The caller driblet successful Bitcoin’s price to $29,200 has sparked important liquidations, with the marketplace witnessing astir $50 cardinal successful realized losses, astir coming from short-term holders.

The behaviour of semipermanent holders (LTH) and short-term holders (STH) is important to knowing marketplace dynamics. LTHs are those who person held their Bitcoin for much than 155 days, portion STHs person held their Bitcoin for little than this period. The actions of these 2 groups tin supply invaluable insights into marketplace sentiment and imaginable aboriginal movements.

LTHs are considered investors with a precocious condemnation successful Bitcoin’s semipermanent worth and are little apt to merchantability their coins successful effect to short-term marketplace fluctuations. On the different hand, STHs are mostly much responsive to short-term terms movements and marketplace news. They are much apt to bargain during marketplace upswings and merchantability during downturns, contributing to marketplace volatility. An summation successful the proportionality of Bitcoin held by short-term holders tin often awesome accrued speculative enactment and tin sometimes precede accrued terms volatility.

Despite the caller terms volatility and accrued realized losses, information from on-chain analytics steadfast Glassnode indicates that LTHs look to clasp strong. There has been small alteration successful the proviso of Bitcoin held by this group, suggesting resilience successful the look of the existent terms slump.

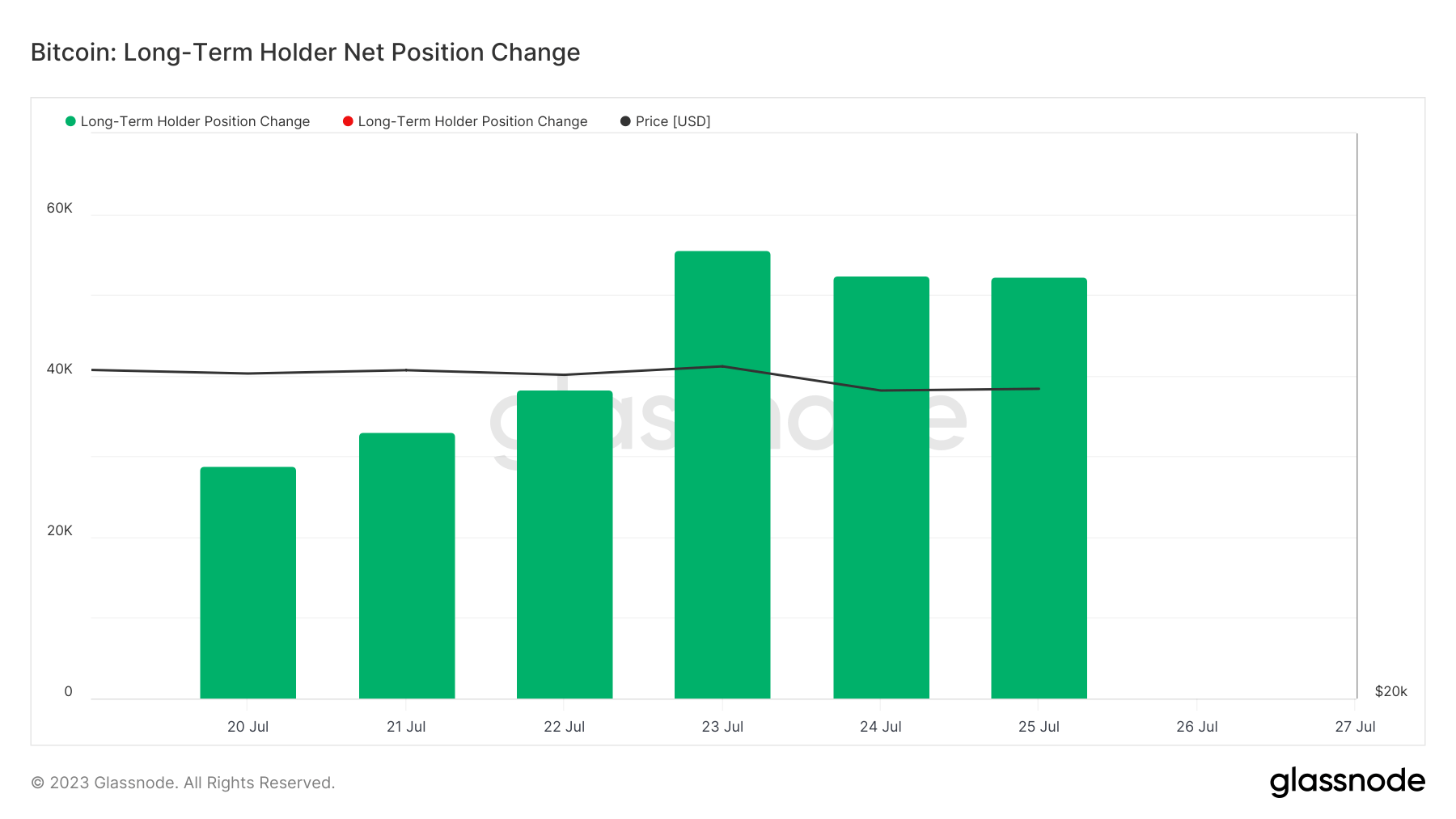

Graph showing the semipermanent holder presumption alteration from July 20 to July 26 (Source: Glassnode)

Graph showing the semipermanent holder presumption alteration from July 20 to July 26 (Source: Glassnode)The LTH Capitulation Risk, a metric that identifies periods of elevated accent connected semipermanent Bitcoin investors, indicates small information of these holders selling disconnected their BTC holdings.

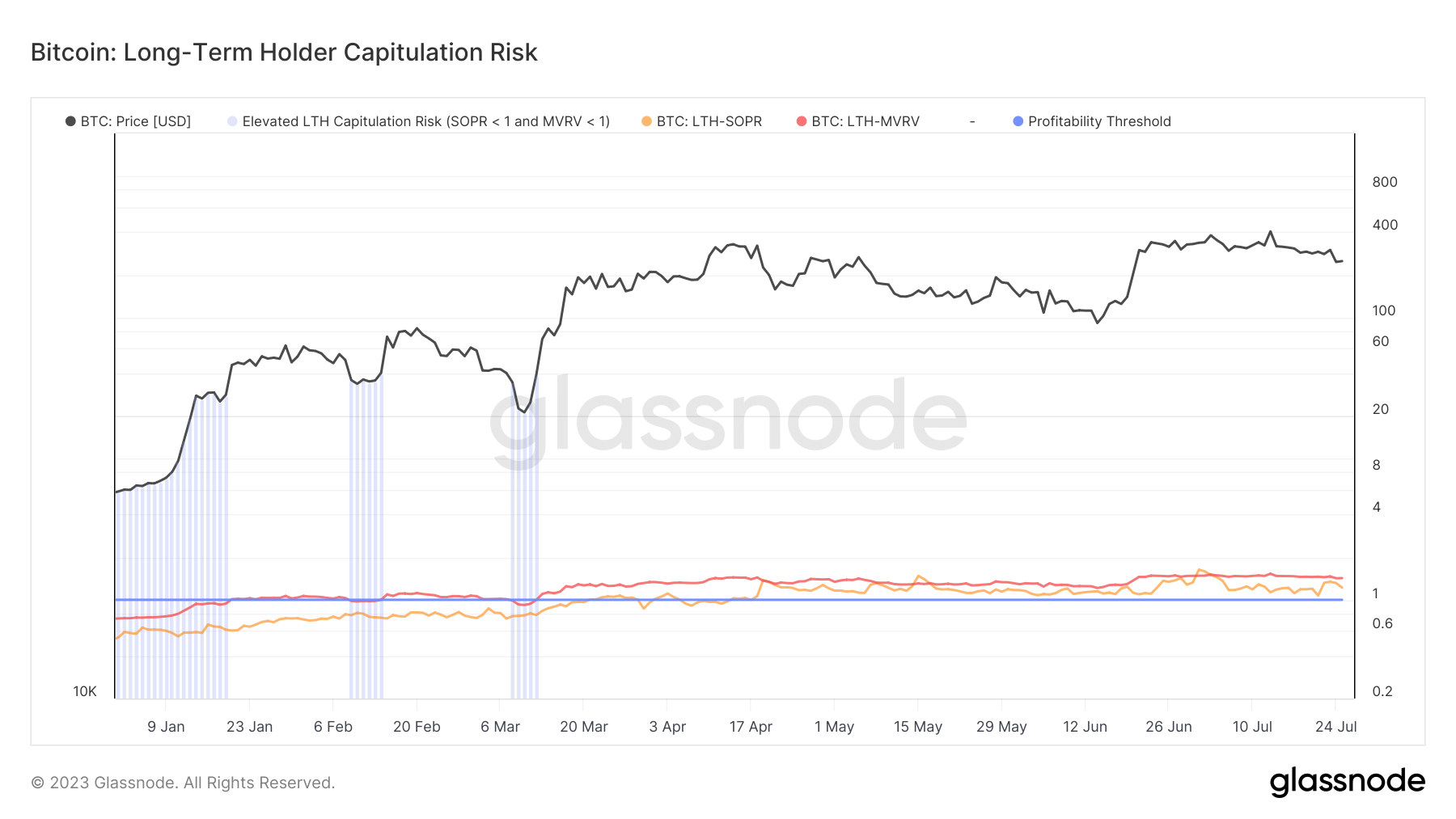

Graph showing the LTH capitulation hazard successful 2023 (Source: Glassnode)

Graph showing the LTH capitulation hazard successful 2023 (Source: Glassnode)This metric amalgamates 2 indicators: the LTH-MVRV, representing the unrealized profit oregon nonaccomplishment of semipermanent holders, and the LTH-SOPR, indicating the realized nett oregon nonaccomplishment of the aforesaid group. Historically, periods of elevated capitulation hazard person correlated with Bitcoin’s terms dips, but currently, this hazard appears to beryllium low.

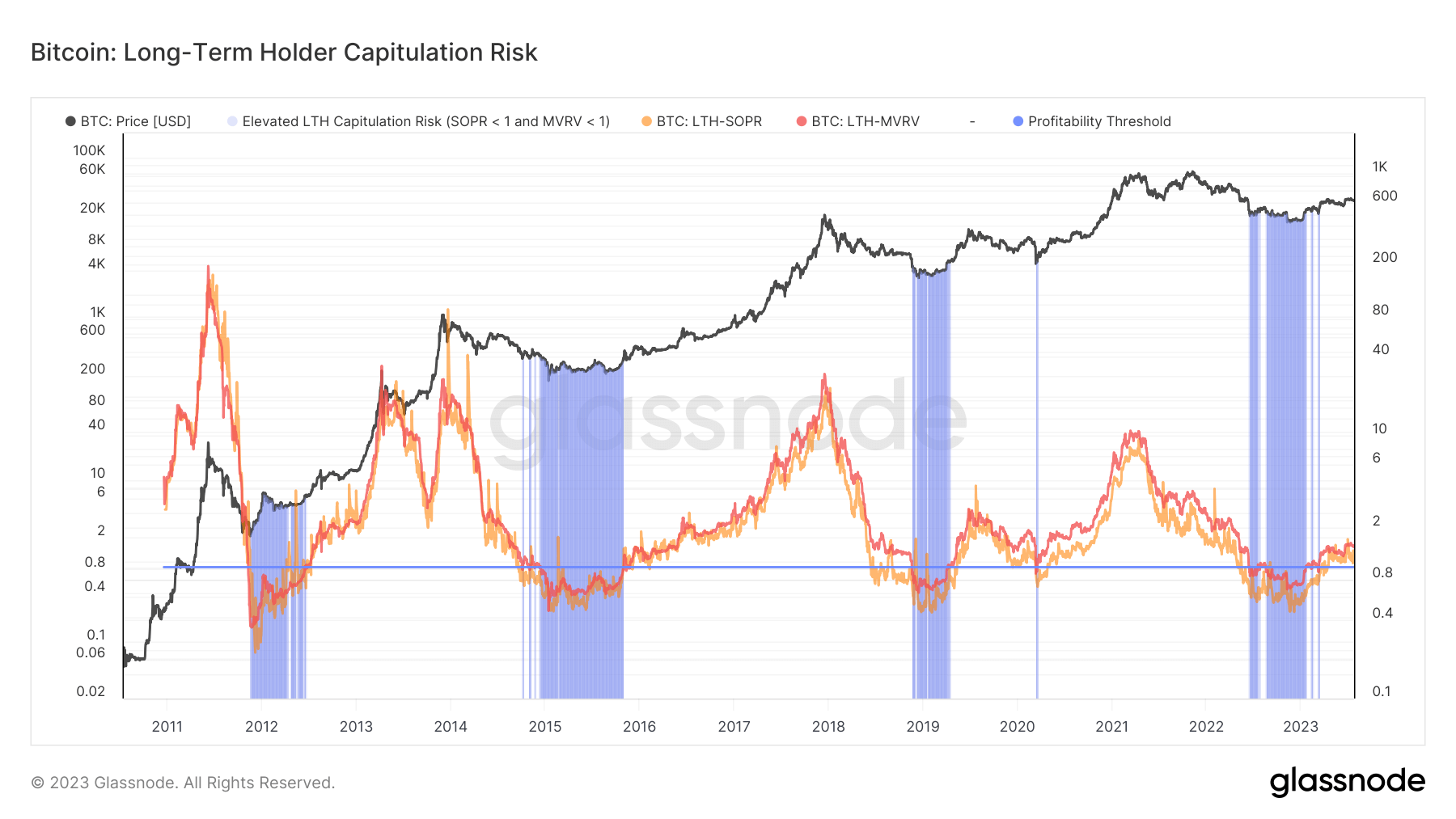

Graph showing the LTH capitulation hazard from 2010 to 2023 (Source: Glassnode)

Graph showing the LTH capitulation hazard from 2010 to 2023 (Source: Glassnode)Further, the realized price, which reflects the aggregate terms astatine which each coin was past spent on-chain, presently stands astatine $20,540, portion Bitcoin’s spot terms stood astatine $29,200 astatine property time. This suggests a important buffer earlier Bitcoin’s terms drops beneath the acquisition terms of semipermanent holders.

In contrast, the realized terms for short-term holders is $28,200, indicating an elevated hazard of STH sell-offs. This is due to the fact that the spot terms is dangerously adjacent to the mean acquisition terms for this group, and a further dip could trigger much liquidations.

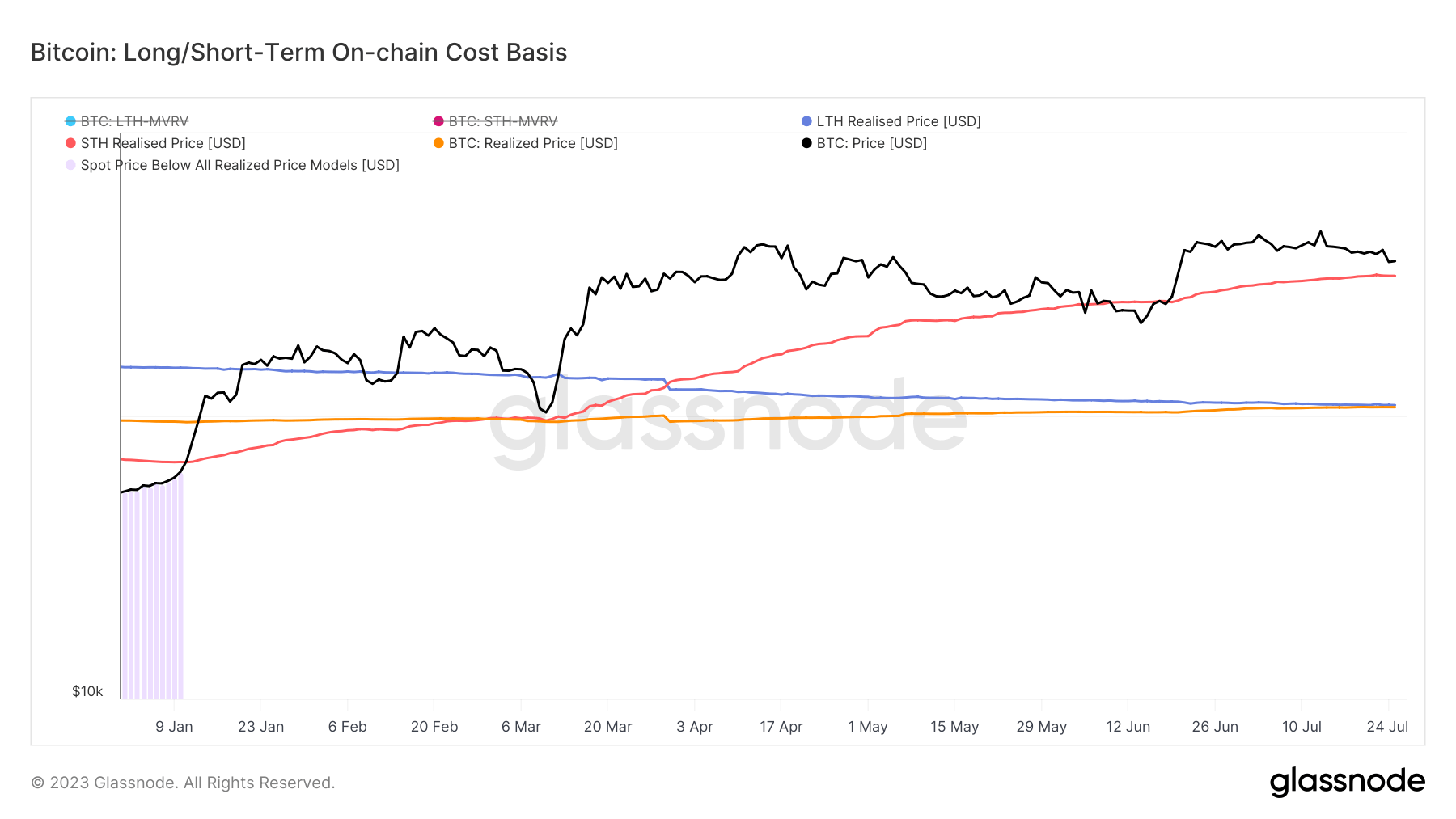

Graph showing the on-chain outgo ground for LTHs and STHs successful 2023 (Source: Glassnode)

Graph showing the on-chain outgo ground for LTHs and STHs successful 2023 (Source: Glassnode)Despite Bitcoin’s caller terms dip and the ensuing marketplace turbulence, semipermanent holders look to beryllium weathering the storm. Their holding behaviour and the existent metrics suggest a little hazard of sell-offs from this group. However, the concern for short-term holders is much precarious, and further terms dips could pb to accrued sell-offs.

The station Long-term holders look unfazed by Bitcoin’s dip to $29K appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)