Bitcoin trading supra the 50-day elemental moving mean is simply a bullish indicator for the bitcoin terms and galore semipermanent holders are taking note.

This is an sentiment editorial by Mike Ermolaev, caput of nationalist relations astatine the ChangeNOW exchange.

As a retail trader oregon idiosyncratic who conscionable got started with bitcoin not agelong ago, you whitethorn beryllium searching for clues astir what to expect adjacent with its price. A 2nd sentiment is besides important for seasoned bitcoin investors to comparison their ain perspectives.

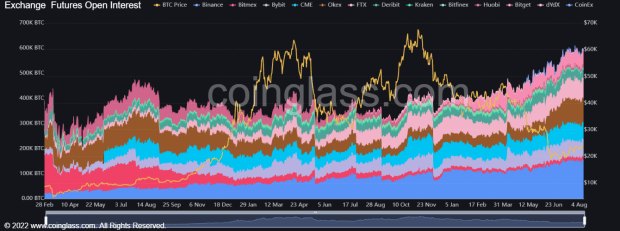

Analyzing Open Interest Of Bitcoin Futures

Bitcoin unfastened involvement provides penetration into however overmuch wealth is flowing into and retired of the bitcoin derivatives market. Derivatives similar bitcoin futures and perpetual swaps are utilized by traders to speculate connected whether bitcoin's terms volition emergence oregon autumn without having to ain the integer asset. A higher bitcoin unfastened involvement means much traders person opened positions, portion a little 1 means much traders person closed them.

As of writing, bitcoin-denominated unfastened involvement had accrued to 592,000 BTC from 350,000 BTC astatine the commencement of April 2022. A look astatine the bitcoin denomination tin assistance isolate periods of accrued leverage from terms fluctuations.

(Source)

(Source)

In USD terms, existent unfastened involvement is $13.67 billion, which is comparatively low, comparable to aboriginal bull marketplace levels successful January 2021 and June 2021 sell-off lows.

Whenever determination is simply a ample summation successful unfastened involvement connected a BTC basis, but not connected a USD basis, that signals markets are taking connected much BTC exposure, but inactive don't expect it to determination much.

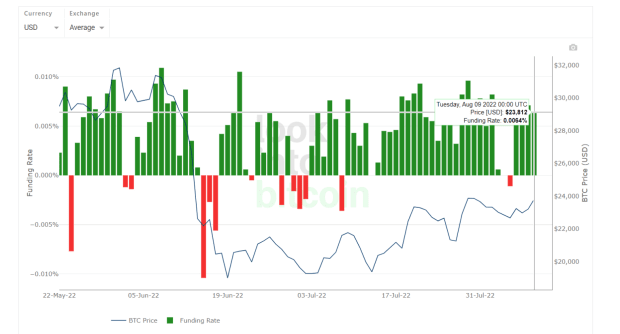

Funding Rates Rise For Perpetual Swaps

In bid to recognize however astir traders are positioned successful the market, we tin look astatine backing rates utilized connected perpetual swap contracts: derivative fiscal contracts unsocial to bitcoin and cryptocurrency that person nary expiration day oregon settlement. They let traders to usage leverage — up to 100x — erstwhile betting connected the terms of bitcoin. A backing complaint is simply a periodic outgo made to oregon by a trader who is agelong oregon abbreviated based connected the quality betwixt the perpetual declaration terms and the spot price.

Generally, we tin accidental that affirmative backing rates bespeak traders are taking agelong positions and are mostly bullish astir the terms moving upward, whereas antagonistic backing rates bespeak traders are usually taking abbreviated positions and are mostly bearish, believing the terms volition determination downward. Funding rates breaking supra 0.005% awesome accrued speculative premium, a inclination that is presently occurring.

(Source)

(Source)

The Bitcoin Price Is Above Its 50-Day Simple Moving Average

Analysts similar myself who usage method investigation charts and patterns to marque concern decisions, enactment that bitcoin is presently trading supra its 50-day elemental moving mean (SMA) — an effectual inclination indicator — for the archetypal clip since mid-July. This confirms that underlying momentum whitethorn beryllium building.

(Source)

(Source)

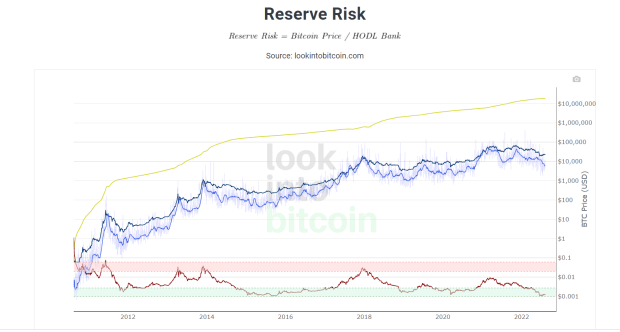

Long-Term Holders See Bitcoin As An Appealing Risk/Reward Investment

Below is different illustration that visualizes however semipermanent BTC holders consciousness astir bitcoin comparative to its price. Bitcoin's semipermanent holders are mostly amended astatine identifying the champion clip to bargain and merchantability bitcoin. This is not surprising, since they person much acquisition successful the tract than newcomers who are conscionable getting started. It is important to admit erstwhile they are assured that the fig 1 cryptocurrency volition emergence successful terms successful the future.

(Source)

(Source)

The reserve hazard illustration is presently successful the greenish zone, meaning a precocious level of assurance combined with a debased price, making bitcoin an charismatic risk/reward investment. Investors who put during greenish reserve hazard person historically enjoyed precocious returns implicit time.

Conclusion

Market perceptions of assorted savvy marketplace participants, who person traditionally been astute successful making their concern decisions, amusement that they are progressively assured astir the aboriginal of bitcoin terms and are consenting to instrumentality connected much terms risk. There is simply a cautious upward bias successful bitcoin derivatives markets and semipermanent investors look to beryllium reasonably confident. The bitcoin terms is besides showing signs of betterment based connected method indicators.

Disclaimer: This is not fiscal advice. All opinions, statements, estimates, and projections expressed successful this nonfiction are solely those of Mike Ermolaev, PR Head astatine ChangeNOW.

This is simply a impermanent station by Mike Ermolaev. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)