Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Bitcoin (BTC) declined from a precocious of $30,654 connected Wednesday, tracking losses successful stocks.

The cryptocurrency has been stuck successful a choky trading scope implicit the past fewer days, though volatility remains elevated. That could summation the hazard of greater terms swings oregon a imaginable breakdown connected the charts.

For now, alternate cryptos (altcoins) proceed to underperform bitcoin, indicating a little appetite for hazard among crypto traders. For example, ether (ETH) was down by 4% implicit the past 24 hours, compared with a 3% dip successful BTC implicit the aforesaid period. Solana's SOL token declined by 7% and Decentraland's MANA token was down by 10% connected Wednesday.

Just launched! Please motion up for our regular Market Wrap newsletter explaining what happens successful crypto markets – and why.

The S&P 500 declined portion retail and tech stocks underperformed connected Wednesday. Also, the Chicago Board Options Exchange's CBOE Volatility Index (VIX), a fashionable measurement of the banal market's anticipation of volatility based connected S&P 500 scale options, ticked higher connected Wednesday, reversing a week-long downtrend.

●Bitcoin (BTC): $29,225, −2.67%

●Ether (ETH): $1,975, −3.28%

●S&P 500 regular close: $3,924, −4.03%

●Gold: $1,814 per troy ounce, −0.21%

●Ten-year Treasury output regular close: 2.89%

Bitcoin, ether and golden prices are taken astatine astir 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information astir CoinDesk Indices tin beryllium recovered astatine coindesk.com/indices.

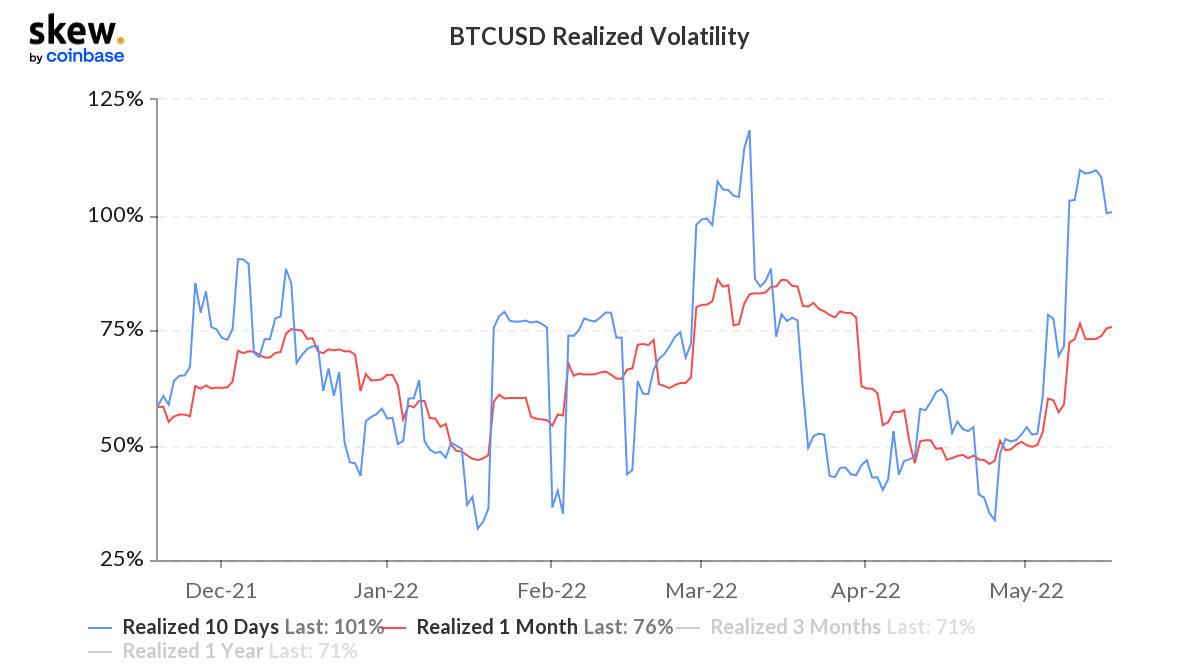

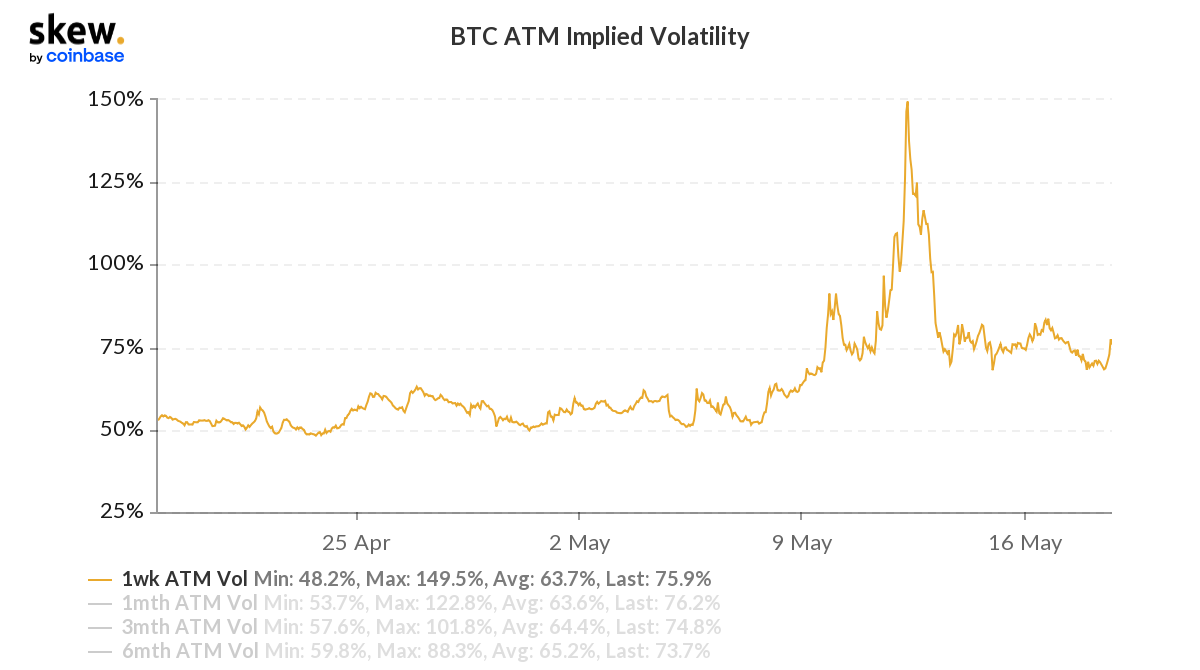

Bitcoin's short-term realized volatility remains elevated arsenic the cryptocurrency struggles to clasp the $30,000 terms level. And implied volatility (based connected the market's anticipation for question implicit 1 week), ticked higher connected Wednesday. That suggests terms enactment could stay choppy arsenic traders respond to macroeconomic hazard and turmoil successful the stablecoin market.

Option marketplace information inactive shows accrued request for puts versus calls, which means traders are actively hedging the hazard of continued terms declines.

Currently, the options marketplace places a 66% probability that BTC volition commercialized supra $25,000 successful June, according to information provided by Skew.

Bitcoin realized volatility (Skew)

Bitcoin implied volatility (Skew)

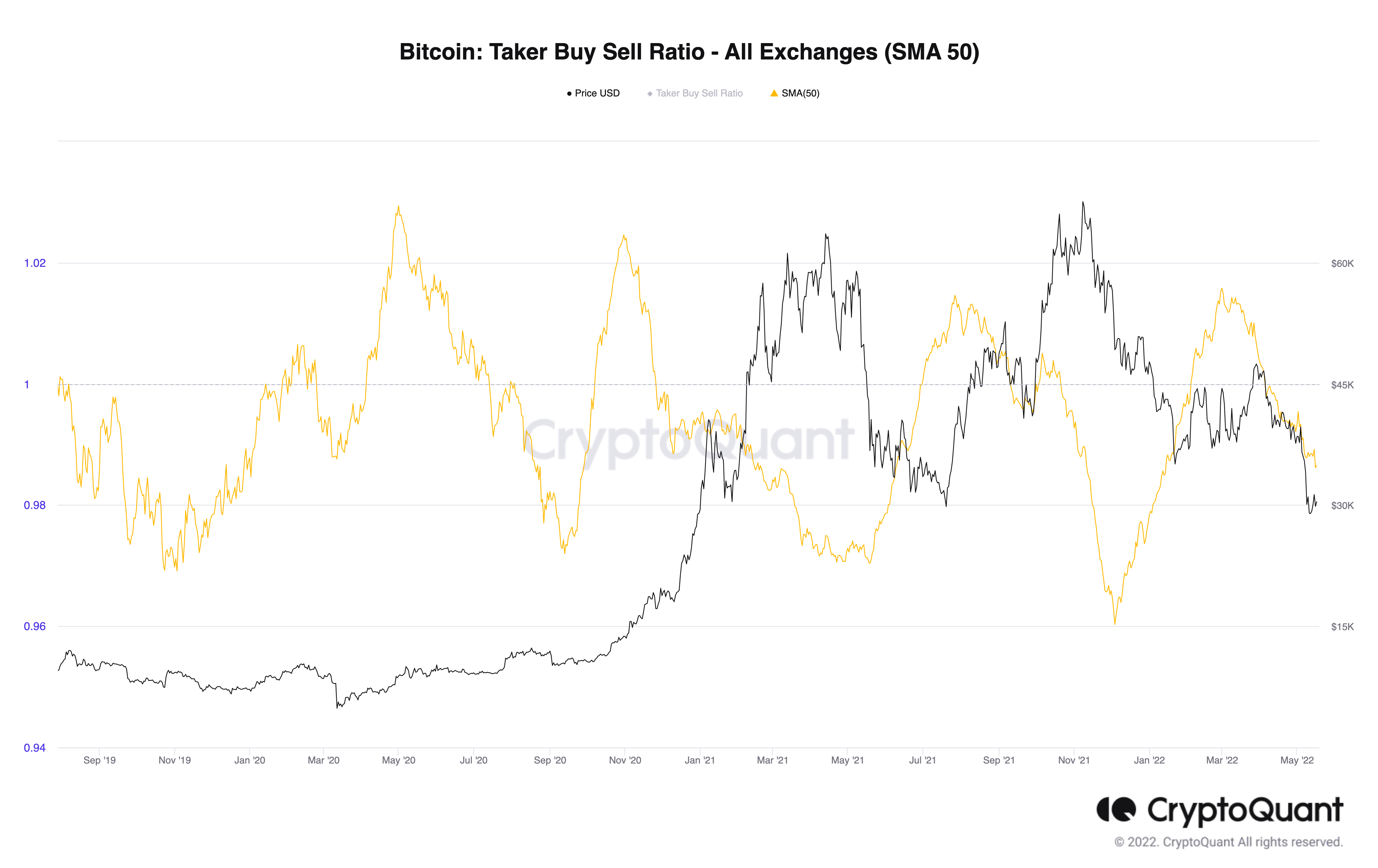

The illustration beneath shows the ratio of bargain measurement divided by merchantability measurement successful bitcoin's perpetual swaps market, a benignant of derivative trading merchandise akin to futures successful accepted markets.

Values greater than 1 bespeak bullish sentiment, portion values little than 1 bespeak bearish sentiment. The 50-day moving mean of the buy/sell measurement ratio has declined implicit the past 2 months, indicating persistent selling pressure.

Further, the ratio is inactive supra anterior lows, which suggests the downtrend successful BTC's terms could proceed until buyers instrumentality with greater conviction.

Bitcoin buy/sell measurement (CryptoQuant)

Do Kwon plans to enactment Terra backmost connected track: Terraform Labs laminitis Do Kwon connected Wednesday greeting announced an on-chain governance connection adjacent arsenic results from a preliminary online poll connected a hard fork program recovered minimal backing among assemblage members. The caller concatenation would wholly chopped retired the failed UST merchandise and alternatively absorption connected decentralized concern (DeFi) applications gathering connected Terra. Read much here.

Aave's decentralized societal media level arrives connected Polygon: Lens Protocol opened connected the Polygon blockchain mainnet Wednesday. Built by Aave Companies, it allows developers to physique their ain decentralized societal media networks successful which users afloat ain their data. The protocol was archetypal announced successful February, but present radical tin starting minting their profiles. Read much here.

NFT-focused task fund: Hackathon organizer DoraHacks has raised $20 cardinal successful a backing circular led by FTX Ventures, the concern limb of crypto speech FTX, and Liberty City Ventures. The superior volition beryllium utilized to thrust the launches of the Dora Grant DAO, a decentralized assistance community, and Dora Infinite Fund, a task money focused connected non-fungible tokens (NFT). Read much here.

Most integer assets successful the CoinDesk 20 ended the time lower.

Biggest Gainers

There are nary gainers successful CoinDesk 20 today.

Biggest Losers

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, broad and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)