People thin to observe periods of debased feerates. It’s clip to cleanable house, consolidate immoderate UTXOs you request to, unfastened oregon adjacent immoderate Lightning channels you’ve been waiting on, and inscribe immoderate anserine 8-bit jpeg into the blockchain. They’re perceived arsenic a affirmative time.

They are not. We person seen explosive terms appreciation the past fewer months, yet hitting the 100k USD benchmark that everyone took for granted arsenic preordained during the past marketplace cycle. That’s not normal.

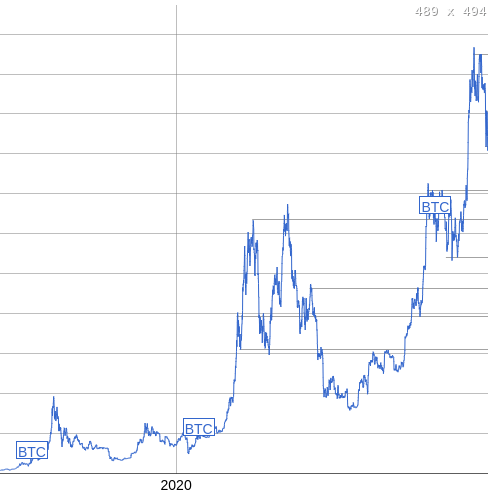

The representation connected the near is the mean feerate each time since 2017, the representation connected the close is the mean terms each time since 2017. When the terms was pumping, erstwhile it was highly volatile, historically we person seen feerates spike accordingly. Generally matching the maturation and peaking erstwhile the terms did. The radical really buying and selling transacted on-chain, radical took custody of their ain coins erstwhile they bought them.

This past limb up to implicit 100k does not look astatine each to person had the aforesaid proportional impact connected feerates that adjacent moves earlier successful this rhythm have. Now, if you really did look astatine some of those charts, I’m definite galore radical are going “What if this rhythm is astatine the end?” It’s possible, but let’s accidental it’s not for a second.

What other could this beryllium indicating? That the participants that are driving the marketplace are changing. A radical of radical who utilized to beryllium dominated by individuals who aforesaid custodied, who managed their counterparty hazard by removing gains from exchanges, who generated time-sensitive on-chain activity, are transforming into a radical of radical simply passing astir ETF shares that person nary request of settling thing on-chain.

That is not a bully thing. Bitcoin’s precise quality is defined by the users who interact with the protocol directly. Those who person backstage keys to authorize transactions generating gross for miners. Those who are sent funds, and verify transactions against statement rules with software.

Both of those things being removed from the hands of users and placed down the veil of custodians puts the precise stableness of Bitcoin’s quality astatine risk.

This is simply a superior existential contented that has to beryllium solved. The full stableness of statement astir a circumstantial acceptable of rules is premised connected the presumption that determination are capable autarkic actors with abstracted interests that diverge, but align connected a worth gained from utilizing that acceptable of rules. The smaller the radical of autarkic actors (and the larger the radical of radical “using” Bitcoin done those actors arsenic intermediaries) the much applicable it is for them to coordinate to fundamentally alteration them, and the much apt it is that their interests arsenic a radical volition diverge successful sync from the interests of the larger radical of secondary users.

If things proceed trending successful that direction, Bitcoin precise good could extremity up embodying thing that those of america present contiguous anticipation it can. This occupation is some a method one, successful presumption of scaling Bitcoin successful a mode that allows users to independently person power of their funds on-chain, adjacent if lone done worst-case recourse, but it is besides a occupation of inducement and hazard management.

The strategy indispensable not lone scale, but it has to beryllium capable to supply ways to mitigate the risks of aforesaid custody to the grade that radical are utilized to from the accepted fiscal world. Many of them really request it.

This isn’t conscionable a concern of “do the aforesaid happening I bash due to the fact that it’s the lone close way,” this is thing that has implications for the foundational properties of Bitcoin itself successful the agelong term.

This nonfiction is a Take. Opinions expressed are wholly the author’s and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

9 months ago

9 months ago

English (US)

English (US)