In filings with securities authorities released connected Monday, renowned hedge money manager Michael Burry, whose exploits were famously captured successful the movie “The Big Short,” took a bearish stance connected the market. Burry’s Scion Asset Management shorted the S&P 500 and Nasdaq 100 for the adjacent of the 2nd quarter, wagering astir $1.6 cardinal connected an impending banal marketplace collapse.

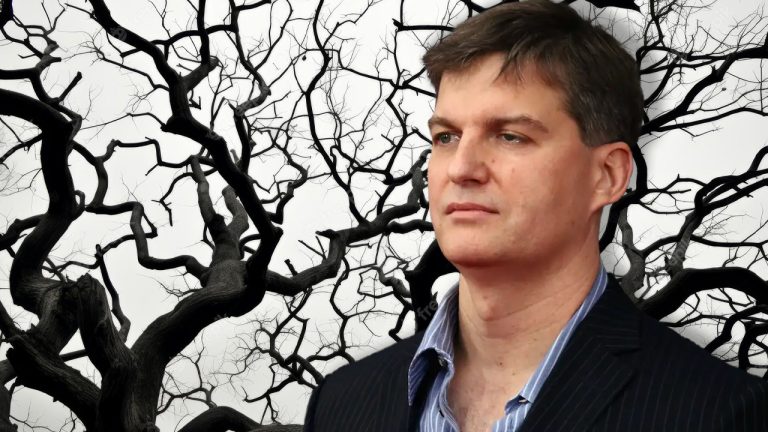

A New ‘Big Short’? Michael Burry Wagers $1.6 Billion Against QQQ and SPY

Michael Burry appears to beryllium taking a bearish stance connected Wall Street erstwhile more, with Scion Asset Management’s latest Securities and Exchange Commission (SEC) 13F filing revealing a important acquisition of enactment options against Invesco QQQ ETF (NASDAQ: QQQ) and SPDR S&P 500 ETF Trust (NYSEARCA: SPY). These options person a notional worth of $1.62 billion, comprising a staggering 93% of Scion’s disclosed assets.

Of this important wager, $738.8 cardinal has been placed against QQQ, portion $886.6 cardinal targets SPY. Despite the S&P 500 and Nasdaq 100 performing robustly frankincense acold successful 2023, the specifics of Burry’s filings, specified arsenic acquisition prices and expiration dates, stay concealed. Given Burry’s palmy bets during the 2008 fiscal crisis, his marketplace moves are intimately watched. Yet successful a astonishing turn, Burry shifted from a selling stance successful January 2023 to admitting helium was mistaken by April.

He openly acknowledged his mistake successful advising sales, adjacent extending congratulations to the “BTFD generation.” Alongside these bold moves, Scion’s latest filing reveals agelong positions successful companies specified arsenic Stellantis, Discovery, Expedia, CVS, MGM Resorts, Iheartmedia, and Cigna. It was astir this aforesaid clip past year, successful August 2022, erstwhile Burry began to predict a multi-year recession successful the United States, adopting a much bearish outlook.

In March, Burry likened 3 large slope collapses to the Panic of 1907, and the latest SEC filings bespeak that Scion eliminated vulnerability to Western Alliance Bancorp and Pacwest. As August 2023 progresses, some the S&P 500 and Nasdaq 100 person retreated against the U.S. dollar, shedding 2% to 3% respectively this month. The 13F filing additionally reveals that Scion has divested its holdings successful Alibaba Group and JD.com.

What bash you deliberation astir Michael Burry’s abbreviated bets? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)