While a bull rally correction has been anticipated, Bitcoin’s driblet from its all-time precocious of $99,600 to $92,000 managed to hitch retired a bully chunk of optimism from the market. The gait of Bitcoin’s maturation since the US statesmanlike elections successful November led galore to expect BTC to interruption done the coveted $100,000 people comparatively rapidly and participate into a full-blown bull marketplace by year’s end.

Previous CryptoSlate research analyzed futures backing rates, exploring however the outgo of maintaining positions reflects marketplace sentiment. Consistently precocious volume-weighted and unfastened interest-weighted backing rates mirrored the market’s optimism and showed that the rally was mostly driven by derivatives trading.

However, it besides showed a important information of the marketplace overheating, arsenic elevated backing rates awesome excessive leverage that creates a fragile marketplace environment. Periods of precocious backing rates often precede crisp corrections, arsenic overextended traders are forced to exit positions.

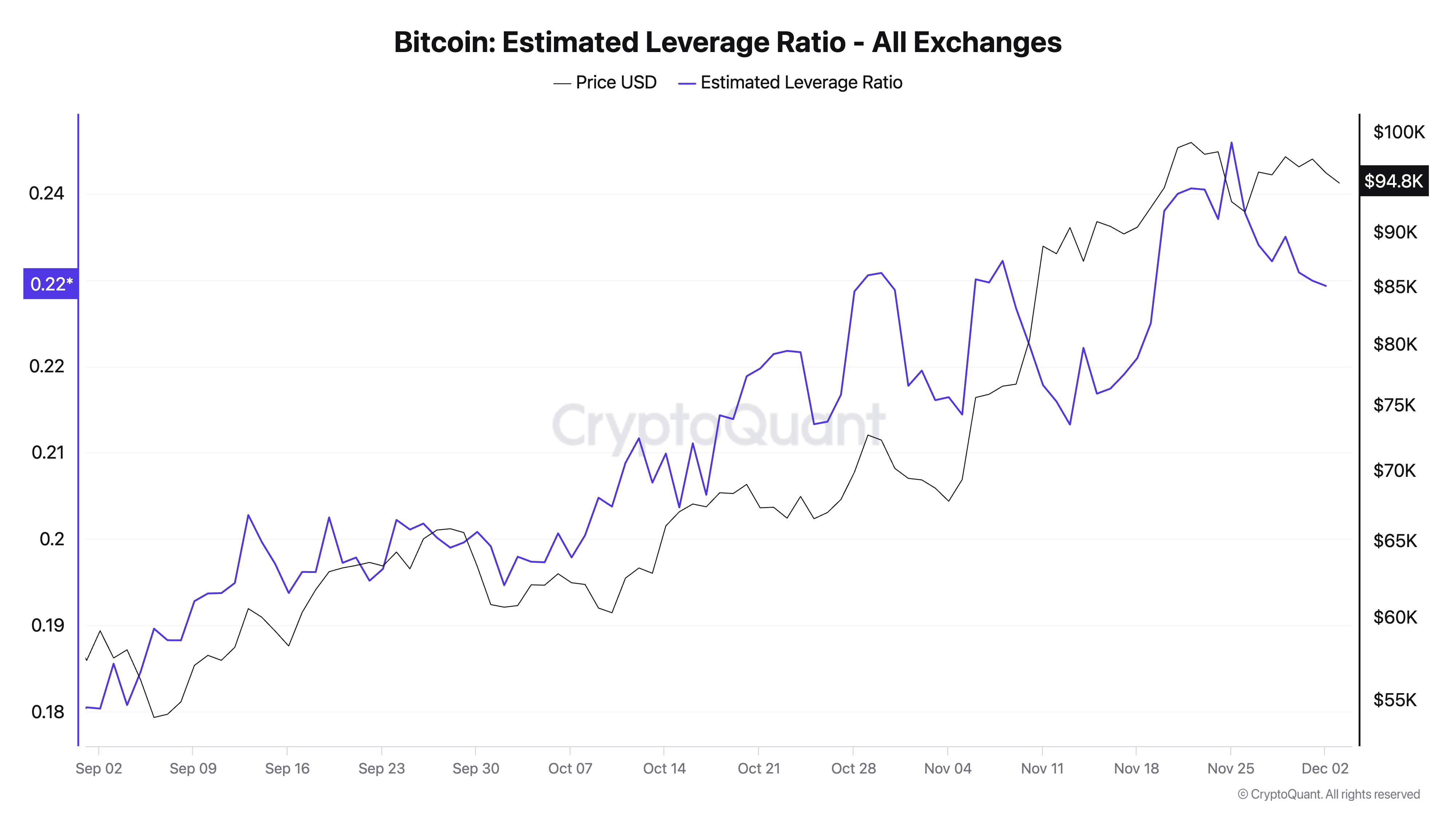

The grade of this leverage tin beryllium seen done the estimated leverage ratio (ELR). ELR is calculated by dividing the unfastened involvement successful derivatives markets by Bitcoin’s full speech reserves. A rising ELR indicates that much leverage is utilized comparative to the disposable Bitcoin, signaling heightened speculation.

The ELR besides provides a model into however assertive traders are successful taking leveraged positions and however overmuch of the marketplace is driven by derivatives alternatively than spot activity. Since the opening of September, the ELR has grown significantly, pursuing Bitcoin’s rally from $65,000 to $98,000. This shows that traders were riding the bullish momentum and deploying leverage on the way, amplifying the upward terms enactment we’ve seen successful the past 3 months.

Graph showing Bitcoin’s estimated leverage ratio (ELR) from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s estimated leverage ratio (ELR) from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)However, successful the past fewer days of November, the ELR began to diminution adjacent arsenic Bitcoin’s terms remained adjacent oregon astatine its all-time high. This divergence is peculiarly important erstwhile analyzing the market, arsenic it indicates a signifier of deleveraging oregon hazard reduction.

Traders whitethorn person started unwinding their leveraged positions to unafraid profits oregon debar liquidation hazard successful an progressively volatile environment. The diminution successful ELR indicates that leveraged enactment was scaling back, reducing the speculative unit that had driven the rally.

Given the market’s existent sensitivity, this deleveraging couldn’t spell unnoticed, pushing BTC further down to $92,000.

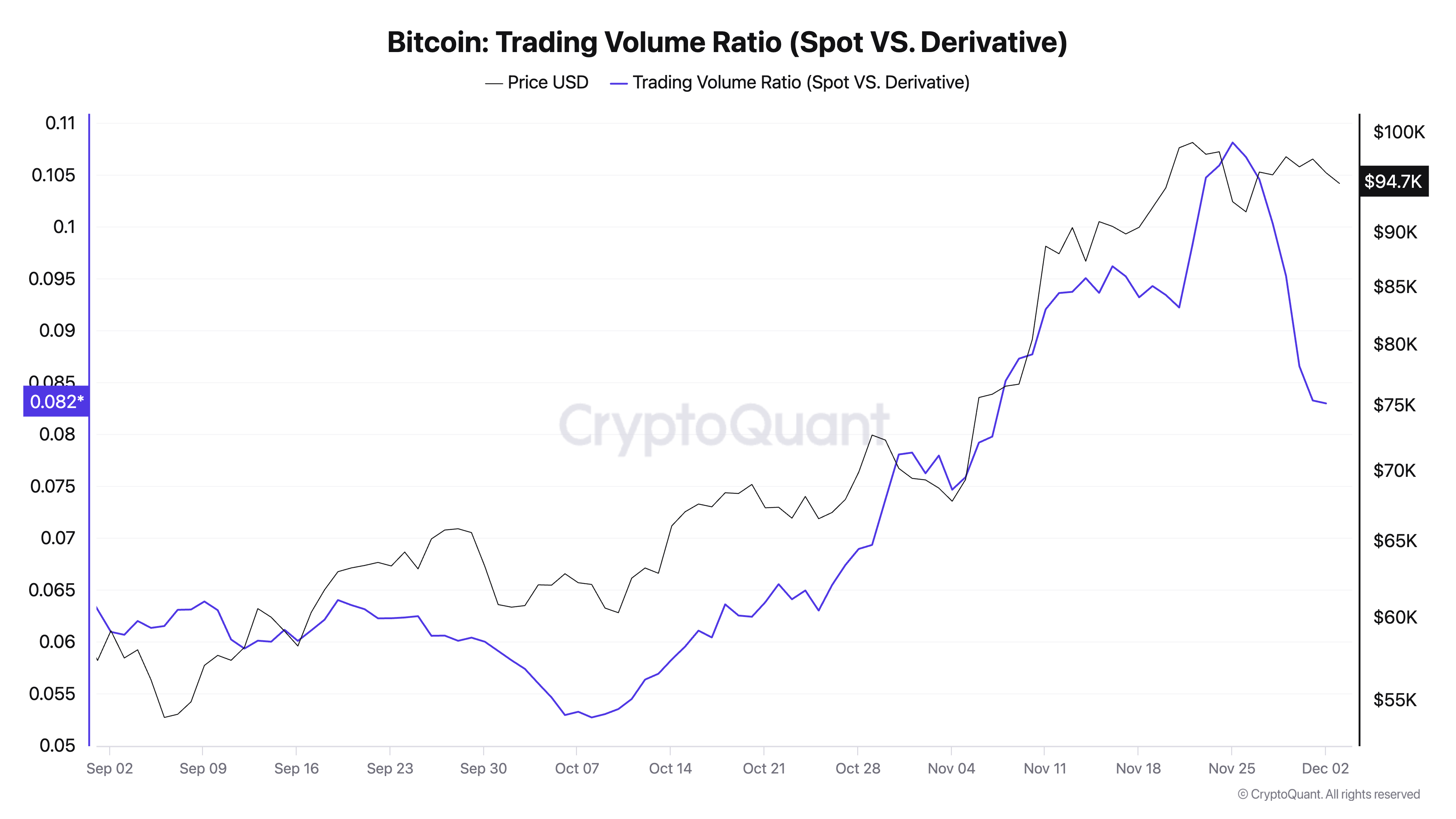

We cognize that deleveraging successful the derivatives marketplace caused this driblet by looking astatine the ratio betwixt spot and derivatives trading volume. Derivatives person consistently dwarfed spot trading volume, showing conscionable however overmuch speculative enactment influences price.

In November, the trading measurement ratio betwixt spot and derivatives markets remained low, signaling that astir enactment was concentrated successful derivatives alternatively than spot markets. As the terms peaked, the derivative trading measurement spiked adjacent further, portion spot measurement showed little melodramatic growth. This indicates that the terms rally was heavy influenced by leveraged traders alternatively than integrated request from spot buyers.

Graph showing Bitcoin’s spot-to-derivatives trading measurement ratio from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s spot-to-derivatives trading measurement ratio from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)In the last days of November and the archetypal 2 days of December, the derivative measurement began to diminution sharply, reflected successful some the implicit trading volumes and the trading measurement ratio. This driblet successful derivative enactment coincided with the diminution successful ELR, suggesting that traders were scaling backmost their speculative positions.

The falling spot-to-derivative measurement ratio during the rally and its flimsy betterment arsenic prices stabilized adjacent $95,000 suggests a impermanent pullback successful speculative fervor. However, the little ratio wide signals that derivatives markets stay the superior operator of Bitcoin’s terms movements, adjacent during deleveraging phases.

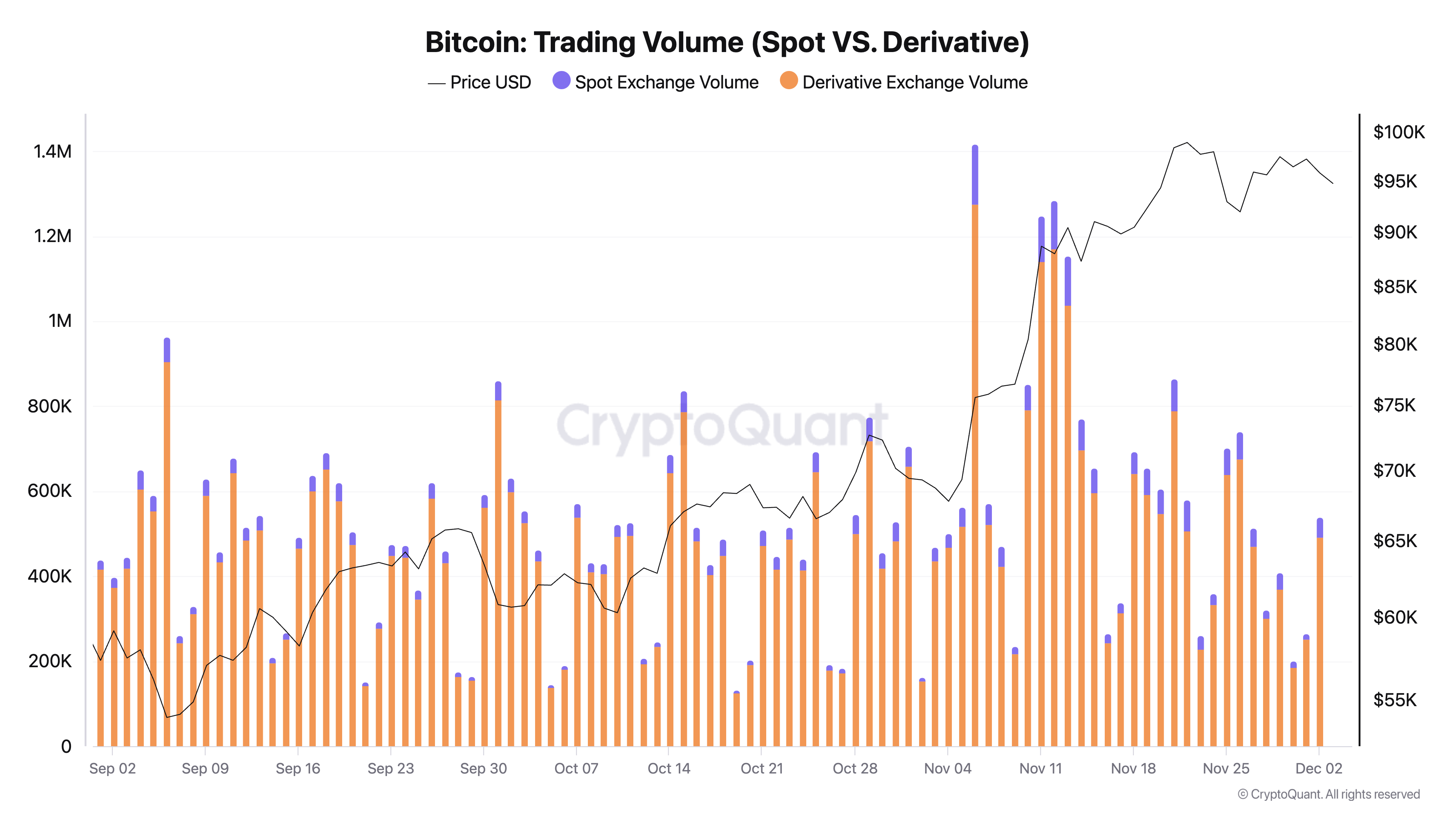

Graph showing Bitcoin’s spot and derivatives trading measurement from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s spot and derivatives trading measurement from Sep. 1 to Dec. 3, 2024 (Source: CryptoQuant)The operation of ELR and trading measurement metrics reveals the grade to which speculative enactment drives Bitcoin’s terms movements and however leverage tin amplify some rallies and corrections. The caller diminution successful ELR and derivatives volume, coupled with a flimsy betterment successful the spot-to-derivative ratio, suggests that the marketplace is entering a play of consolidation.

If integrated spot enactment increases, this whitethorn supply a healthier instauration for aboriginal terms moves.

The station Massive deleveraging stopped Bitcoin from breaking done $100k appeared archetypal connected CryptoSlate.

10 months ago

10 months ago

English (US)

English (US)