In its Aug. 1 fiscal results, concern quality steadfast MicroStrategy said it acquired important Bitcoin during Q2 2023.

Andrew Kang, Chief Financial Officer astatine MicroStrategy, said:

“The summation successful the 2nd 4th of 12,333 bitcoins [is] the largest summation successful a azygous 4th since Q2 2021. We efficiently raised capital… and utilized currency from operations to proceed to summation bitcoins connected our equilibrium sheet.”

In a separate presentation, the steadfast said that the 12,333 BTC it bought was purchased for $347 cardinal astatine an mean of $28,136 per Bitcoin.

However, those numbers lone correspond the company’s latest additions, not the full magnitude of Bitcoin it acquired. MicroStrategy said that, arsenic of July 31, 2023, it had acquired 152,800 BTC for $4.53 cardinal oregon $29,672 per Bitcoin.

Despite those precocious estimates, the institution said that the carrying worth (the archetypal outgo of the asset, little immoderate depreciation, amortization oregon impairment costs) of its Bitcoin was conscionable $2.3 billion. That fig reflects cumulative impairment losses of $2.196 cardinal since MicroStrategy’s archetypal acquisition and an mean carrying magnitude per Bitcoin of $15,251.

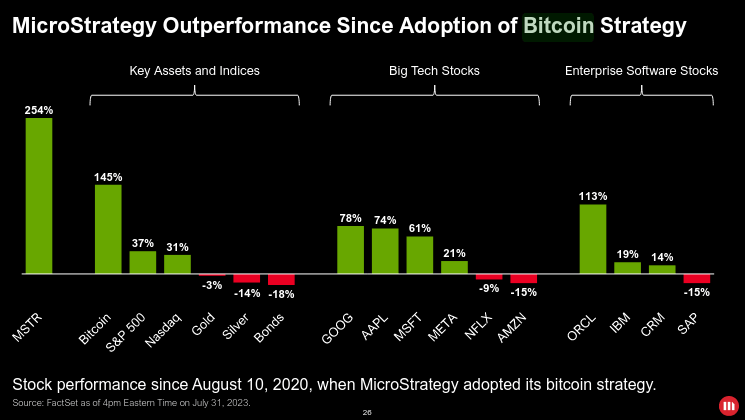

MicroStrategy noted elsewhere that Bitcoin and its ain MSTR banal person outperformed galore different indexes and assets. MSTR has gained 254% since it adopted its Bitcoin strategy successful August 2020, portion Bitcoin itself has gained 145% since that date.

Via MicroStrategy

Via MicroStrategyMicroStrategy different reported full revenues of $120.4 cardinal successful Q2 2023, which represents a 1% alteration successful gross year-over-year.

Bitcoin successful the bigger picture

Kang besides positioned MicroStrategy’s purchases wrong broader manufacture developments, specified arsenic expanding involvement from organization investors and regulatory clarity astir Bitcoin.

Kang besides said that MicroStrategy is seeing advancement regarding Bitcoin accounting practices. In May, the institution submitted a letter to the Financial Accounting Standards Board (FASB) expressing enactment for a just worth accounting for crypto assets. It said this would let it to supply a “more applicable view” of its Bitcoin holdings.

In its institution profile, Microstrategy called Bitcoin a “dependable store of value” and described Bitcoin acquisition arsenic 1 of its 2 main strategies alongside its endeavor bundle business.

The station MicroStrategy made largest Bitcoin acquisition since 2021 successful Q2 2023 amid flimsy gross decrease appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)