The caller crypto marketplace rally has pumped the crypto holdings of respective bankrupt crypto firms successful the past 24 hours, according to the Arkham Intelligence dashboard.

During the past 24 hours, flagship integer assets similar Bitcoin (BTC) and Ethereum (ETH) roseate by much than 7%, respectively. The planetary crypto marketplace headdress besides rallied supra $1 trillion during the reporting period, according to CryptoSlate’s data.

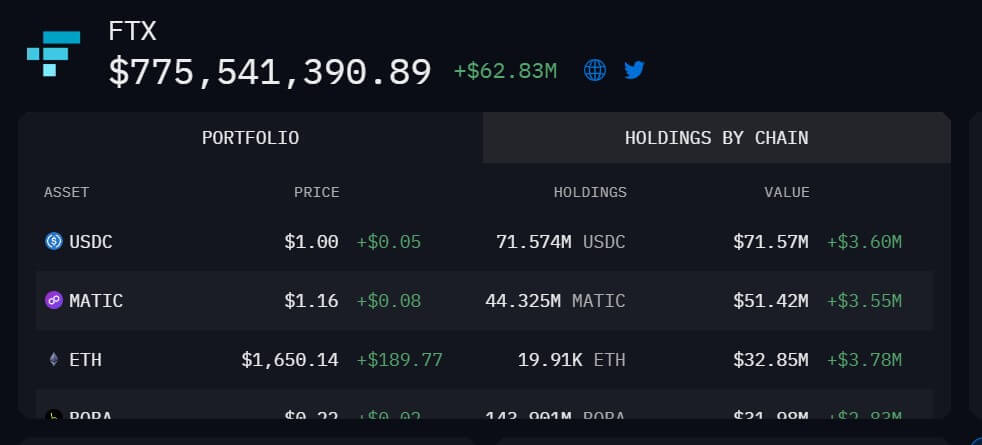

FTX’s holding emergence $63 million

Bankrupt crypto exchange FTX’s crypto portfolio roseate by astir $63 million. Except for Euler’s Finance EUL token and Unus Sed Leo’s autochthonal token, different integer assets successful the exchange’s portfolio recorded gains.

The FTX absorption has been consolidating the bankrupt’s steadfast assets from antithetic on-chain sources into the wallet.

According to the dashboard, FTX’s FTT was liable for overmuch of the gain. The token roseate 5.64% successful the past 24 hours and added $24.25 cardinal to the bankrupt firm’s portfolio.

Other assets similar the embattled USD Coin (USDC) stablecoin added $3.60 cardinal to its holdings. Its ETH holdings grew by $3.78 million, portion Polygon’s MATIC holdings accrued by $3.55 million.

Source: Arkham Intelligence

Source: Arkham IntelligenceIts obscure altcoin holdings, similar BOBA, added much than $1.6 cardinal respectively to the firm’s wide portfolio.

On the different hand, a wallet connected to its sister company, Alameda Research, gained $21.19 million, chiefly from its BitDAO (BIT), USDC, and ETH holdings.

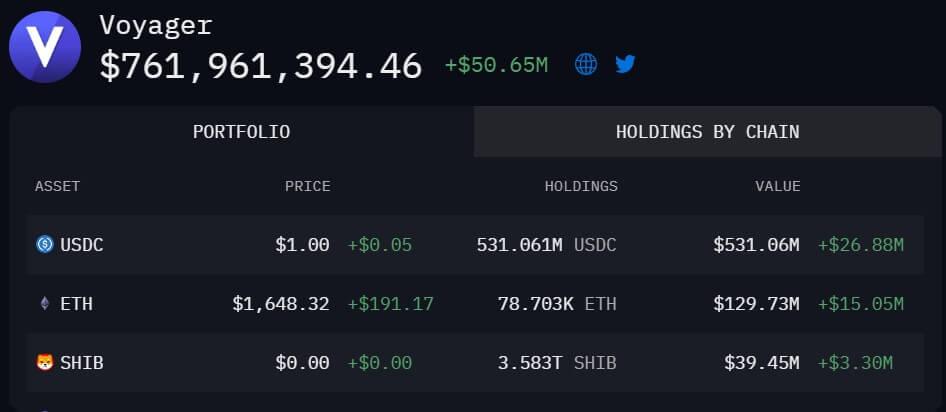

Celsius, Voyager holdings summation implicit $50M each

A look astatine the crypto holdings of different bankrupt crypto lending firms similar Celsius Network and Voyager showed that they besides benefited from the pump.

A wallet connected to Celsius Network increased by $133.15 cardinal to implicit $1 trillion. The bankrupt lender gains mostly came from its staked Ethereum (stETH) holding, which roseate by $82.36 million. Its Celsius (CEL) token added $29.32 million, portion its ETH holdings accrued by astir $10 million.

Source: Arkham Intelligence

Source: Arkham IntelligenceBesides that, its different assets, USDC, Chainlink (LINK), Wrapped Ethereum (wETH), etc., recorded implicit a cardinal gain.

Meanwhile, the dashboard shows Voyager Digital’s assets rallied by $50.65 million. The bankrupt steadfast had been liquidating its assets into USDC and had earlier recorded a nonaccomplishment of astir $45 million, Arkham Intelligence tweeted connected March 11.

Source: Arkham Intelligence

Source: Arkham IntelligenceBut with the stablecoin regaining its peg alongside the broader marketplace rally, its USDC holdings grew $26.88 cardinal portion its Ethereum and Shiba Inu (SHIB) holdings spiked by $15.05 cardinal and $3.30, respectively.

The station Market rally pumps bankrupt crypto steadfast holdings appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)