Disclaimer: The expert who wrote this portion owns shares of MicroStrategy (MSTR)

The bitcoin (BTC) improvement institution MicroStrategy (MSTR) is 1 of the astir volatile and traded equities connected the market.

Volatility wrong an equity tin beryllium beneficial arsenic it allows for high-volume trading. Even though MicroStrategy has a marketplace headdress of little than $100 billion, its trading measurement rivals that of the magnificent 7 exertion companies.

All the 7 magnificent tech stocks person a marketplace headdress of astatine slightest $1 trillion, good implicit 10 times the marketplace capitalization of MicroStrategy, with Apple (APPL), NVIDIA (NVDA), and Microsoft (MSFT) having marketplace caps of implicit $3 trillion.

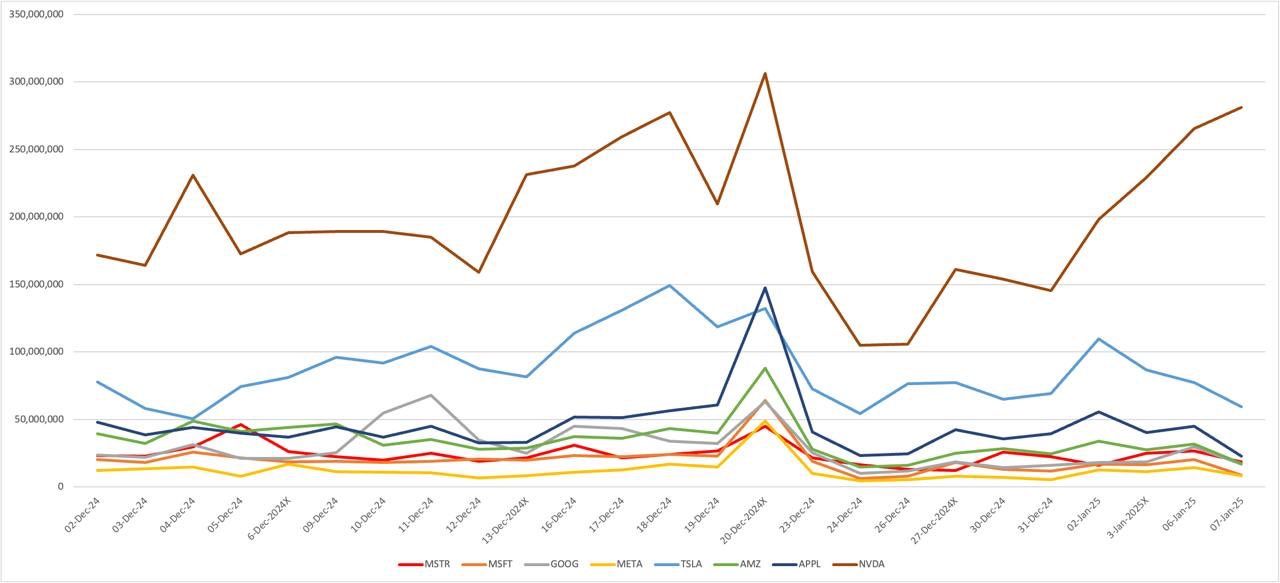

Data from Market Chameleon shows that betwixt Dec. 2, 2024, to Jan. 7, 2025, an mean of astir 24 cardinal MSTR shares were traded daily. This would spot MicroStrategy sixth retired of the different tech stocks, supra Microsoft (MSFT), which trades 20 cardinal shares daily, and META (META), which trades 12.2 cardinal shares daily. The wide victor is NVIDIA, with Tesla (TSLA) successful 2nd place.

MicroStrategy is up astir 14% twelvemonth to date, with a 30-day implied volatility (IV) of 104; IV determines the market's anticipation of aboriginal terms movements for the plus implicit the adjacent 30-day period.

The IV comes from options pricing, and considering that iShares Bitcoin Trust (IBIT) has an IV of astir 60, this would marque MSTR 1.7 times much volatile than IBIT. As of Jan. 7 data, MicroStrategy has the highest IV30 of 105, the highest retired of each 7 magnificent tech stocks, with Tesla arsenic its closest rival with an IV30 of 71.0, according to marketplace chameleon data.

8 months ago

8 months ago

English (US)

English (US)