While President Donald Trump's tariff warfare aims to spark a manufacturing roar astatine home, firm America's spending absorption remains firmly connected "bits" alternatively than "bricks and mortar."

This opposition is evident successful the spending patterns of the Magnificent 7 (Mag 7) stocks – a radical comprising large-cap tech companies, including Alphabet (parent institution of Google), Amazon, Apple, Meta Platforms (parent institution of Facebook and Instagram), Microsoft, Nvidia, and Tesla.

These firms are expected to cumulatively walk an astonishing $650 cardinal this twelvemonth connected superior expenditure (capex) and probe and improvement (R&D), according to information tracked by Lloyds Bank. That magnitude is larger than what the U.K. authorities spends connected nationalist investments successful a year, the slope noted successful a Thursday note.

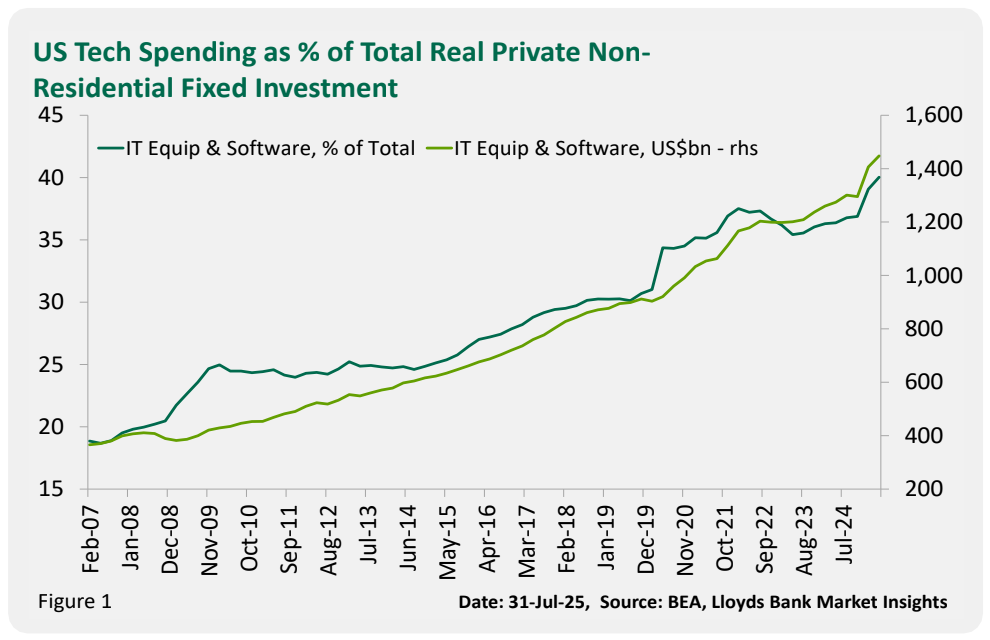

If that fig unsocial doesn't impressment you, see this: the full economy-wide concern spending connected IT instrumentality and bundle has continued to surge this year, accounting for 6.1% of GDP, portion some backstage fixed and fixed non-residential investment, excluding IT, person shrunk for consecutive quarters.

FOMO and AI

According to Lloyds' FX Strategist Nicholas Kennedy, the diminution successful investments crossed different sectors of the system could beryllium owed to respective reasons, including the fearfulness of missing retired (FOMO) connected the artificial quality (AI) boom.

"There mightiness beryllium immoderate explanations different than a crowding retired by IT spending and political/trade uncertainties that you could telephone on; the gathering roar that was triggered by Biden's CHIPS act, which boosted structures, has faded, for instance. There is besides a FOMO effect astatine work, firms encouraged to divert concern resources from what they traditionally bash towards fashionable AI-related projects. So they're conscionable spending elsewhere," Kennedy said successful a enactment to clients.

The illustration indicates that U.S. firm spending connected IT instrumentality and bundle has accrued to $1.45 trillion, representing a 13.6% year-over-year rise. The tally makes up implicit 40% of the full U.S. backstage fixed investment.

The U.S. second-quarter GDP estimate, released by the Bureau of Economic Analysis aboriginal this week, showed that backstage fixed concern successful IT accrued by 12.4% quarter-on-quarter.

Meanwhile, concern successful non-IT sectors oregon the broader system fell by 4.9%, extending the three-quarter declining trend.

From 'bricks' to 'bits'

This continued dominance of "bits" spending successful firm America should calm the nerves of those disquieted that the administration's absorption connected manufacturing whitethorn suck superior distant from exertion markets, including emerging avenues similar cryptocurrencies.

Bitcoin and NVDA, the bellwether for each things AI, some bottomed retired successful precocious November 2022 with the motorboat of ChatGPT and person since enjoyed unthinkable bull runs, demonstrating a almighty correlation betwixt technology's emergence and the crypto market.

"Whether that [AI spending boom] generates a instrumentality is different matter, but it does reshape plans towards bits from bricks," Kennedy said.

Moreover, the crypto marketplace has besides recovered a important tailwind successful the signifier of a favourable regulatory argumentation nether Trump. The medication has demonstrated its pro-crypto bias done the signing of respective cardinal pieces of authorities aimed astatine clarifying regulatory oversight for integer assets and stablecoins, including measures that person garnered bipartisan support. Additionally, the medication has made strategical appointments to fiscal regulatory bodies.

3 months ago

3 months ago

English (US)

English (US)