Microstrategy reported a 3.3% summation successful full revenues to $129.5 cardinal successful the 3rd 4th of 2023, adjacent arsenic the institution took impairment losses of $33.6 cardinal connected its bitcoin holdings, according to the firm’s latest fiscal disclosure. The firm’s founder, Michael Saylor, revealed that Microstrategy purchased an further 155 BTC for $5.3 cardinal successful October and the institution present holds a expansive full of 158,400 BTC.

Microstrategy Sees Revenue Growth Despite Bitcoin Impairments successful Q3

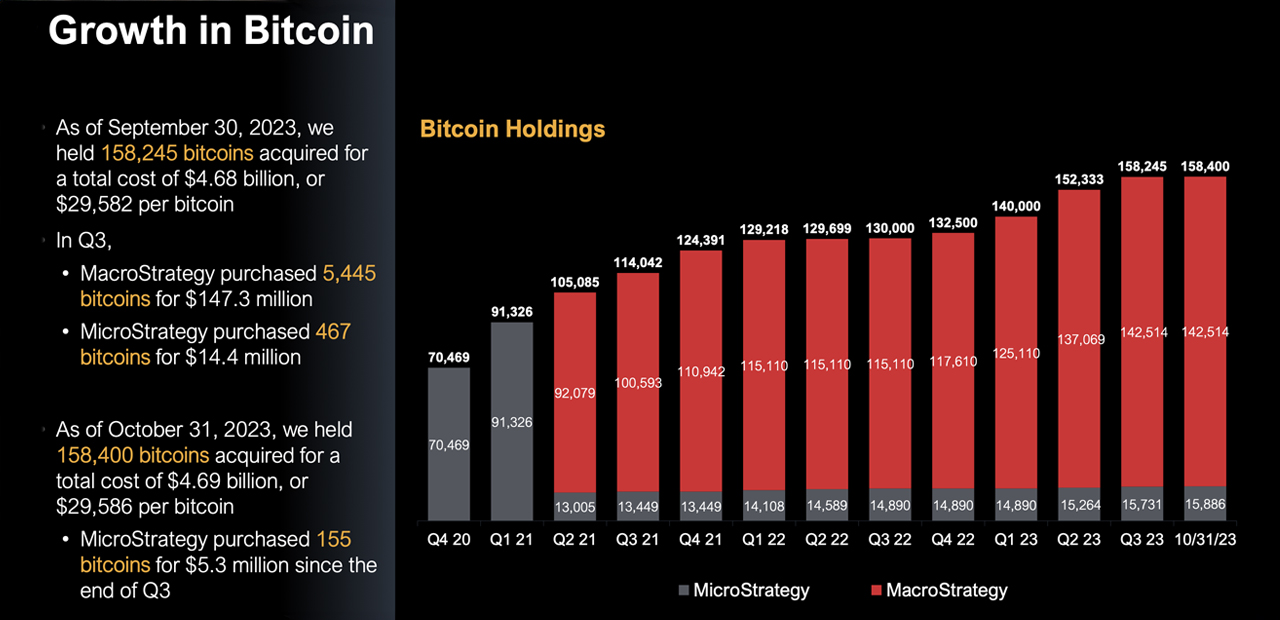

This week Microstrategy (Nasdaq: MSTR) published the firm’s Q3 2023 Earnings Presentation which gives a broad overview of the company’s existent fiscal standings. In the property announcement released connected Wednesday, the concern quality (BI) bundle institution said it has acquired astir 158,400 bitcoins to day arsenic portion of its crypto concern strategy.

Microstrategy besides launched its caller Microstrategy AI bundle successful Q3, its archetypal offering to integrate AI capabilities utilizing Microsoft Azure Openai. The institution elaborate it saw maturation crossed its halfway gross streams, including a 16% summation successful bundle licenses gross to $45 cardinal and a 28% maturation successful subscription services gross to $21 cardinal successful the 3rd quarter.

However, Microstrategy reported a nett nonaccomplishment of $143.4 cardinal for the quarter, driven chiefly by the impairment losses connected its bitcoin holdings arsenic prices declined successful the cryptocurrency carnivore market. Microstrategy has been aggressively acquiring bitcoin since August 11, 2020, making it the largest publicly-listed firm holder of the cryptocurrency.

According to the presentation, the institution added 5,912 bitcoins successful Q3 2023, bringing its full holdings for the 4th to 158,245 bitcoins acquired astatine an aggregate acquisition terms of $4.68 cardinal and an mean outgo of $29,582 per bitcoin. The institution would past adhd 155 much coins to the pile, aft Q3, noting:

As of October 31, 2023, we held 158,400 bitcoins acquired for a full outgo of $4.69 billion, oregon $29,586 per bitcoin.

Despite cumulative impairment losses to date, Microstrategy said it remains committed to its bitcoin concern thesis.

“We further accrued our full bitcoin holdings to 158,400 bitcoins, adding 6,067 bitcoins since the extremity of the 2nd quarter,” Andrew Kang, Microstrategy’s main fiscal serviceman said successful a connection connected Wednesday. “Our committedness to get and clasp bitcoin remains strong, particularly with the promising backdrop of imaginable accrued organization adoption.”

Microstrategy’s fiscal results for the 3rd 4th person been unveiled amid important excitement and anticipation surrounding the imaginable authorization of a spot bitcoin exchange-traded money (ETF). Numerous fiscal institutions, including Blackrock, Fidelity, Valkyrie, and Vaneck, person submitted their applications to the U.S. Securities and Exchange Commission (SEC), eagerly awaiting support from the regulatory body.

What bash you deliberation astir Microstrategy’s October acquisition upping its bitcoin stash to 158,400 bitcoins? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)