Two publically listed companies, Japan’s Metaplanet and the United Kingdom’s The Smarter Web Company, added astir $100 cardinal worthy of Bitcoin to their firm treasuries.

On Tuesday, Metaplanet disclosed that it had purchased 518 Bitcoin (BTC) for astir $61.4 cardinal astatine an mean terms of $118,519 per coin. The bargain lifted the Tokyo-listed company’s full holdings to 18,113 BTC, worthy astir $2.15 cardinal astatine existent prices, and acquired astatine an mean of $101,911 per Bitcoin.

Led by CEO Simon Gerovich, Metaplanet present ranks sixth globally successful nationalist institution Bitcoin holdings, down Michael Saylor’s Strategy, MARA, XXI, Bitcoin Standard Treasury Company, and Riot, according to information from BitcoinTreasuries.NET.

The latest acquisition follows Metaplanet’s announcement earlier this period of plans to raise up to 555 cardinal Japanese yen ($3.7 billion) done offering perpetual preferred shares to enactment its acquisition strategy.

Related: Strategy adds $18M successful Bitcoin connected 5th day of BTC strategy

Smarter Web Company acquires 295 BTC

The Smarter Web Company, a London-listed web plan and Bitcoin treasury firm, besides revealed connected Tuesday that it has acquired 295 BTC for 26.3 cardinal pounds ($35.2 million) astatine an mean of $119,412.

The acquisition was funded successful portion by a $10.2 cardinal equity rise completed connected Monday. As reported, The Smarter Web Company besides raised $21 cardinal done a Bitcoin-denominated enslaved offering past week.

The acquisition brings Smarter Web’s full holdings to 2,395 BTC, purchased astatine an mean of $110,555 each for a full outgo of $264.8 million. At existent prices, the stash is valued astatine astir $284.8 million, giving the institution an unrealized summation of astir $20 million.

With much than 1,500 BTC bought successful July alone, Smarter Web has jumped from 36th to 23rd spot successful the planetary nationalist institution rankings and is targeting a top-20 spot successful the coming weeks.

Related: Bitcoin Treasury Model Faces Collapse — Strategy Stands Strong

US could nationalize firm Bitcoin

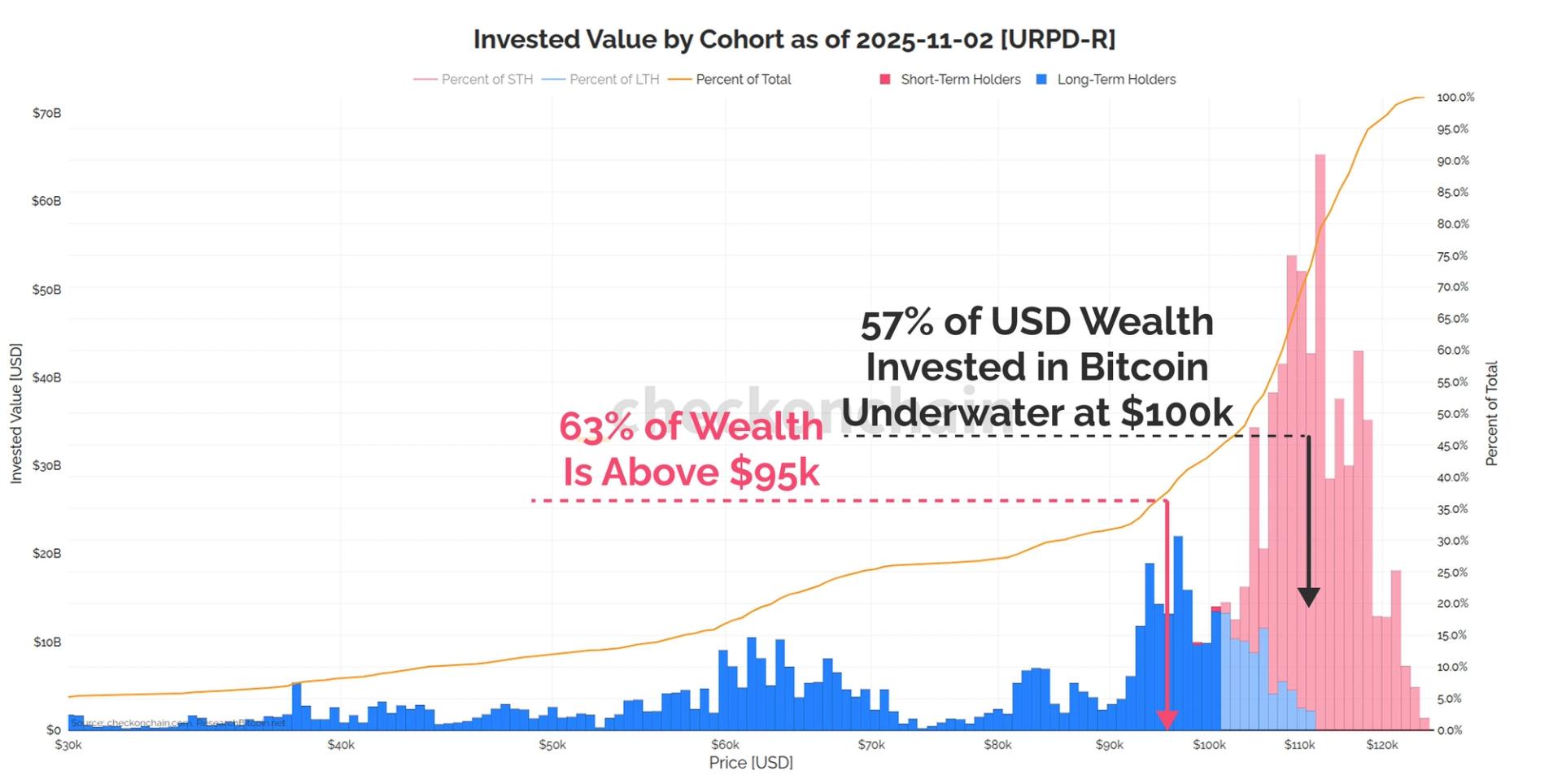

Corporate crypto treasuries have crossed the $100 cardinal mark, with Bitcoin treasury companies holding 791,662 BTC arsenic of July, representing astir 4% of the circulating supply. However, immoderate analysts person warned that the increasing attraction of assets successful firm hands could make a cardinal constituent of vulnerability for Bitcoin.

Crypto expert Willy Woo suggested the US could 1 time determination to nationalize these holdings, drafting parallels to the 1971 golden modular exit. Woo speculated the authorities mightiness centralize firm Bitcoin reserves and perchance “rug” them, conscionable arsenic golden convertibility was suspended nether President Richard Nixon.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

2 months ago

2 months ago

English (US)

English (US)