MicroStrategy enforcement president Michael Saylor has urged Microsoft to follow Bitcoin arsenic portion of its strategy, according to a three-minute presentation to the company’s committee that was shared connected X (formerly Twitter).

In the presentation, Saylor positioned Bitcoin arsenic a captious constituent of the adjacent technological wave. He warned that failing to integrate Bitcoin into Microsoft’s operations could permission the institution lagging down competitors.

Saylor emphasized Bitcoin’s outperformance, noting it has delivered returns 10 times higher than Microsoft’s banal annually. He argued that redirecting resources from banal buybacks to Bitcoin investments would make greater value.

He stated:

“Microsoft can’t spend to miss the adjacent exertion question and Bitcoin is that wave…It makes a batch much consciousness to bargain Bitcoin than to bargain your ain banal back.”

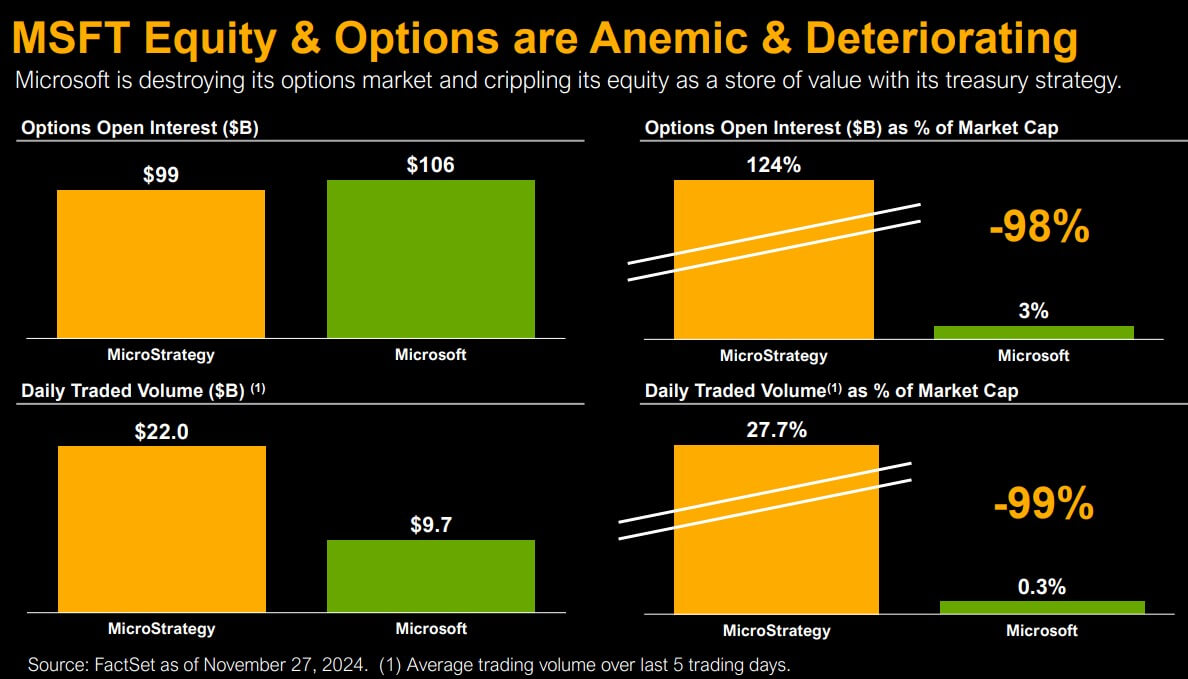

According to him, Microsoft’s existent treasury strategy is weakening its equity and options markets and eroding its presumption arsenic a store of value.

Microsoft’s Current Equity Performance (Source: Michael Saylor)

Microsoft’s Current Equity Performance (Source: Michael Saylor)Saylor besides outlined a transformative roadmap for the Bitcoin ecosystem successful 2025. This includes wide Wall Street adoption of Bitcoin ETFs, favorable fair-value accounting rules, pro-crypto enactment successful Congress, and a displacement successful regulatory attitudes. He believes this evolving scenery makes Bitcoin adoption not conscionable advantageous but essential.

He said:

“You person a prime to make: cling to the past, oregon clasp the future. Divest billions of dollars and dilatory your maturation rate, put billions of dollars and accelerate your maturation rate.”

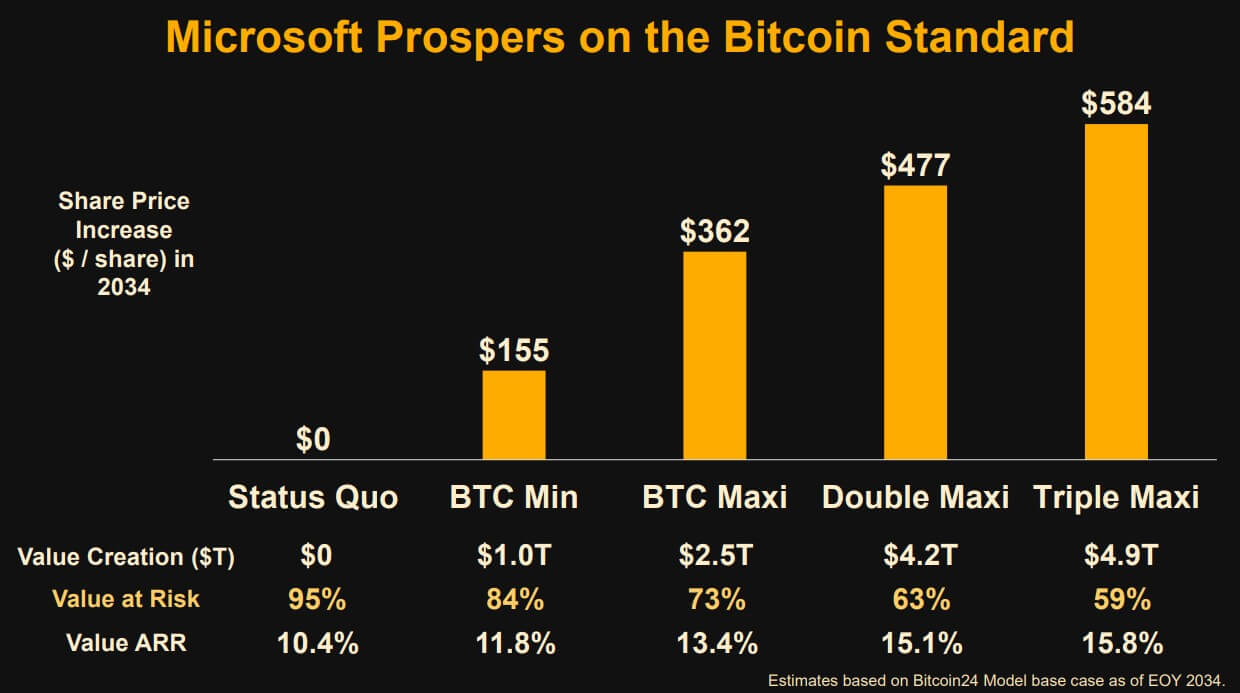

$5 trillion summation to Microsoft’s marketplace cap

As portion of his pitch, Saylor projected that an assertive Bitcoin strategy could adhd astir $5 trillion to Microsoft’s marketplace headdress implicit the adjacent decade.

He projected converting Microsoft’s currency flows, dividend payouts, and banal buybacks into Bitcoin. He argued that this would adhd hundreds of dollars to the company’s banal terms portion minimizing shareholder risk.

Based connected his projections, if Bitcoin reaches $1.7 cardinal per coin by 2034, Microsoft could summation $4.9 trillion successful endeavor value.

Microsoft’s Predicted Market Cap if it Adopts Bitcoin (Source: Michael Saylor)

Microsoft’s Predicted Market Cap if it Adopts Bitcoin (Source: Michael Saylor)Saylor besides suggested investing $100 cardinal annually successful Bitcoin alternatively of banal repurchases oregon bonds. He described Bitcoin arsenic an plus escaped from counterparty risk, offering unmatched information and maturation potential.

The station Michael Saylor tells Microsoft committee Bitcoin could boost its marketplace headdress by $5 trillion appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)