Michael Saylor’s MicroStrategy is backmost successful the news, with its banal trading astatine a 25-year high. TradingView’s caller information shows that MicroStrategy (MSTR) deed $235.89 successful Thursday’s session. The stock’s terms accrued by much than 7% connected October 25th. MicroStrategy’s terms enactment past Thursday continued its 6-week rally and came up of its scheduled Q3 net report.

This week’s banal show reflected the company’s accordant maturation implicit the past fewer years. MicroStrategy has outperformed astir of its peers successful the S&P 500 scale and adjacent outpaced Microsoft’s maturation since 1999. According to observers, MicroStrategy is bullish, with marketplace analysts listing $245 arsenic the stock’s adjacent target.

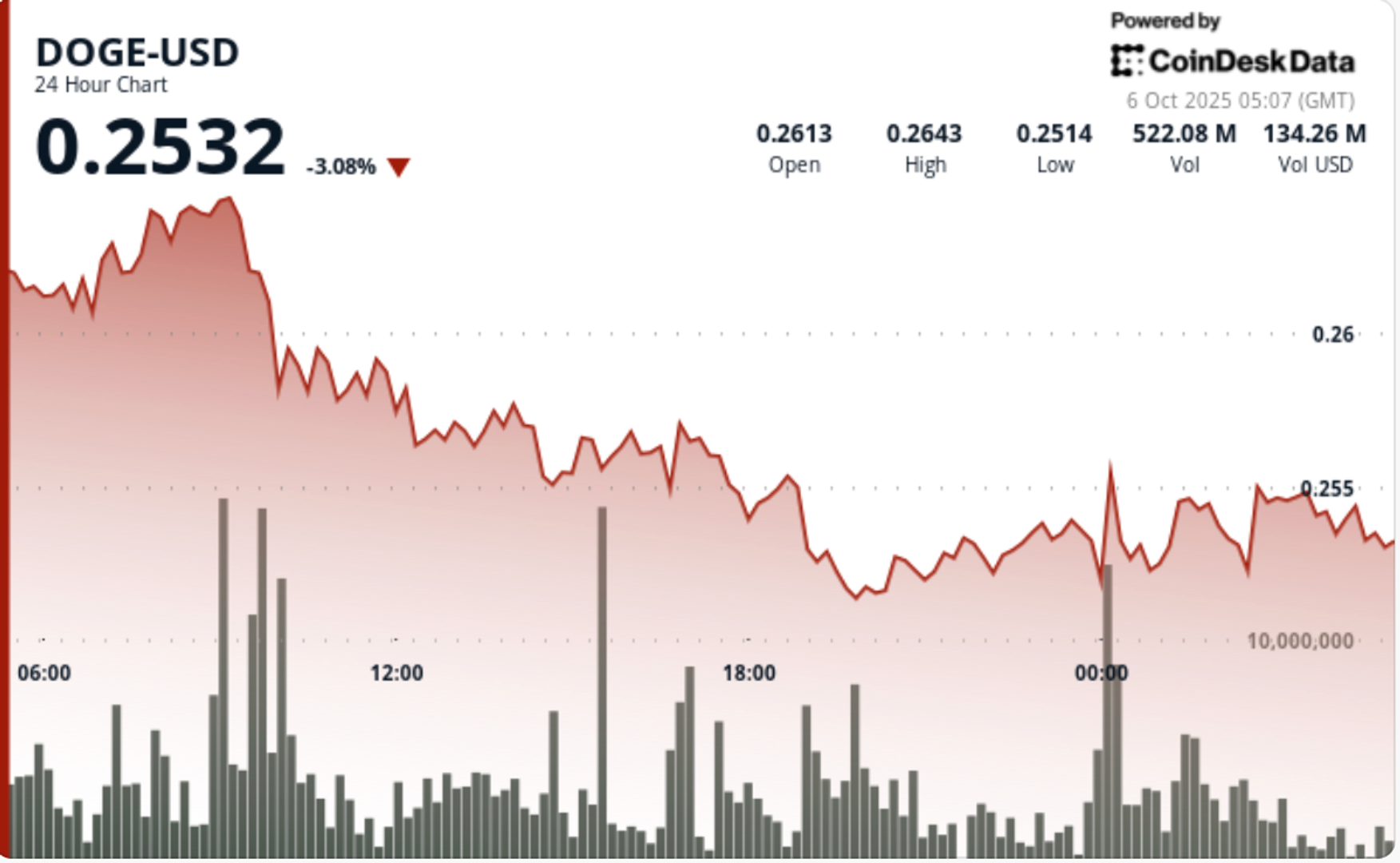

Bitcoin terms up successful the past 24 hours. Souce: Coingecko

Bitcoin terms up successful the past 24 hours. Souce: CoingeckoMicroStrategy Continues Its Bitcoin Focus

MicroStrategy, a Virginia-based Bitcoin improvement company, is presently the world’s largest firm holder of Bitcoin, with 252,222 BTC. With Bitcoin’s existent terms of $67,392, the institution holds much than $17 cardinal successful assets.

MicroStrategy Stock Hits New Highs

MicroStrategy’s banal (MSTR) has soared implicit 7% to a 25-year precocious of $236, with a existent marketplace headdress of $47 billion, overtaking Microsoft successful all-time banal gains.

Since adopting Bitcoin arsenic a treasury plus successful 2020, MicroStrategy’s banal is up… pic.twitter.com/cyXS0KODCD

— The Wolf Of All Streets (@scottmelker) October 25, 2024

Initially, the institution developed bundle to analyse outer and interior information to assistance decision-making, with IBM Cognos, Oracle Corporation’s BI Platform, and SAP AG Business objects arsenic its superior competitors. However, successful August 2020, the institution changed its concern exemplary to absorption connected Bitcoin. The institution has raised $4.25 cardinal from its equity offerings, the instauration for increasing its Bitcoin holdings.

MicroStrategy’s Bitcoin Plan Has Its Costs, Too

As portion of its Bitcoin plan, it aims to bargain BTC astatine each opportunity. For the astir part, Saylor’s strategy was a hit. However, the concern program to absorption connected Bitcoin came astatine a cost, and Saylor earned a fewer detractors and critics on the way.

For example, the institution has expanded its convertible enactment offering to rise funds to bargain much Bitcoin. However, the bulk of these notes bash not mature until 2032. Some marketplace observers besides accidental that MicroStrategy is successful a hard situation, particularly during marketplace downturns. Since the institution relies connected Bitcoin, the company’s aboriginal is babelike connected crypto’s utmost volatility. Although astir criticisms are valid, Michael Saylor remains defiant and has since doubled its BTC investments.

Hey @SatyaNadella, if you privation to marque the adjacent trillion dollars for $MSFT shareholders, telephone me. pic.twitter.com/NPnVvL7Wmj

— Michael Saylor⚡️ (@saylor) October 25, 2024

Next Target For MicroStrategy Is $245

Market observers are present bullish connected Saylor’s company. According to Mark Palmer, the company’s banal has boasted a 17.8% output since starting its Bitcoin strategy. Palmer and the different analysts present people $245 to code this abrupt surge and bullish sentiment. Palmer adds that the company’s stock terms has accrued by 1,600% successful the past 4 years, and much gains are possible.

It besides helps that Michael Saylor has remained steadfast successful his imaginativeness and passionateness for Bitcoin. In a caller Twitter/X post, MicroStrategy’s enforcement president hinted astatine the company’s adjacent determination and made a transportation to Microsoft’s Satya Nadella.

Featured representation from Dall.E, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)