Microstrategy has expanded its bitcoin holdings with the acquisition of 16,130 much bitcoins. With this latest purchase, the Nasdaq-listed bundle quality steadfast is present hoding 174,530 bitcoins, acquired for astir $5.28 billion. Since adopting its bitcoin strategy, Microstrategy’s banal has outperformed large plus classes and indices.

Microstrategy’s Bitcoin Treasury Rises to 174,530 Coins

Microstrategy (Nasdaq: MSTR) has disclosed its astir caller acquisition of bitcoin. The firm’s president and erstwhile CEO, Michael Saylor, shared connected societal media level X Thursday:

Microstrategy has acquired an further 16,130 BTC for ~$593.3 cardinal astatine an mean terms of $36,785 per bitcoin. As of 11/29/23, Microstrategy present hodls 174,530 $BTC acquired for ~$5.28 cardinal astatine an mean terms of $30,252 per bitcoin.

According to the company’s filing with the U.S. Securities and Exchange Commission (SEC), the further coins were acquired successful currency during the play betwixt Nov. 1 and Nov. 29.

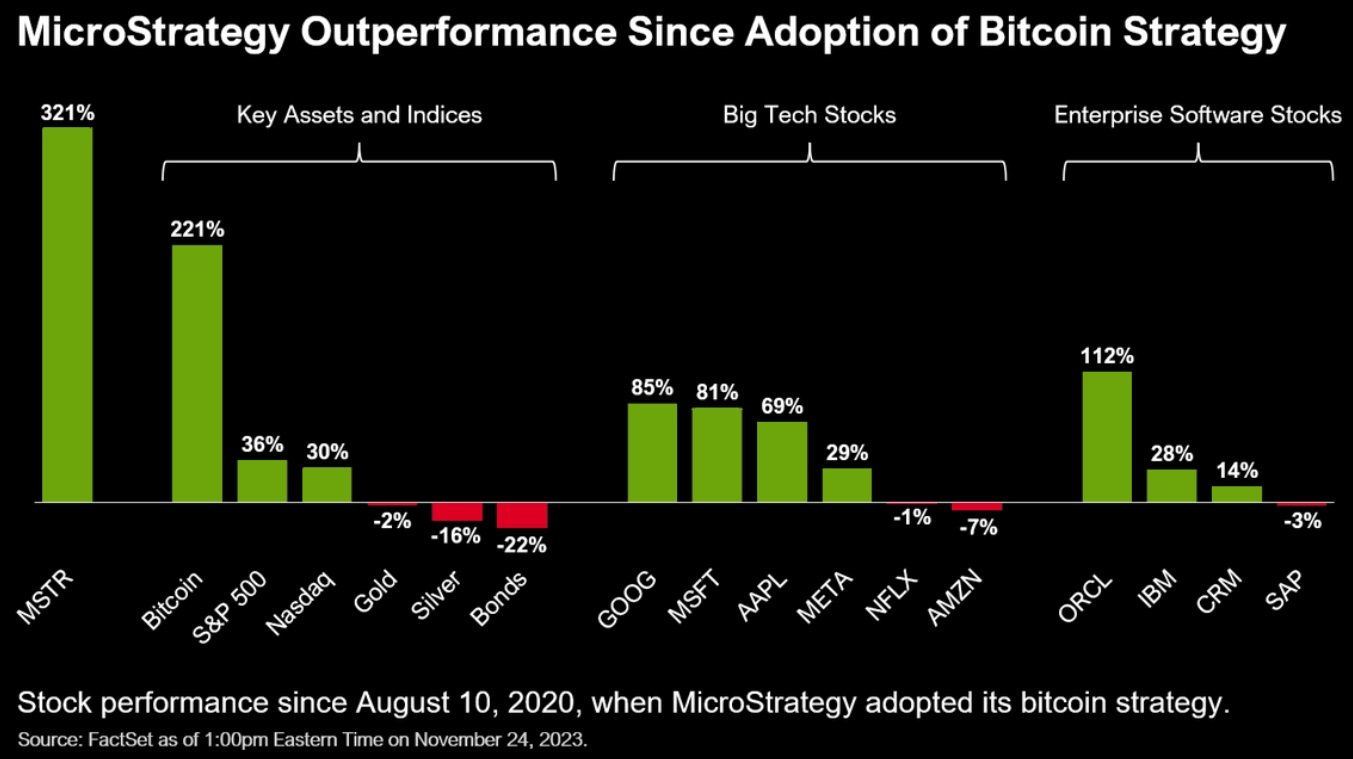

Since Microstrategy adopted its bitcoin strategy connected Aug. 10, 2020, its banal has surged by 321%, according to a illustration shared by Saylor connected X, showing the performances of MSTR, bitcoin, arsenic good arsenic different well-known plus classes, indices, and stocks. In the aforesaid period, bitcoin roseate by 221%, the S&P 500 experienced a 36% increase, and the Nasdaq Composite scale saw a 30% rise. Meanwhile, golden declined by 2%, metallic fell by 16%, and bonds dropped by 22%.

The bundle quality steadfast besides reported to the SEC successful Thursday’s filing that it entered into a missive statement connected Nov. 29, terminating the income statement it had with Cowen, Canaccord, and Berenberg Capital Markets. The income agreement, established connected Aug. 1, allowed Microstrategy to contented and merchantability shares of its communal banal with an aggregate offering terms of up to $750 million. Before the termination, Microstrategy issued and sold 1,189,588 shares of its communal banal betwixt Nov. 1 and Nov. 28, generating nett proceeds of astir $590.9 million. The institution antecedently stated that these proceeds would beryllium utilized to get bitcoin.

Saylor antecedently explained that his company’s bitcoin strategy “seeks to maximize semipermanent value” for shareholders. He described the world’s largest cryptocurrency arsenic “a dependable store of worth and an charismatic concern plus with much semipermanent appreciation imaginable than holding cash.” The enforcement added: “Since its inception implicit a decennary ago, bitcoin has emerged arsenic a important summation to the planetary fiscal system, with characteristics that are utile to some individuals and institutions.”

What bash you deliberation astir Microstrategy holding 174,530 bitcoins? Let america cognize successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)