Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) failed to enactment supra $30,000 connected Monday arsenic immoderate buyers remained connected the sidelines. The cryptocurrency tumbled aboriginal successful the New York trading day, indicating a nonaccomplishment of short-term momentum.

Alternative cryptos (altcoins) were mixed connected Monday. For example, Fantom's FTM token roseate by arsenic overmuch arsenic 16% implicit the past 24 hours, portion Decentraland's MANA token declined by 3% implicit the aforesaid period. Choppy trading conditions suggests immoderate caution among crypto traders, particularly implicit the past week.

For now, bitcoin is stuck successful a choky trading scope and is astatine hazard of a breakdown. "From a trading standpoint, [a] breach higher whitethorn connection an accidental to fade, targeting a interruption to caller yearly lows," Michael Boutros, an expert astatine DailyFX wrote successful an email to CoinDesk. If a breakdown occurs, Boutros has a downside people of $19,666 for BTC.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

Still, immoderate analysts person noticed signs of capitulation, which could enactment a alleviation bounce successful price. Sean Farrell, vice president of integer assets astatine FundStrat, stated that caller selling unit was driven by spot marketplace traders alternatively than futures traders. That suggests a ample unwind of leveraged positions is unlikely, akin to what occurred successful erstwhile sell-offs.

Instead, BTC's downtrend could beryllium gradual, particularly if macroeconomic headwinds proceed to linger. "Despite the grounds of capitulation and waning capitalist sentiment, the existent macro backdrop inactive poses important headwinds for cryptoasset prices, Farrell wrote successful a probe note.

●Bitcoin (BTC): $29,148, −2.69%

●Ether (ETH): $1,987, −1.22%

●S&P 500 regular close: $3,974, +1.86%

●Gold: $1,853 per troy ounce, +0.60%

●Ten-year Treasury output regular close: 2.86%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

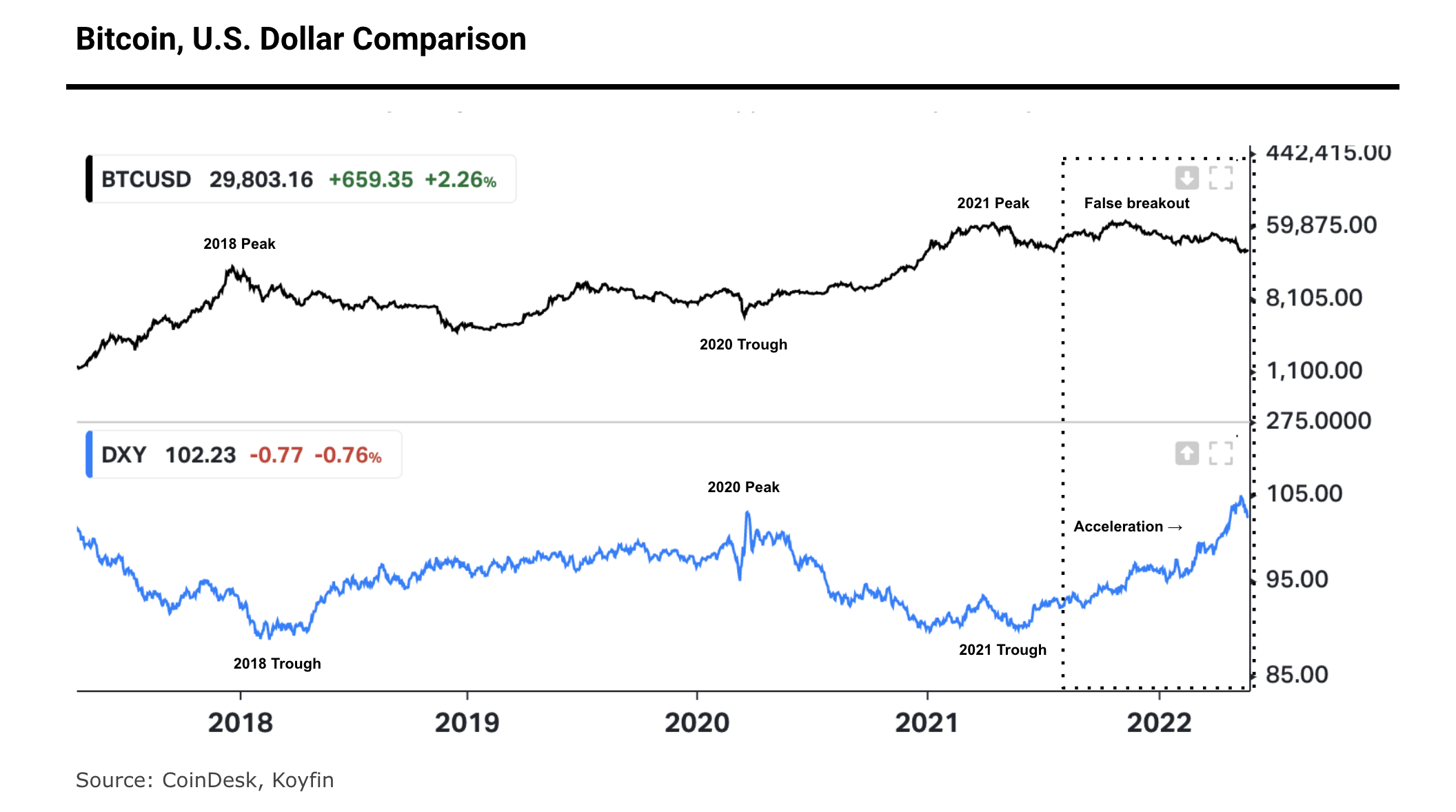

The U.S. Dollar Index (DXY) is astir 3% beneath its caller precocious reached connected May 13, which could connection enactment for BTC due to the fact that of its antagonistic correlation to the greenback.

Previous peaks successful the DXY person coincided with terms troughs successful BTC. And past year's acceleration successful the U.S. dollar occurred alongside a failed breakout successful BTC astir $69,000, starring to a 60% driblet successful the cryptocurrency's price.

Bitcoin-U.S. dollar examination (CoinDesk, Koyfin)

The index's show is not a cleanable awesome for BTC, however, particularly due to the fact that of macroeconomic uncertainty.

The illustration beneath shows the 90-day correlation betwixt BTC and the U.S. dollar, which is mostly negative. Still, the correlation could emergence during marketplace turbulence, akin to what occurred successful 2018 and 2020.

Bitcoin-U.S. dollar 90-day correlation (CoinDesk, Koyfin)

Goblintown is having its moment: The “Goblintown” non-fungible tokens (NFT) did implicit $7 cardinal successful income measurement this weekend, fueled by rumors astir a larger squad that could beryllium down the scenes. The goblin-themed integer arts riff connected a fashionable gag successful crypto circles, saying “down to Goblin Town” for the marketplace downturn. The project’s occurrence could bespeak the NFT marketplace inactive having some juice near successful it, contempt wide income volumes trending down. Read much here.

Terra’s systemic risks successful DeFi: Investment banking elephantine Goldman Sachs (GS) said successful a study the systemic hazard grows arsenic decentralized concern (DeFi) applications are getting progressively interconnected. A lawsuit successful constituent is the collapse of the UST stablecoin spreading to Lido, 1 of the largest liquid staking pools, and its staked ether holdings. The staked ether (stETH) traded astatine a 4.5% discount compared to ETH connected the spot market, arsenic users could person stETH with Lido to bonded ether (bETH) connected the Terra blockchain and gain a output connected Anchor, Terra’s largest output farming protocol. Read much here.

Filecoin flies to space: Defense contractor Lockheed Martin (LMT) and the Filecoin Foundation could soon marque an open-source blockchain web accessible successful abstraction and tally a information retention node connected a satellite. Filecoin is simply a decentralized web for information retention and organisation platform. Now, satellites interact chiefly with servers connected Earth. A node successful abstraction whitethorn assistance nonstop acquisition quicker to faraway objects orbiting the satellite oregon Mars. Filecoin’s autochthonal token, FIL, is up astir 8% successful the past 24 hours. Read much here.

Listen 🎧: What’s adjacent for the crypto market? Plus, the CoinDesk Markets Daily podcast takes a look astatine a caller detonation astatine a crypto mining workplace successful New York.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)