Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

South Korea has agelong been known for its outsized power connected altcoin markets, from the XRP mania that drove a 400% rally past year to the present-day obsession with a token that proudly calls itself USELESS.

The $USELESS phenomenon has ties to South Korean KOLs, Bradley Park, a Seoul-based expert with DNTV Research, told CoinDesk successful an interview.

At the halfway of everything is Yeomyung, a Korean KOL and liquidity supplier who aped into USELESS early, held done a 50% drawdown, and is present sitting connected superior insubstantial gains.

“He made large profits during the Trump coin run, and with USELESS, helium besides earned from [providing liquidity] aboriginal connected and is present conscionable holding,” Park told CoinDesk. “They’re each conscionable waiting for a CEX listing, due to the fact that without it, there’s nary existent mode to exit.”

Park tracked Yeomyung’s wallet enactment and noted that his aboriginal condemnation has inspired copy-trading among Korean retail investors. Even wallets tied to insiders connected Solana’s Jupiter JUP are holding. The emergence of USELESS reflects a broader improvement successful Korean marketplace behavior.

“I genuinely deliberation Korean users successful this marketplace are nary longer conscionable exit liquidity," helium said. "They’re starting to recognize the marketplace and are evolving into existent planetary players.”

Another quality successful this communicative is Bonk Guy, an aboriginal promoter of BONK, who reappeared to tweet enthusiastically astir USELESS aft the terms rebounded, though immoderate Korean traders, including Park, person questioned his sincerity.

“Bonk Guy was the archetypal to shill LetsBONK,” Park said. “But aft the terms collapsed, helium went silent. Now that USELESS is bouncing back, he’s abruptly showing involvement again.”

Park pointed to the emergence of Hyperliquid, Kaia, and present Solana-based memecoins similar USELESS arsenic grounds that Korea is nary longer a secondary market.

While XRP’s rally was underpinned by ineligible clarity successful the U.S. and narratives astir Trump-era deregulation, USELESS feels little similar chaos for chaos’s involvement and much similar a reflection of wherever attention, and exhaustion, is flowing successful today’s market, Park said.

With nary roadmap, nary utility, and nary pretense of gathering thing bigger, it taps into a benignant of memetic disillusionment: a corporate motion astatine accepted crypto promises, and an ironic stake connected nothingness that, paradoxically, appears to beryllium much honorable than galore tokens claiming to alteration the world.

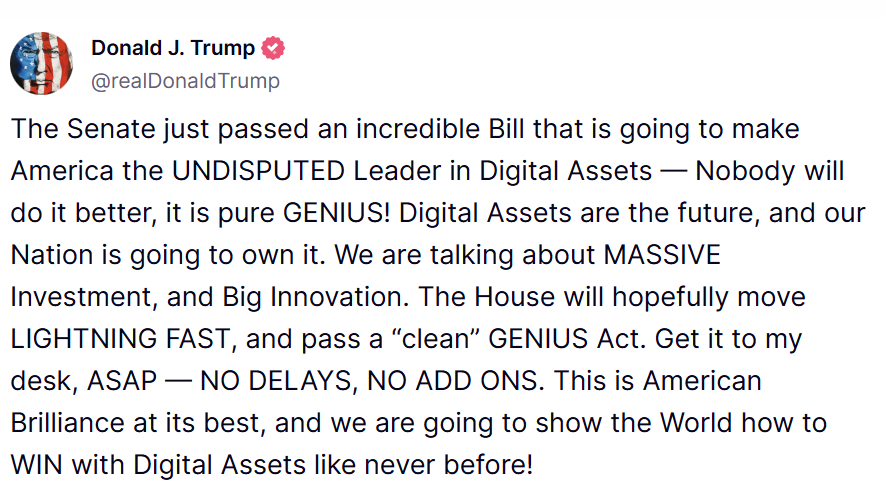

Trump Endorses GENIUS Act

President Donald Trump connected Tuesday endorsed the GENIUS Act successful a Truth Social post pursuing its bipartisan transition successful the Senate, calling it a large measurement toward U.S. enactment successful the integer plus sector.

Trump urged the House of Representatives to walk the measure “lightning fast” and without amendments, stating it should beryllium sent to his table with “no delays, nary add-ons.”

The connection signals beardown enforcement enactment for the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which introduces reserve and compliance requirements for dollar-backed stablecoin issuers and marks the archetypal large portion of crypto authorities to wide the Senate.

Trump framed the authorities arsenic cardinal to enabling “massive investment” and “big innovation,” positioning the U.S. arsenic a planetary person successful integer assets.

While the measure passed the Senate with important bipartisan backing, its destiny successful the House remains uncertain.

Democratic lawmakers are weighing imaginable amendments, including stricter oversight for foreign-issued tokens and limitations connected imaginable issuers.

However, the measure isn't without its critics. In a caller CoinDesk editorial, Georgetown University concern prof James J. Angel argues that the GENIUS Act is simply a flawed portion of authorities due to the fact that of fragmented oversight by 55 regulators, redundant processes, exclusion of interest-bearing stablecoins, and inefficient associated rulemakings.

News Roundup: Coinbase Unveils Coinbase Payments for Merchants

Coinbase (COIN) unveiled Coinbase Payments connected Wednesday, CoinDesk antecedently reported, a caller merchant-focused payments stack built connected its Ethereum layer-2 web Base.

The merchandise allows planetary ecommerce platforms similar Shopify to judge USDC 24/7 without needing blockchain expertise, utilizing tools similar a gasless stablecoin checkout, an ecommerce API engine, and an onchain payments protocol.

Coinbase said the strategy is designed to replicate accepted outgo rails portion lowering costs and offering always-on settlement. The motorboat positions Coinbase alongside fintech firms similar Stripe and PayPal successful the contention to modernize payments with blockchain infrastructure.

It besides deepens its concern with USDC issuer Circle (CRCL), whose shares jumped 25% connected the news, portion Coinbase rallied 16%. Coinbase says stablecoins processed $30 trillion successful transactions past year, tripling from the twelvemonth prior, and it's betting that programmable, dollar-pegged payments volition proceed to disrupt the planetary fiscal stack.

Market Movements:

- BTC: Bitcoin rebounded supra $105,000 successful a V-shaped betterment contempt escalating Israel-Iran tensions, with beardown ETF inflows and cardinal enactment astatine $103,650 highlighting organization assurance amid marketplace volatility, according to CoinDesk Research's method investigation data.

- ETH: Ethereum rebounded 4% to clasp supra $2,500 contempt Middle East tensions, with record-high staking and accumulation signaling increasing capitalist condemnation amid marketplace volatility.

- Gold: Gold slipped 0.19% to $3,383.11 aft the Fed held rates dependable astatine 4.25–4.5%, with Chair Powell signaling nary imminent argumentation changes and emphasizing continued economical spot contempt commercialized tensions.

- Nikkei 225: Japan’s Nikkei 225 slipped 0.27% connected Thursday arsenic Asia-Pacific markets traded mixed, weighed down by the Fed’s complaint intermission and ongoing Israel-Iran tensions.

- S&P 500: The S&P 500 dipped 0.03% to 5,980.87 aft the Fed held rates steady, with Chair Powell signaling a wait-and-see attack amid uncertainty implicit Trump’s tariffs.

Elsewhere successful Crypto:

- Crypto doesn’t person to beryllium a marketplace for lemons (Blockworks)

- Are Criminals Really Switching From Crypto to Gold for Money Laundering? (Decrypt)

- UK to Propose Restrictions connected How Banks Can Deal With Crypto Next Year (CoinDesk)

4 months ago

4 months ago

English (US)

English (US)