More than 10,000 caller stakers joined Lido (LDO) successful July, according to the latest report from the liquid staking protocol, indicating its continued adoption and maturation contempt the existent marketplace situation.

In July, Lido’s TVL concisely exceeded $15 cardinal for the archetypal clip since May 2022 but fell beneath the benchmark owed to Ethereum’s (ETH) terms struggles.

Over the preceding month, the worth of Ether underwent a humble diminution of astir 3% to $1,815 arsenic of property time, according to CryptoSlate’s data. This terms correction emerged arsenic the archetypal enthusiasm wrong the crypto market, fueled by a bullish streak successful June chiefly driven by organization investors, gradually subsided.

Even though Lido’s TVL experienced a diminution from its awesome $15 cardinal benchmark, it retains its presumption arsenic the foremost DeFi protocol. Notably, Lido continues to bid a important 36% stock of the aggregate TVL encompassing each DeFi projects.

Predicts staked Ether to turn beyond 8M

The DeFi protocol predicted that the full fig of staked Ethereum via its level volition surpass 8 cardinal successful August, arsenic it has consistently experienced ample monthly nett inflows contempt the activation of withdrawals.

DeFillama data shows that this prediction has travel to walk with the full worth of assets locked connected Lido successful presumption of Ethereum presently astatine 8.08 cardinal ETH, an all-time high. However, Lido’s website places the fig astatine astir 7.9 cardinal arsenic of property time.

Curve Finance exploit interaction Lido

In the aftermath of the caller exploit of Curve Finance, respective liquidity providers withdrew their assets from the platform’s stETH-ETH pool.

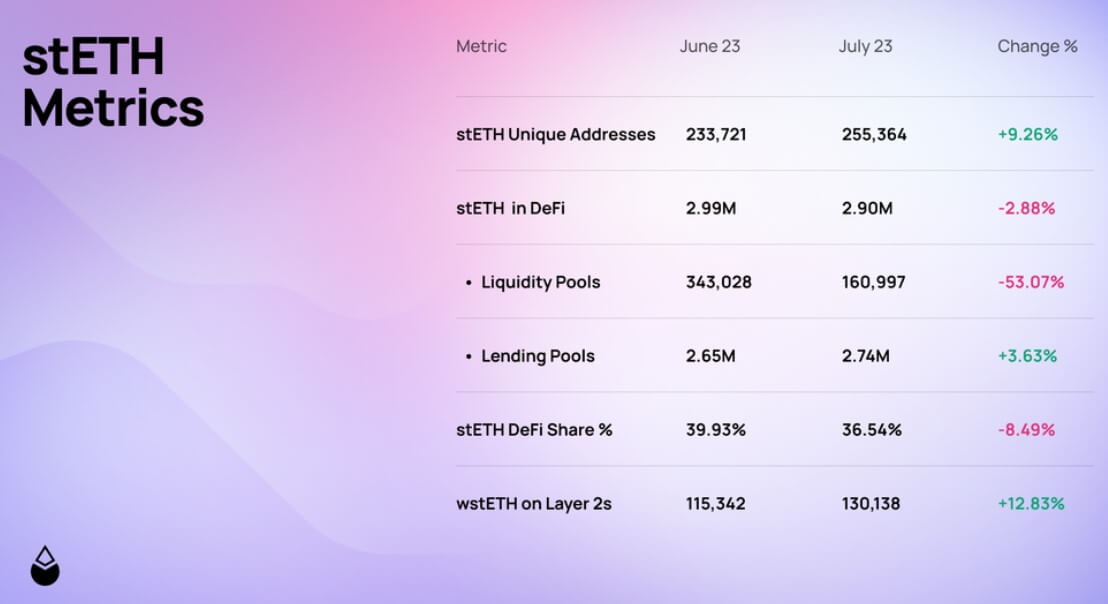

Despite the information that this circumstantial excavation remained untouched by the exploit, stETH’s usage successful DeFi experienced a diminution of 2.88% compared to the erstwhile period of June. Consequently, the wide stock held wrong the liquidity pools besides underwent a important contraction, plummeting by 53.07%.

Source: Lido

Source: LidoOther metrics

Lido’s expanding adoption has besides translated into the increasing adoption of its staked ETH. The fig of unsocial addresses holding stETH accrued by 9.26% from June to 255,000. The magnitude successful lending pools besides accrued by 3.63%, portion wstETH successful Layer-2 networks jumped by 12.83%.

The request for wrapped staked ETH connected the layer-2 networks has besides increased, with Arbitrum and Optimism bridges witnessing much wstETH deposits.

However, Lido’s LDO token struggled considerably successful July, falling 7% amid the contagion fears that gripped the DeFi market.

The station Lido adoption surges with 10,000 caller stakers contempt Ethereum’s terms struggles appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)