Disclaimer: The expert who wrote this nonfiction owns shares successful Strategy.

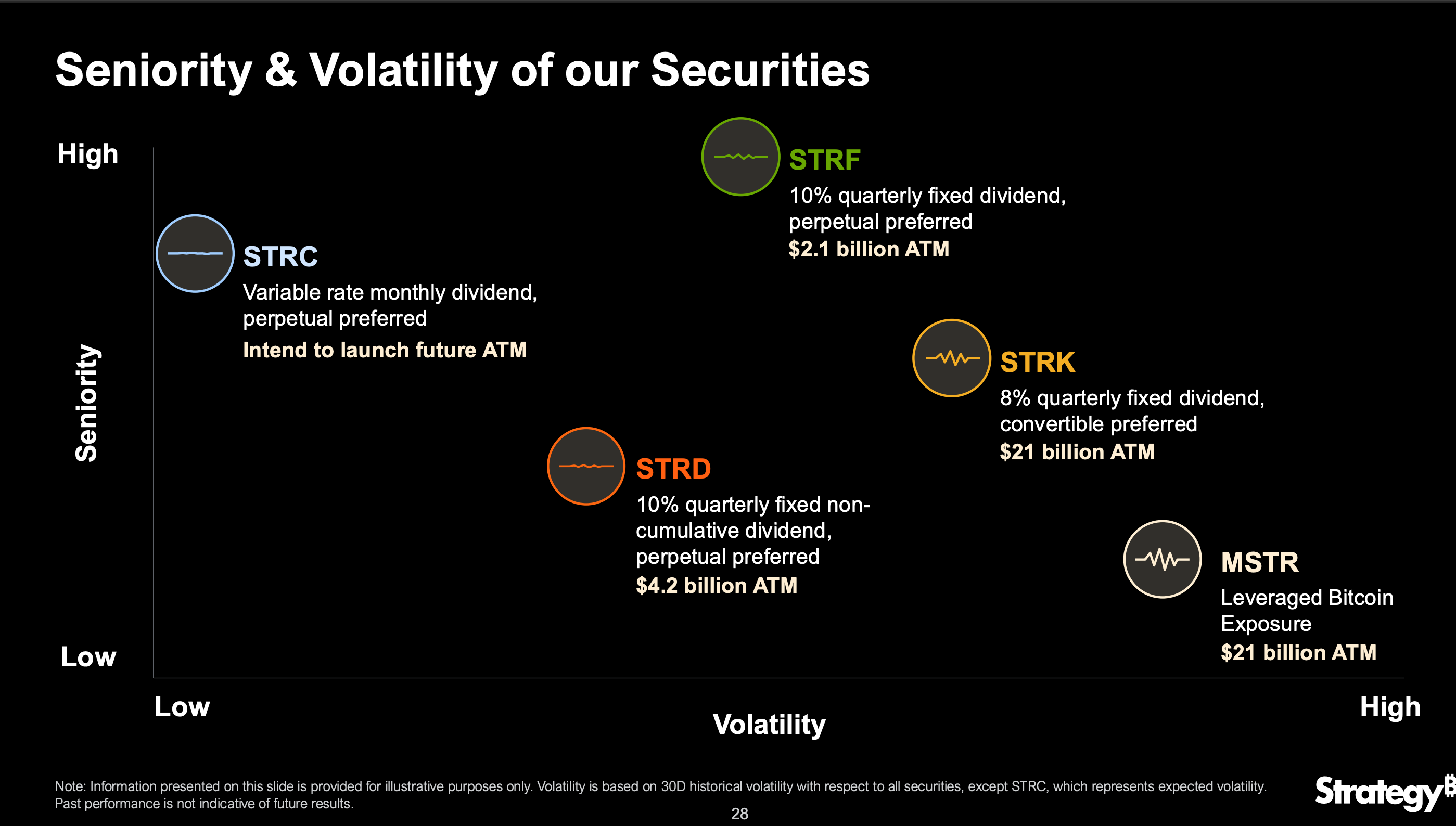

Strategy (MSTR), nether the enactment of Executive Chairman Michael Saylor, whitethorn person conscionable finalized its largest preferred banal issuance to day with an STRC (Stretch) offering joining the STRD, STRF and STRK preferred shares to physique retired the company's recognition output curve.

Among these, STRC is ranked precocious successful seniority and debased successful expected volatility. It adds a caller short-duration furniture to Strategy’s financing premix and diversifies however the institution tin rise superior for BTC acquisition.

According to a Fidelity alert connected X, the woody is 28 cardinal shares priced astatine $90 each, totaling implicit $2.52 billion. This represents a melodramatic summation from the archetypal $500 cardinal extremity announced just days earlier and underscores the company’s continued ambition to aggressively grow its bitcoin BTC holdings.

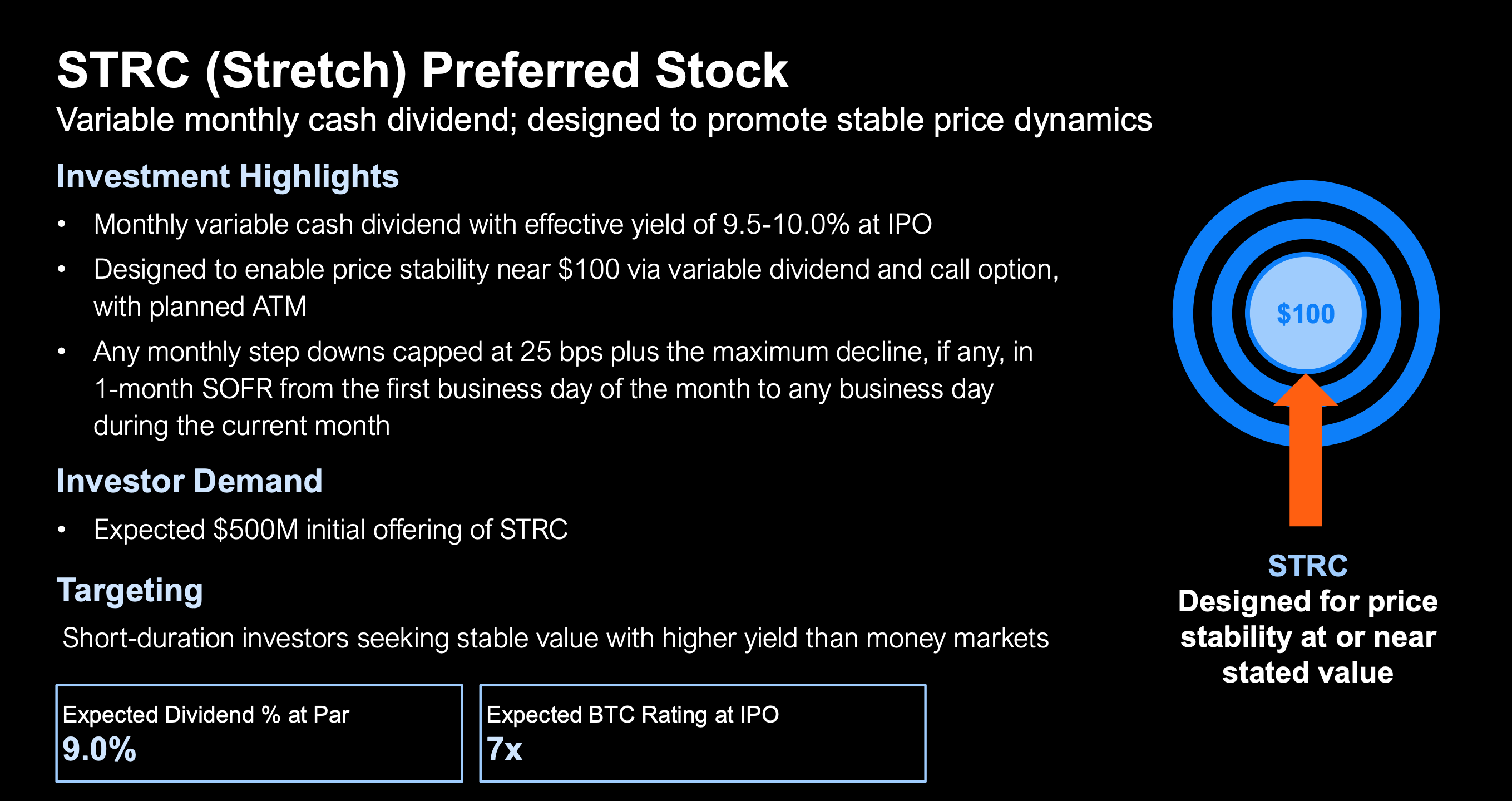

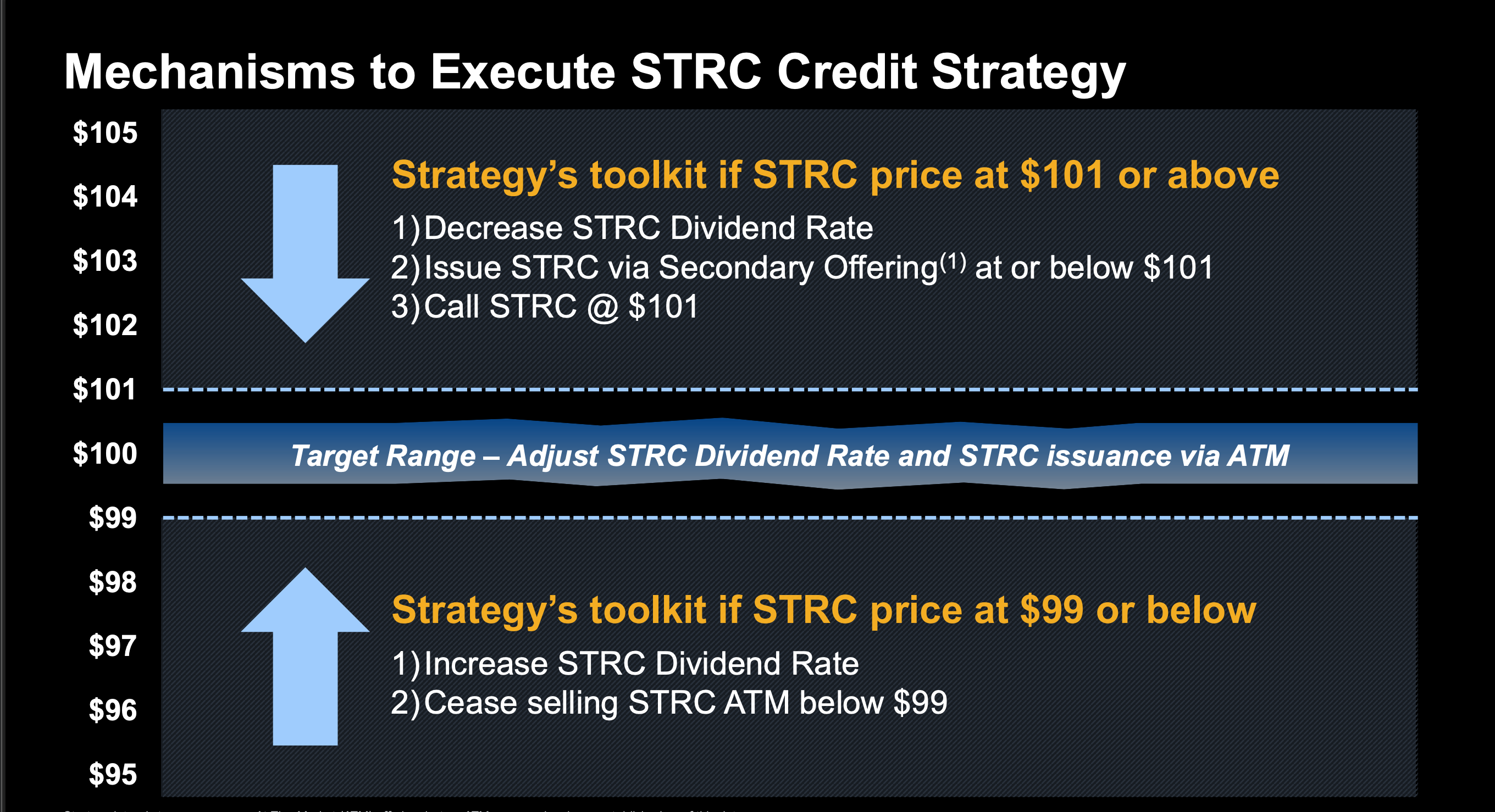

STRC is simply a senior, perpetual preferred banal offering a adaptable monthly dividend designed to entreaty to yield-seeking investors who privation stableness adjacent par value. At the clip of the offering, STRC carried an effectual output of 9.5%–10.0% paid monthly. It contains mechanisms to support a trading scope adjacent to $100, including adjustable dividend rates, secondary issuance windows and telephone options supra par.

The toolkit includes raising dividends and halting income erstwhile STRC trades beneath $99, oregon issuing caller shares and calling the banal if it rises supra $101. These levers are designed to make a self-correcting strategy that promotes marketplace stableness portion offering charismatic returns successful the existent interest-rate environment.

Any step-downs successful the dividend are capped astatine 25 ground points positive the maximum diminution successful the one-month secured overnight financing complaint (SOFR) implicit the period.

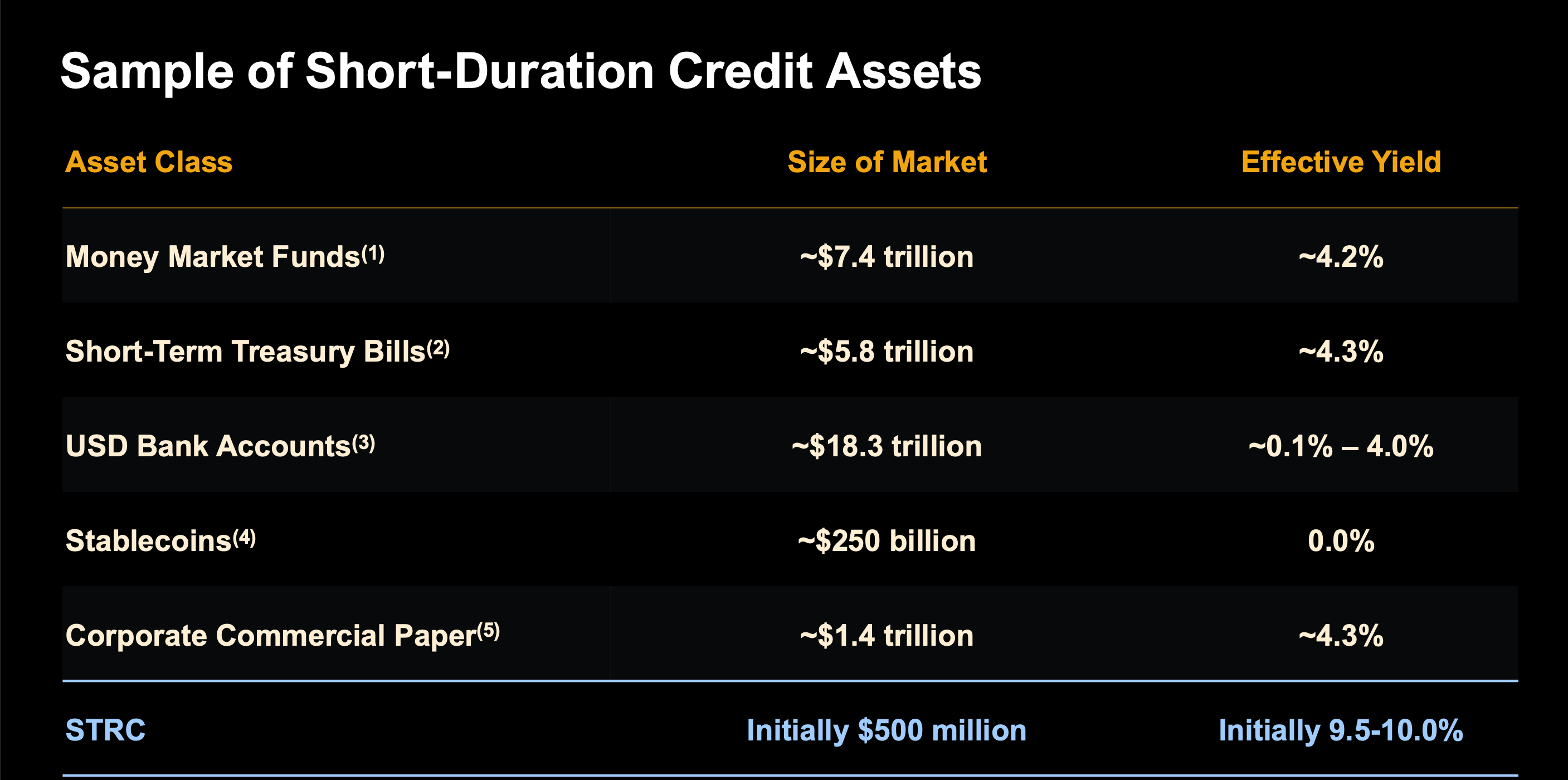

Compared with accepted short-duration recognition options, STRC stands out, offering much than treble the 4% disposable from wealth marketplace funds and Treasury bills. It is targeting investors looking for higher output without important terms volatility, positioning it competitively against accepted instruments similar commercialized insubstantial and slope deposits.

3 months ago

3 months ago

English (US)

English (US)