Bitcoin’s hash complaint represents the full computational powerfulness employed to excavation and validate transactions connected the network. Beyond simply representing the sheer computing prowess, the hash complaint serves arsenic a barometer for the network’s information and vitality.

A robust hash complaint indicates not lone a precocious information of miners but besides underscores the network’s resilience against imaginable attacks. Monitoring this metric is crucial, arsenic fluctuations tin connection insights into miner sentiment, imaginable web vulnerabilities, and the wide wellness and decentralization of the Bitcoin ecosystem. In essence, the hash complaint is simply a multifaceted indicator, reflecting some the method spot and the corporate assurance successful the Bitcoin network.

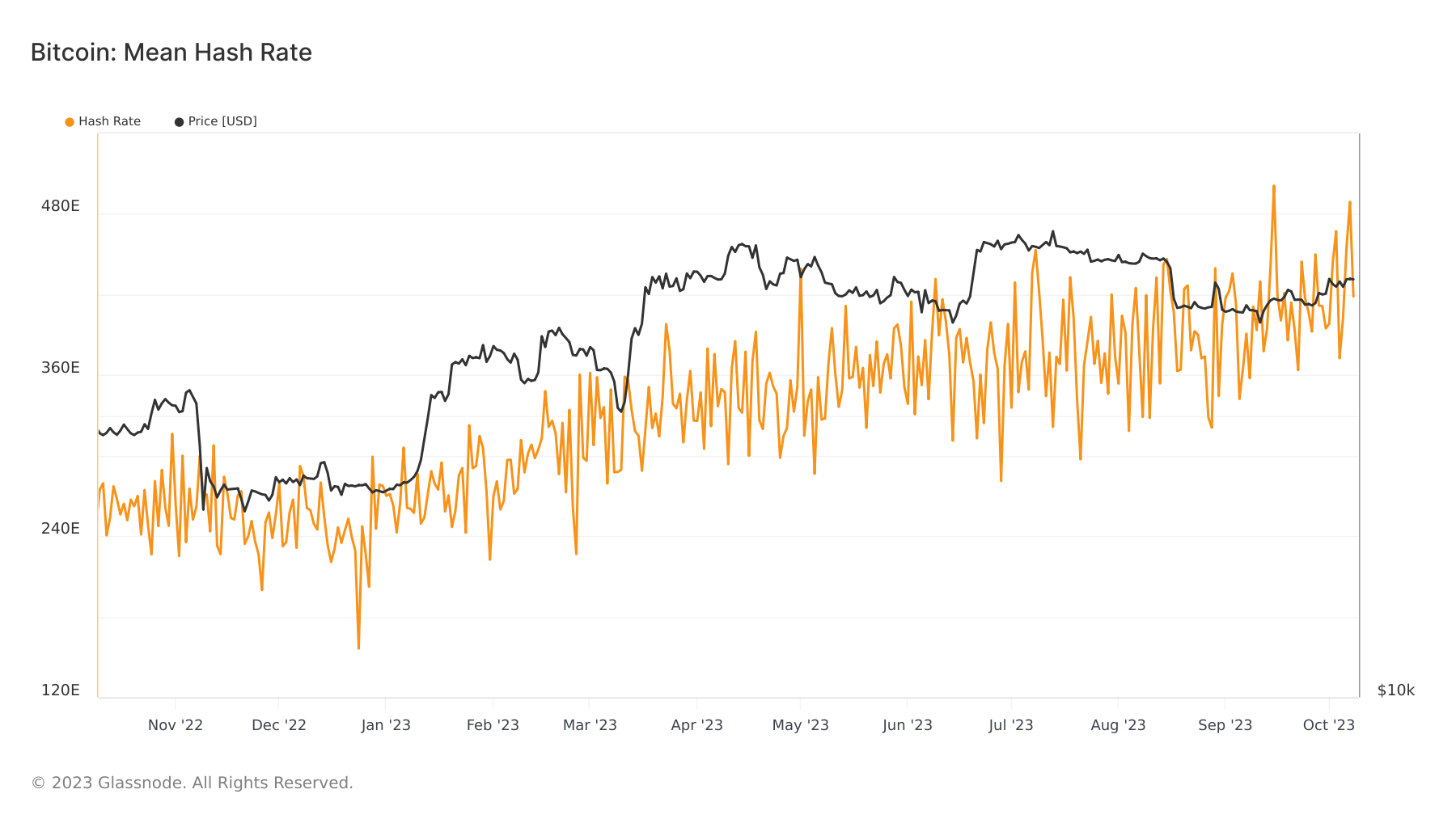

Bitcoin’s hash complaint has been posting caller all-time highs each week since December 2022, peaking astatine 501 EH/s connected Sep. 15. As of Oct. 8, the hash complaint stands astatine 418 EH/s.

Graph showing Bitcoin’s hash complaint from October 2022 to October 2023 (Source: Glassnode)

Graph showing Bitcoin’s hash complaint from October 2022 to October 2023 (Source: Glassnode)However, simply looking astatine the hash complaint fails to supply much discourse to marketplace sentiment. To get a amended knowing of miner health, we indispensable analyse the convergence and divergence of the moving averages of the hash rate. Monitoring this metric is crucial, arsenic fluctuations tin connection insights into miner sentiment, imaginable web vulnerabilities, and the wide wellness and decentralization of the Bitcoin ecosystem. Hash ribbons are a multifaceted indicator, reflecting some the method spot and the corporate assurance successful the Bitcoin network.

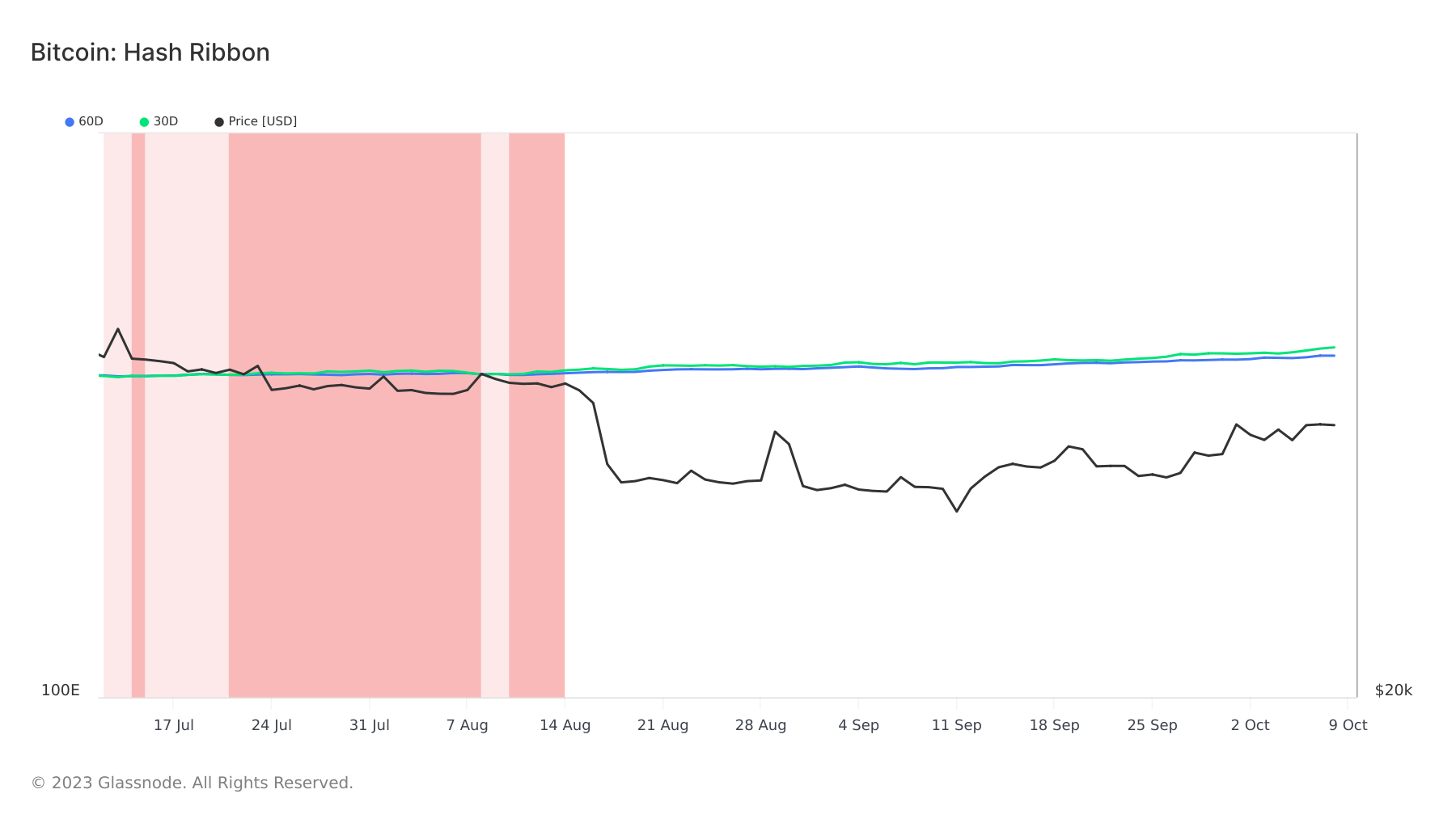

Since mid-August, the 30-day MA of Bitcoin’s hash complaint has consistently outpaced the 60-day MA. Notably, the ribbons underwent compression successful July and August, a improvement historically indicative of miner capitulation. However, the divergence betwixt these 2 moving averages has been widening since the commencement of October 2023, coinciding with Bitcoin’s ascent to $28,000. This divergence suggests that miners are bullish, ramping up their operations successful anticipation of higher prices.

Graph showing Bitcoin’s hash ribbons from July to October 2023 (Source: Glassnode)

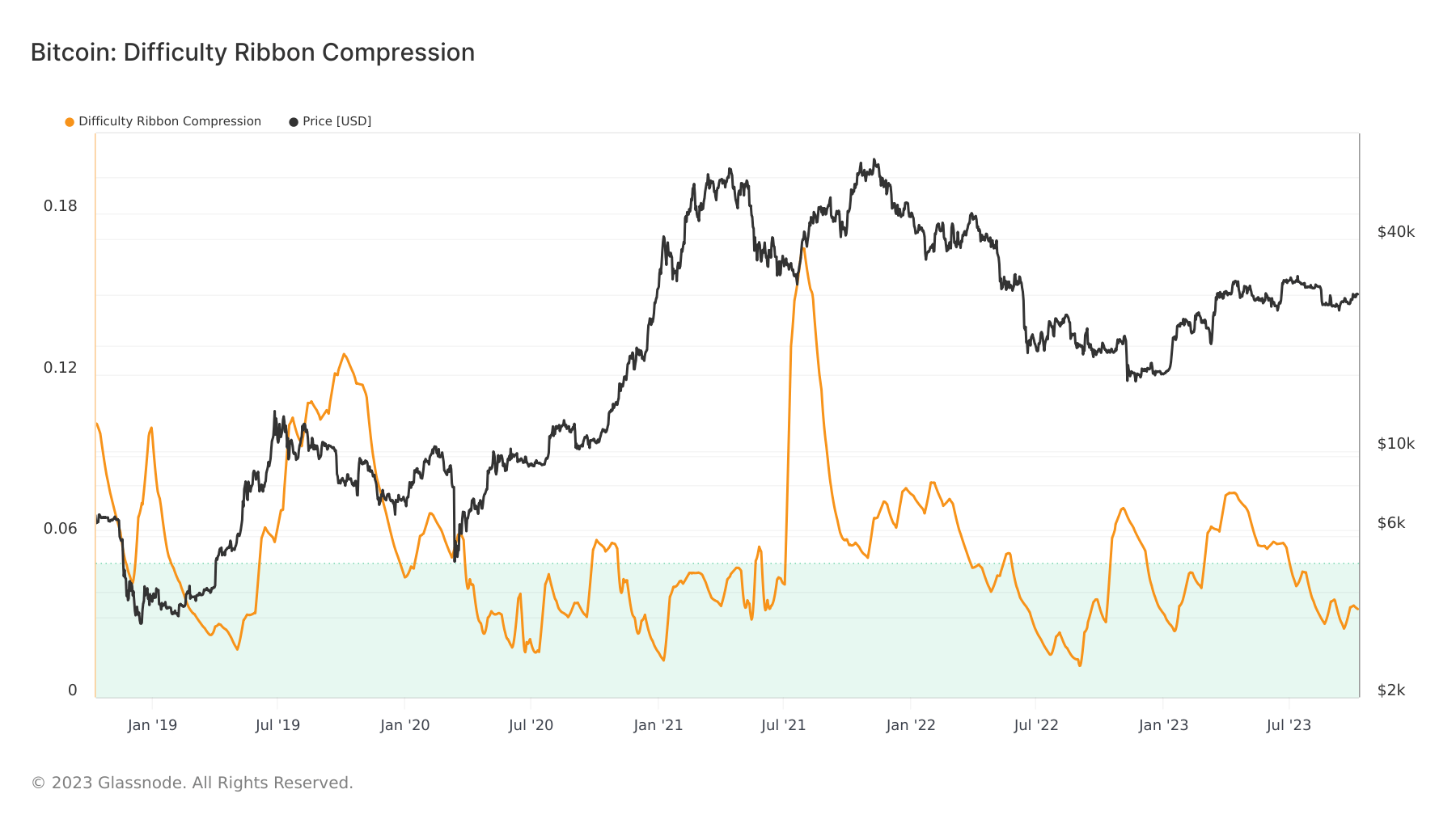

Graph showing Bitcoin’s hash ribbons from July to October 2023 (Source: Glassnode)Mining difficulty, different cornerstone metric, adjusts astir each 2 weeks to guarantee that blocks are added to the blockchain astatine a accordant interval. The Difficulty Ribbon Compression metric provides insights into miner selling pressure. Historically, precocious compression zones, marked by debased values successful this metric, person signaled lucrative buying opportunities for Bitcoin. Conversely, spikes successful this metric person often been successful tandem with Bitcoin’s terms surges. As of June 30, the trouble ribbon compression was beneath the 0.05 threshold, and arsenic of October 8, it stood astatine 0.032, suggesting imaginable upward terms momentum.

Graph showing Bitcoin’s mining trouble compression from October 2018 to October 2023 (Source: Glassnode)

Graph showing Bitcoin’s mining trouble compression from October 2018 to October 2023 (Source: Glassnode)The rising hash complaint underscores a robust and unafraid network, portion the hash ribbons and trouble ribbon compression hint astatine bullish miner sentiment and imaginable terms appreciation.

The station Mining metrics suggest bullish sentiment for Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)