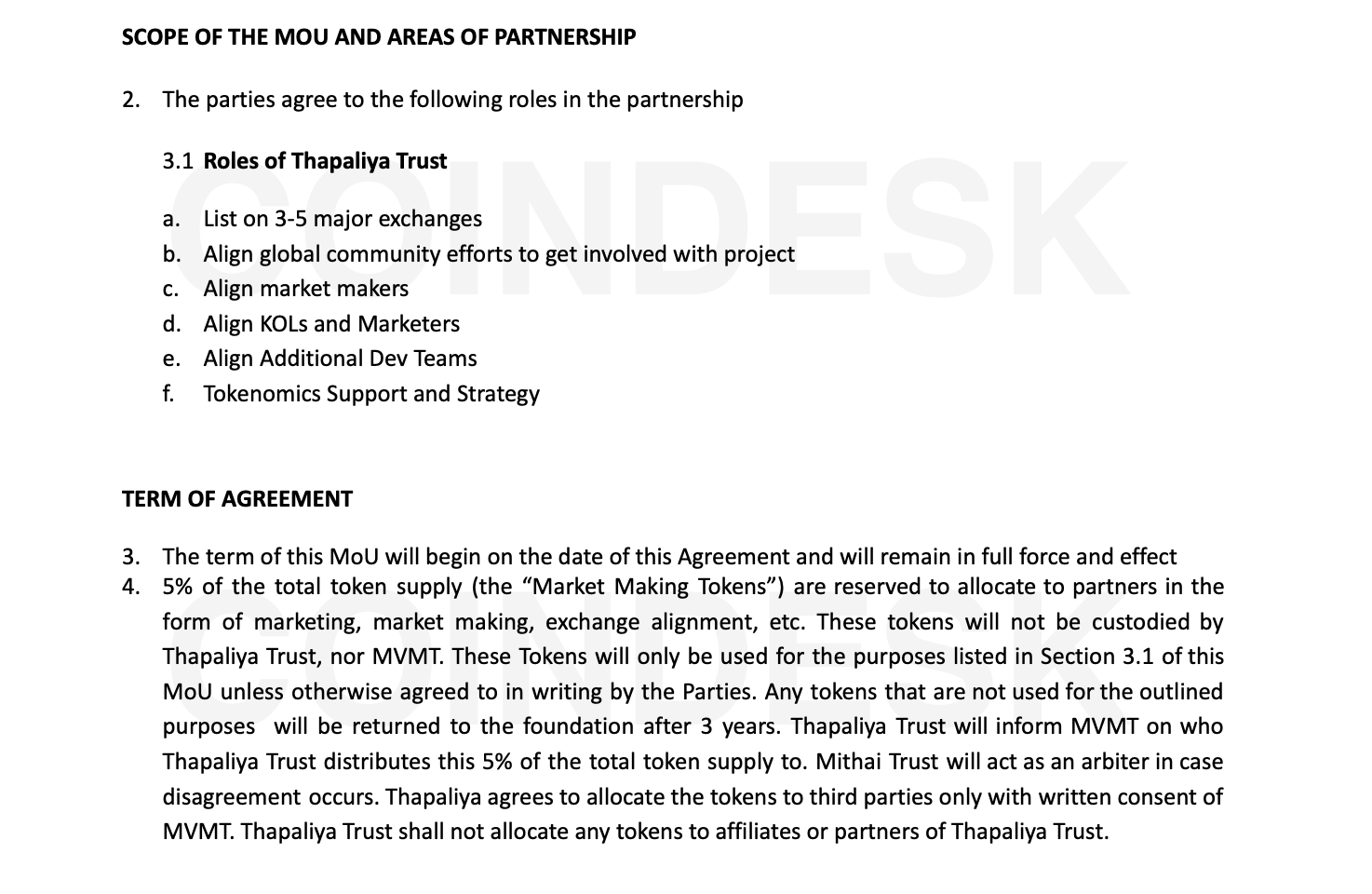

The agreements obtained by CoinDesk interest Sam Thapaliya and Vinit Parekh, some of whom played behind-the-scenes roles successful shaping the task during its aboriginal stages. Together, they were allocated entree to arsenic overmuch arsenic 10% of the full MOVE token proviso successful signed memoranda of knowing that insiders accidental were intentionally kept disconnected the books.

Thapaliya, the CEO of Zebec Protocol and an aboriginal advisor to Manche and Scanlon, was loaned 5% of MOVE’s proviso for selling and market-making purposes, according to one of the agreements obtained by CoinDesk. A second agreement allocated Thapaliya 2.5% of the token's full supply, worthy much than $50 cardinal astatine recent prices.

Movement Labs told CoinDesk the signed agreements with Thapaliya were not binding, but Thapaliya claimed the agreements "were ne'er voided."

While framed arsenic memoranda of knowing — usually considered non-binding — the agreements examined by CoinDesk besides see provisions stating "both parties" indispensable consent to their termination.

"I program connected pursuing legally to workout my assertion to retrieve 2.5% of tokens," Thapaliya said.

Employees astatine Movement referred to Thapaliya arsenic a “shadow co-founder” and said helium was often consulted by Scanlon and Manche for large decisions.

His sanction besides surfaced successful interior communications regarding Movement’s woody with Web3Port. The Chinese marketplace shaper was aboriginal blamed for dumping $38 cardinal successful tokens aft MOVE’s debut — an lawsuit that triggered a sell-off and Binance relationship bans.

The magnitude loaned to Web3Port, 5% of MOVE's supply, was identical to the magnitude loaned to Thapaliya per the agreement.

When contacted by CoinDesk successful beforehand of the archetypal investigation, Thapaliya denied having immoderate fiscal involvement successful Movement Labs oregon the Movement Foundation. He besides denied engagement successful the Web3Port deal.

In aboriginal messages connected Signal, Thapaliya told CoinDesk that his enactment with Movement was accordant with their agreement: “As per the declaration signed successful February 2023, I fulfilled the agreed presumption by supporting Cooper [Scanlon] successful exchange-related discussions, strategizing token allocation, assisting with marketplace shaper selection, and helping prosecute the squad that audited his airdrop model.”

Memoranda of understanding

The usage of informal agreements to softly allocate tokens to insiders reflects a broader signifier wrong the crypto industry, wherever ample sums tin alteration hands without appearing successful authoritative fundraising disclosures.

In 2024, CoinDesk reported that Eclipse — different task linked to Thapaliya — secretly allocated 5% of its token proviso to an worker astatine Polychain, a large crypto task steadfast that aboriginal invested successful the project. Polychain is besides an capitalist successful Movement Labs. Eclipse's woody with the Polychain worker was scrapped pursuing the work of CoinDesk's investigation.

What these cases exemplify is not needfully fraud, but the easiness with which crypto startups tin marque important fiscal commitments down closed doors — commitments that tin aboriginal signifier the trajectory of an full token ecosystem, often without the assemblage oregon adjacent immoderate employees ever knowing.

One idiosyncratic acquainted with the substance said Movement's agreements were tailored to explicitly debar disclosures to investors oregon assemblage members.

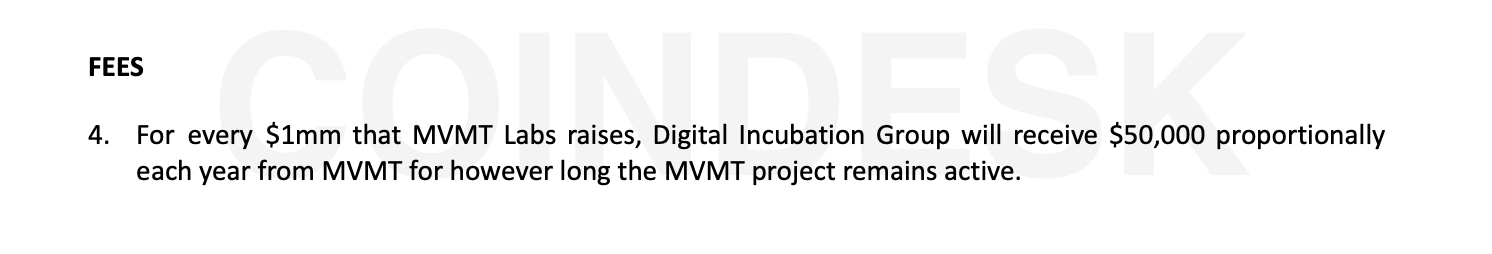

In another 2023 agreement obtained by CoinDesk, Movement Labs agrees to springiness an entity linked to Vinit Parekh, "Digital Incubation Group," $50,000 annually for each $1 cardinal raised by Movement Labs — a sum that would full astir $2 cardinal per year, based connected Movement’s $38 cardinal successful funding. Another agreement granted a abstracted Parekh entity power of 2.5% of the MOVE token supply.

In speech for his allocation, Parekh’s firm, Digital Incubation Group, was tasked with a wide mandate, including: “development of strategy framework, validated by applicable stakeholders; consultation done the pre-seed rise process (including proposal and transportation to investors), adjacent effect raise; improvement of tokenomics and merchandise plan; prosecute successful structuring squad pre-product launch.”

Like Thapaliya’s agreements, Parekh's were structured arsenic memoranda of knowing with a termination clause requiring consent from some "parties." Parekh and Movement Labs some said the agreements were exploratory and that funds ne'er changed hands betwixt either party.

Two radical adjacent to Movement Labs said that Parekh, a Microsoft merchandise manager-turned blockchain manufacture consultant, was nevertheless a predominant beingness astatine Movement's San Francisco bureau and played a relation successful the company's hiring, marketing, and strategy decisions.

"I conscionable attraction astir the ecosystem," Parekh told CoinDesk successful an interview. "No wealth was fixed to maine oregon to anyone I know," successful transportation to the agreements, "[b]ut I did assistance them connected the selling strategy and knowing however to bash go-to-market."

A rift betwixt founders

The fallout from Movement’s market-making ungraded has exposed a widening rift betwixt its co-founders, Manche and Scanlon.

After an excerpt from 1 of the Thapaliya agreements leaked connected X, Manche pointed to Scanlon’s signature connected the memo, highlighting his erstwhile partner’s relation successful approving the deal. He besides reposted a connection questioning whether Movement Labs was “throwing [Manche] nether the bus” portion Scanlon “played innocent.”

Manche was ousted from Movement Labs earlier this month, soon aft CoinDesk reported helium had helped coordinate the project’s arguable market-making statement with Web3Port and an intermediary known arsenic Rentech — a 3rd enactment that Movement aboriginal claimed misrepresented itself successful the deal.

CoinDesk has since learned that Manche besides played a relation successful facilitating a abstracted statement betwixt Web3Port and Kaito, different crypto task that shares the aforesaid manager and wide counsel arsenic Movement Foundation. A declaration reviewed by CoinDesk shows that OpenKaito Foundation loaned 2.5% of its KAITO token proviso to Web3Port for market-making purposes.

The statement — which was besides leaked connected X by an anonymous relationship — was terminated soon aft it was signed, according to an X post from Kaito laminitis Yu Hu. Unlike the Movement deal, it did not see presumption that experts said incentivized pump-and-dump behavior.

A idiosyncratic acquainted with the substance said Manche introduced Kaito to Rentech, which past connected the task to Web3Port.

The contention has already dented Movement’s estimation successful an manufacture that erstwhile saw the startup arsenic a rising star. Coinbase, the largest U.S. crypto exchange, announced it would suspend trading of the MOVE token connected May 15. The token’s terms fell by 50% successful the pursuing week.

On May 7, Movement Labs said it would rotation retired a caller entity, Movement Industries, to service arsenic the network’s superior developer. Scanlon remains with the enactment but has stepped down arsenic CEO.

6 months ago

6 months ago

English (US)

English (US)