Despite Bitcoin’s terms staying beneath the captious $30,000 mark, caller spikes successful a cardinal marketplace metric, the Spent Output Profit Ratio (SOPR), suggest the marketplace is successful a profit-taking regime.

BTC has been flatlining astir $29,200, incapable to regain the $30,000 level it mislaid connected July 23. While the marketplace anticipates further sideways movements earlier breaking done the $30,000 resistance, a cardinal on-chain metric suggests immoderate marketplace participants person already begun raking successful profits.

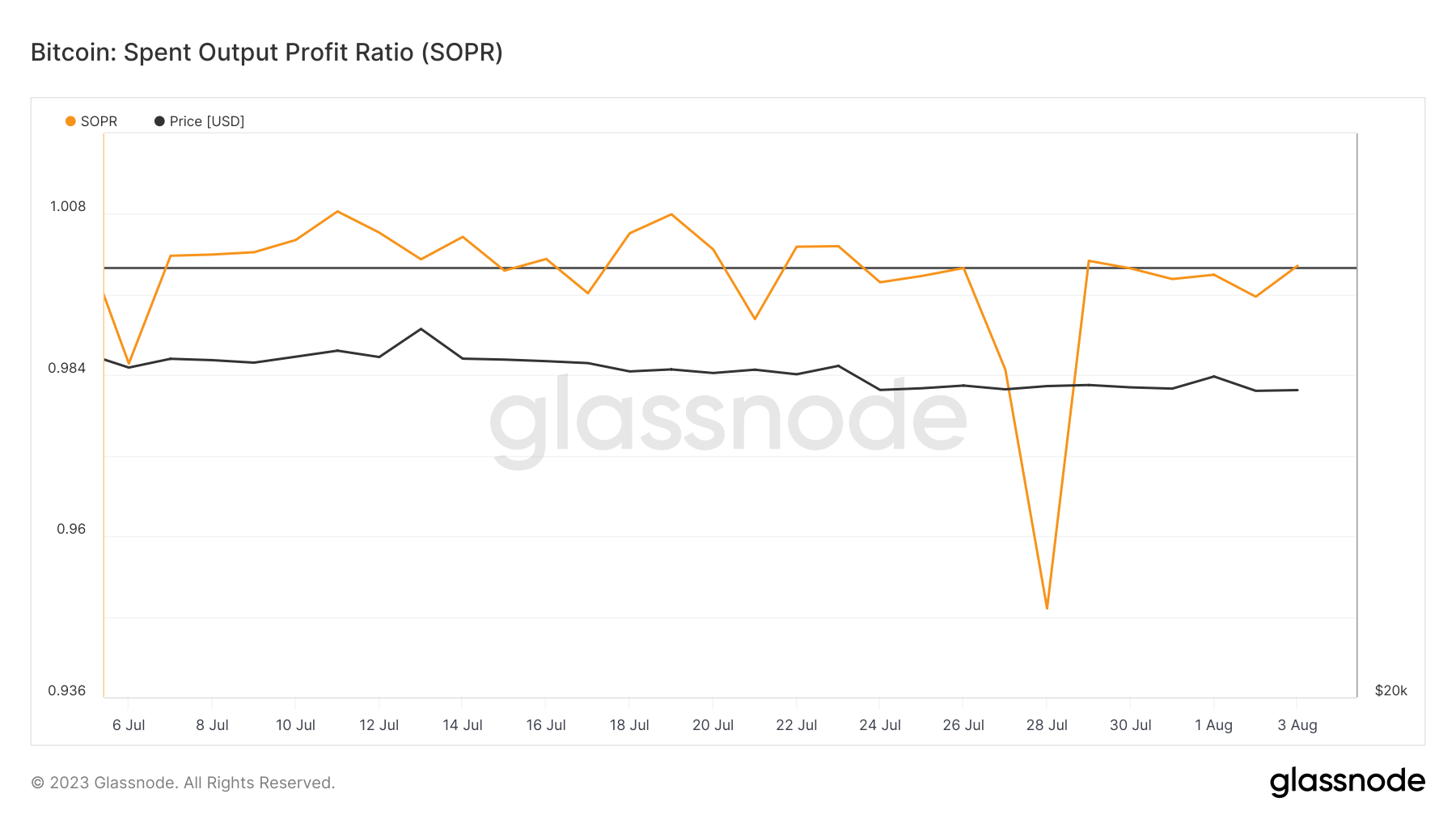

The Spent Output Profit Ratio (SOPR), a cardinal metric successful marketplace analysis, calculates the nett ratio of coins moved on-chain, measured by the terms sold divided by the terms paid. This metric has shown a important summation successful August. A SOPR people of 1 indicates break-even, supra 1 signifies profit, and beneath 1 denotes a loss.

On August 3, the SOPR surged supra 1, signaling that the marketplace had started realizing profits. This surge followed a near-vertical driblet to 0.94 connected July 28, aft a volatile month. This is the archetypal clip successful August that the SOPR has crossed the 1 mark, indicating a displacement successful marketplace sentiment.

Graph showing the Spent Output Profit Ratio (SOPR) for Bitcoin from July 4 to August 4 (Source: Glassnode)

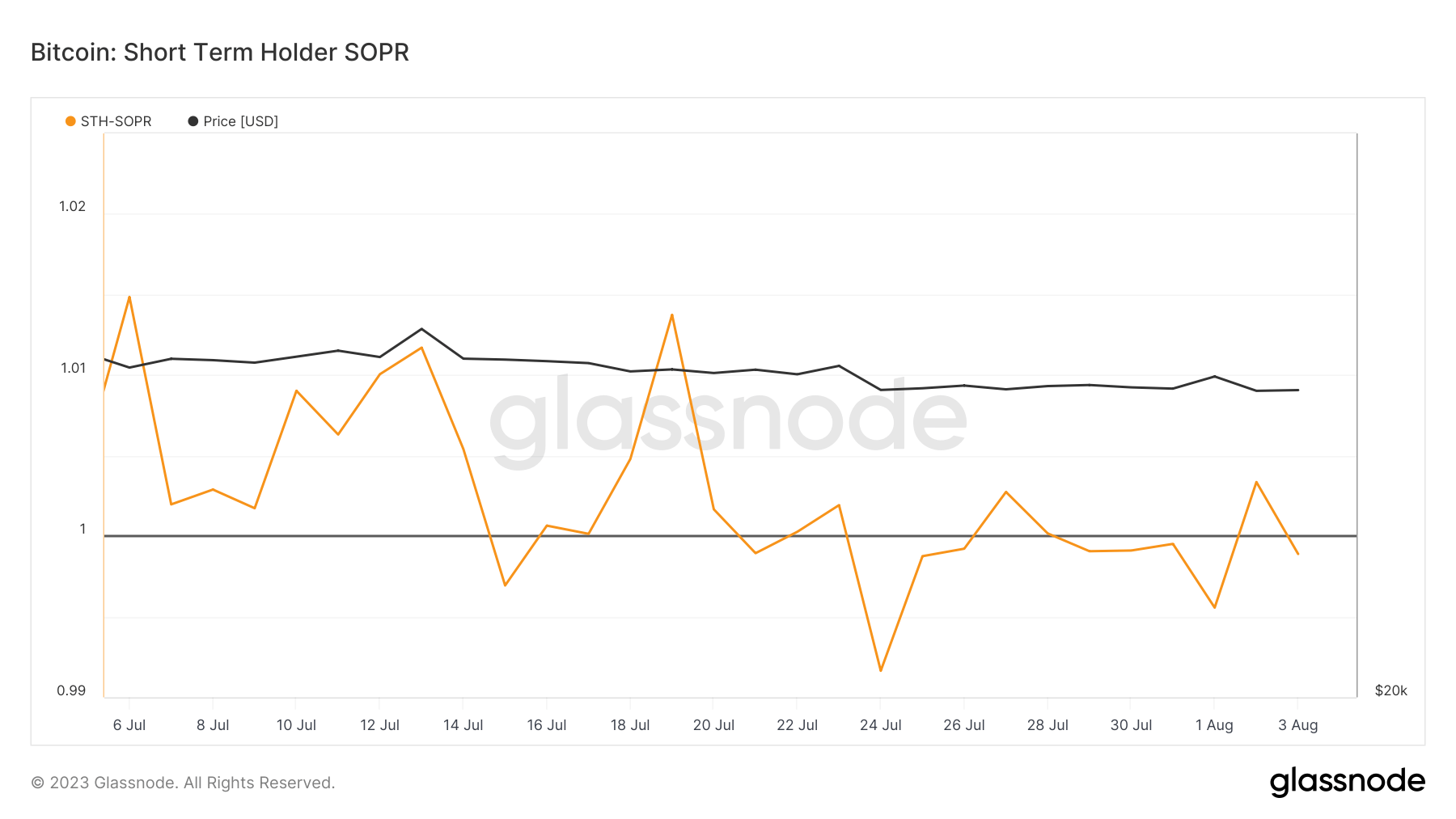

Graph showing the Spent Output Profit Ratio (SOPR) for Bitcoin from July 4 to August 4 (Source: Glassnode)A person introspection of antithetic marketplace cohorts reveals who drives this nett realization. The SOPR for short-term holders (STHs) dropped beneath 1 connected August 4, pursuing a little spike astatine the opening of the month. This suggests that short-term holders are selling astatine a loss.

Graph showing the STH SOPR from July 4 to August 4 (Source: Glassnode)

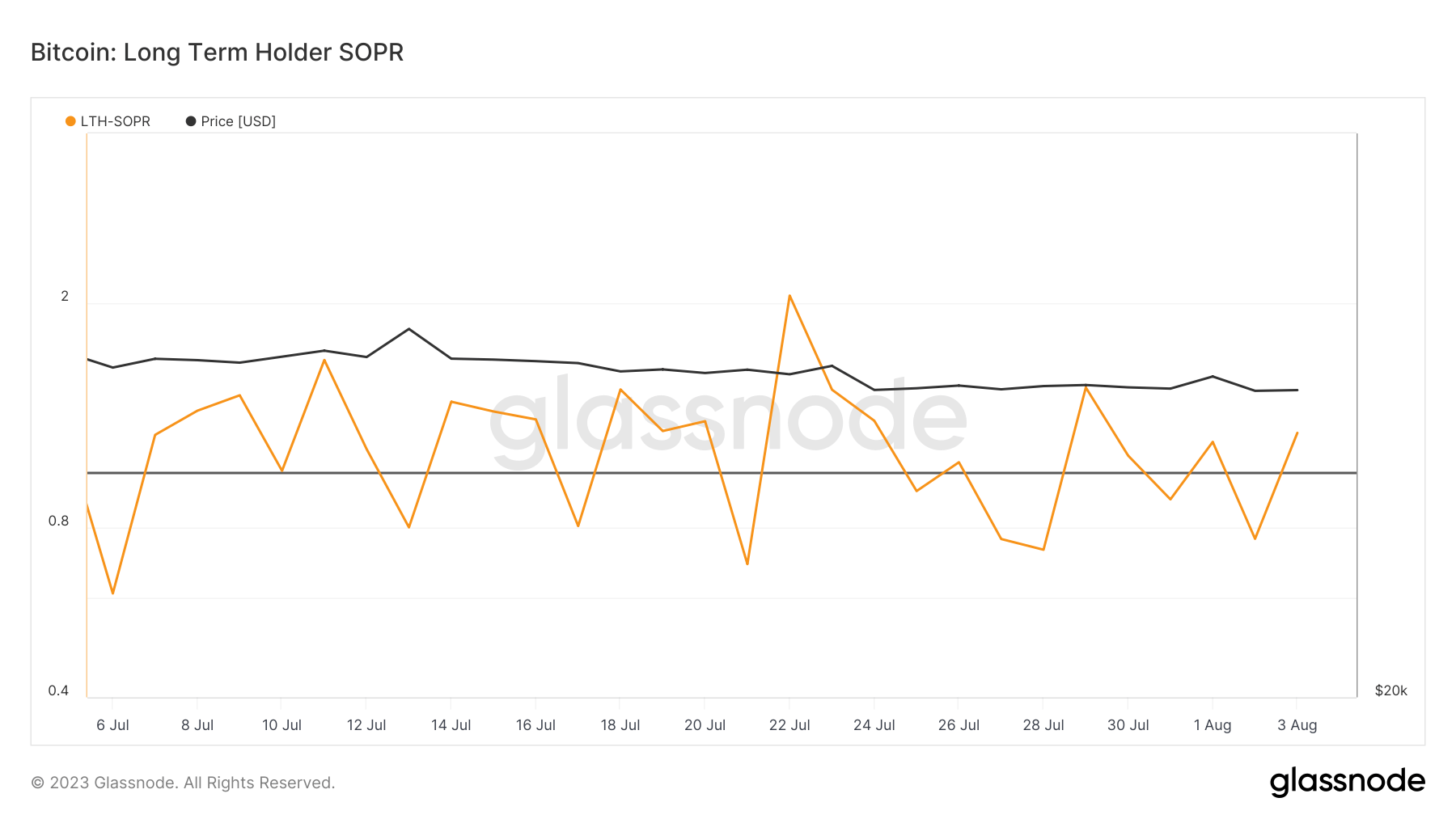

Graph showing the STH SOPR from July 4 to August 4 (Source: Glassnode)In contrast, semipermanent holders (LTH) saw their SOPR leap to 1.17. Over the past 30 days, the LTH SOPR has spent 20 days supra 1, indicating that this cohort is selling astatine a profit.

Graph showing the LTH SOPR from July 4 to August 4 (Source: Glassnode)

Graph showing the LTH SOPR from July 4 to August 4 (Source: Glassnode)These contrasting behaviors betwixt short-term (who are selling astatine a loss) and semipermanent holders (who are capitalizing connected their profits) suggest a marketplace successful the throes of redistribution. While short-term holders capitulate, semipermanent holders capitalize connected their profits. This dynamic could perchance pb to a consolidation of Bitcoin holdings among semipermanent investors, mounting the signifier for the adjacent terms rally.

As Bitcoin continues to commercialized beneath $30,000, these cardinal on-chain metrics, peculiarly the SOPR’s movements, volition apt beryllium the market’s focus. The SOPR movements volition supply invaluable insights into the market’s profit-taking behaviour and its imaginable interaction connected Bitcoin’s terms trajectory.

The station Market backmost successful profit-taking mode contempt level Bitcoin shows cardinal metric appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)