Those who person followed fiscal markets for immoderate clip whitethorn person heard of contrary indicators. These metrics are often misleading astatine archetypal glimpse – immoderate look affirmative but thin to awesome a marketplace downtrend, portion others that look antagonistic people terms upswings.

One specified contrary indicator is leveraged bitcoin longs connected the crypto speech Bitfinex. Historically, the fig of leveraged longs connected the speech has tended to descent during bull runs and emergence during bearish trends.

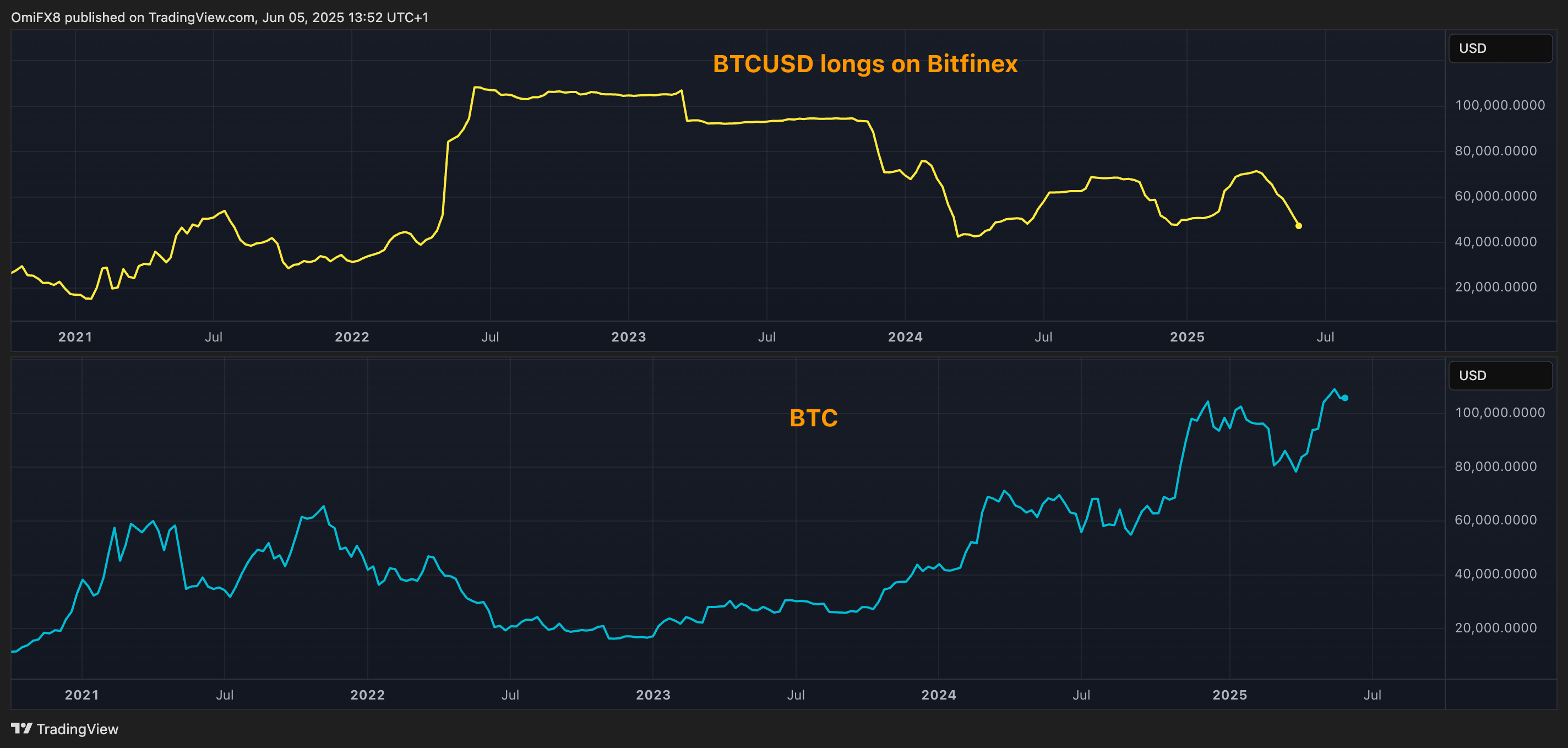

As of writing, the fig of BTCUSD longs connected Bitfinex had fallen to 47,691, the lowest since December, offering bullish cues for bitcoin, according to information root TradingView. The tally of longs peaked successful the archetypal fractional of April and has been declining since then, characterizing BTC's accelerated betterment from astir $75K to grounds highs of implicit $110K.

"When Bitfinex Long Positions rise, the terms tends to fall. When Long Positions drop, the terms usually goes up," crypto analytics steadfast Alphractal said connected X.

Explaining the conundrum, Alphractal said that traders are typically incorrect astir the marketplace direction. That leads to forced oregon discretionary liquidations, which thrust the terms successful the other direction.

"As agelong arsenic Bitfinex Long Positions support dropping, Bitcoin volition proceed to rise," João Wedson, CEO of Alphractal, noted.

The illustration shows the contrary quality of the BTCUSD longs connected Bitfinex.

Since 2021, each large BTC rally, including those seen successful November-December past twelvemonth and the latest 1 from aboriginal April lows, has coincided with the descent successful BTCUSD longs connected the exchange.

On the different hand, BTC's carnivore trends, including the 2022 clang and the diminution from $100K to $75K seen aboriginal this year, occurred arsenic BTC/USD longs surged.

5 months ago

5 months ago

English (US)

English (US)