With the crypto system experiencing important gains implicit the past week and the terms of ethereum rising 11.9%, the marketplace capitalization of Lido’s staked ether has accrued to $10.3 billion. This caller summation has propelled the token’s wide marketplace valuation to the ninth-largest position, according to the crypto marketplace capitalization aggregation website coingecko.com.

Lido Finance’s TVL Dominates Defi with a 21.59% Share

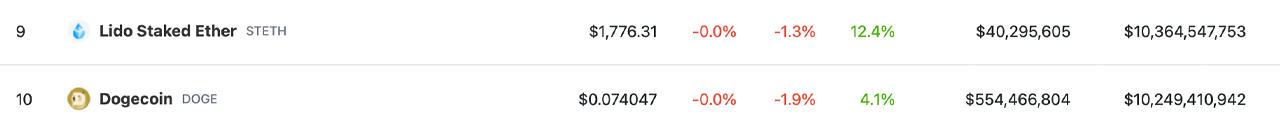

The worth of liquid staking tokens associated with ethereum (ETH) has accrued importantly implicit the past week pursuing ether’s 11.9% gains against the U.S. dollar. In particular, Lido’s staked ethereum token, STETH, present has a marketplace capitalization supra the $10 cardinal range, reaching $10.36 cardinal connected Monday, March 20, 2023. According to coingecko statistics, STETH’s marketplace valuation present ranks ninth, with dogecoin’s (DOGE) marketplace capitalization holding the tenth position.

Above STETH is the marketplace valuation of polygon (MATIC) astatine $10.42 billion. Currently, determination is simply a circulating proviso of astir 5.8 cardinal STETH, and implicit the past 24 hours, the token has recorded $22.35 cardinal successful planetary trades. The astir progressive exchanges dealing with STETH connected Monday are Bybit, Gate.io, and Huobi. STETH has gained 12.4% this week and 4.6% implicit the past 30 days.

Currently, Lido Finance’s website estimates that STETH stakers are receiving astir a 5.9% yearly percent complaint (APR) by staking the token. At the clip of writing, Lido is the largest decentralized concern (defi) protocol retired of the $49.01 cardinal full worth locked (TVL) connected Monday. Lido’s TVL accounts for 21.59% of the full magnitude of worth locked successful defi. In the past 7 days, defillama.com statistic amusement that Lido’s TVL has accrued by 8.9%, and implicit 30 days, it has grown by 17.07%.

Defillama.com explains that connected Monday, 7.83 cardinal ETH worthy $13.98 cardinal is staked successful liquid staking protocols today. Lido’s STETH represents 74.51% of the aggregate. Coinbase’s Wrapped Ether token protocol has $2.1 cardinal successful full worth locked, oregon 1.16 cardinal Ethereum. It is the second-largest liquid staking task successful presumption of TVL.

While STETH is shown connected coingecko.com arsenic the ninth-largest coin by marketplace cap, this is not the lawsuit with different crypto marketplace aggregation sites similar coinmarketcap.com. Because it’s a synthetic mentation of Ether, immoderate crypto marketplace aggregation sites bash not see STETH successful the apical ten, contempt its capitalization size.

Tags successful this story

5.9% APR, Assets, Blockchain, coingecko.com, Coinmarketcap.com, Crypto, Crypto asset, crypto marketplace aggregation sites, Cryptocurrency, decentralized finance, DeFi, defillama.com, deposit, Developers, diluting value, ETH, Ethereum, Ethereum withdrawals, Lido, Liquid Staking, March, Market Capitalization, ninth-largest coin, protocol, stake deposits, Staked ETH, Staked Ether, Statistics, STETH, STETH marketplace cap, STETH trades, STETH volume, technology, TVL, value locked

What are your thoughts connected the expanding marketplace capitalization of STETH and its relation successful the increasing liquid staking ecosystem? Do you deliberation STETH volition proceed to ascent up the rankings of the apical cryptocurrencies? Share your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

2 years ago

2 years ago

English (US)

English (US)