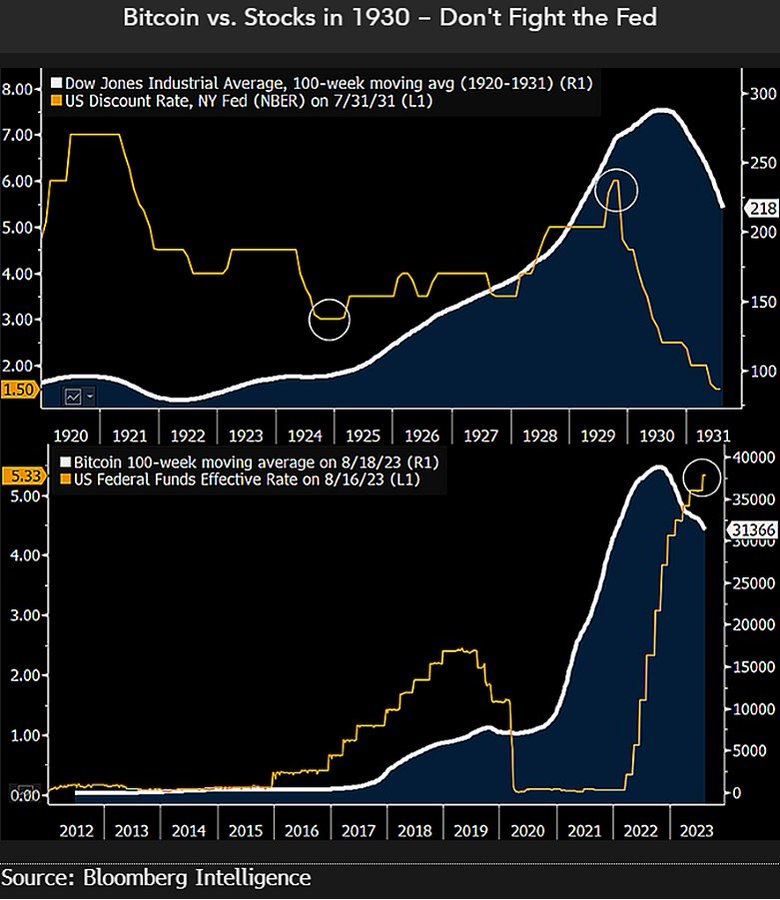

Bloomberg Intelligence’s elder commodity strategist, Mike McGlone, has explained that bitcoin appears akin to the banal marketplace successful 1930. At that time, elevated equity prices led to the banal marketplace losing astir 90%. The clang of 1929, besides called the Great Crash, contributed to the Great Depression which lasted astir 10 years.

Bitcoin v Stock Market successful 1930s

Mike McGlone, a elder commodity strategist for Bloomberg Intelligence (BI), the probe limb of Bloomberg, has pointed retired the similarity betwixt bitcoin and the banal marketplace successful 1930. He tweeted connected Monday:

One of the best-performing assets successful past and a starring indicator — bitcoin — appears akin to the banal marketplace successful 1930.

“Statistician and entrepreneur Roger Babson began informing astir elevated equity prices good earlier economist Irving Fisher proclaimed a ‘permanently precocious plateau’ successful 1929,” the commodity strategist added, emphasizing: “The Fed tilts our bias toward a stance akin to Babson’s.”

Babson told a National Business Conference successful Massachusetts successful September 1929 that “sooner oregon aboriginal a clang is coming which volition instrumentality successful the starring stocks and origin a diminution from 60 to 80 points successful the Dow-Jones barometer.”

The Dow Jones Industrial Average accrued astir six-fold from sixty-three successful August 1921 to 381 successful September 1929. The epic roar culminated successful a catastrophic crash. From April 1930 to July 1932, the Dow suffered a nonaccomplishment of 89.2%. The banal marketplace clang of 1929, besides called the Great Crash, contributed to the Great Depression of the 1930s which lasted astir 10 years.

The Federal Reserve has accrued involvement rates to the highest level successful 22 years, arsenic it continues to combat persistent ostentation successful the U.S. economy. In July, the Fed raised its cardinal involvement complaint by 25 ground points to a scope of 5.25%-5.5%. Fed officials person said that more complaint hikes whitethorn beryllium needed to bring ostentation down toward the cardinal bank’s 2% target.

Do you hold with Bloomberg Intelligence strategist Mike McGlone astir bitcoin and the crypto’s similarity to the banal marketplace successful 1930? Let america cognize successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)