Decentralized concern (DeFi) protocols person seen a important alteration successful the full worth of assets locked (TVL) connected them successful caller months owed to the existent bearish sentiments saturating the market.

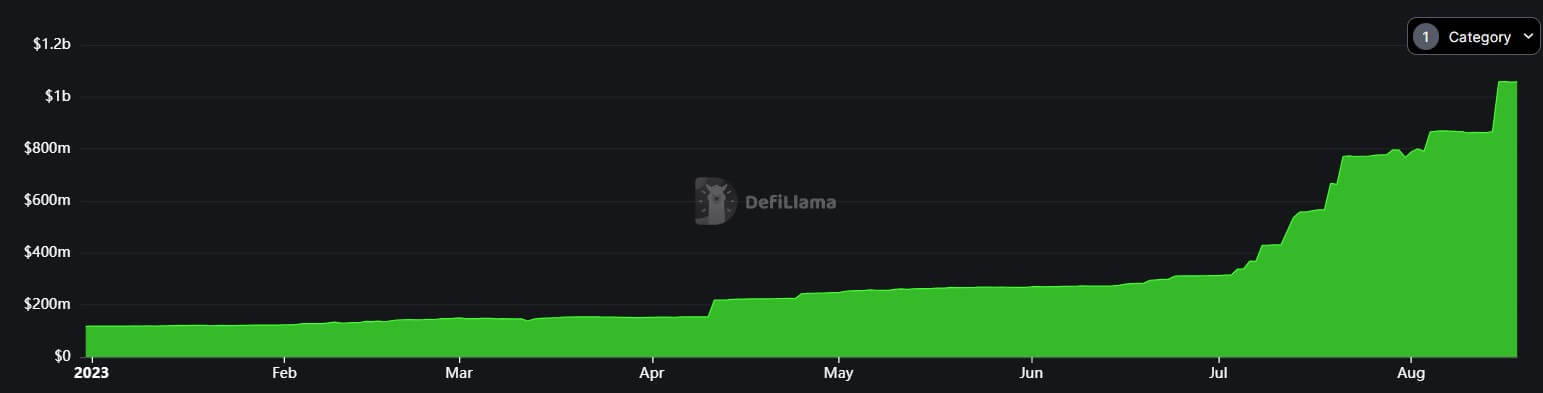

However, this diminution has not impacted the Real-World Assets (RWA) subsector, which has experienced important maturation during the period, with its TVL much than doubling, according to DeFillama data.

Per the information aggregator’s dashboard, RWA’s TVL has much than tripled wrong the past fewer months to implicit $1 cardinal from the $270.29 cardinal recorded connected June 1.

Source: DeFillama

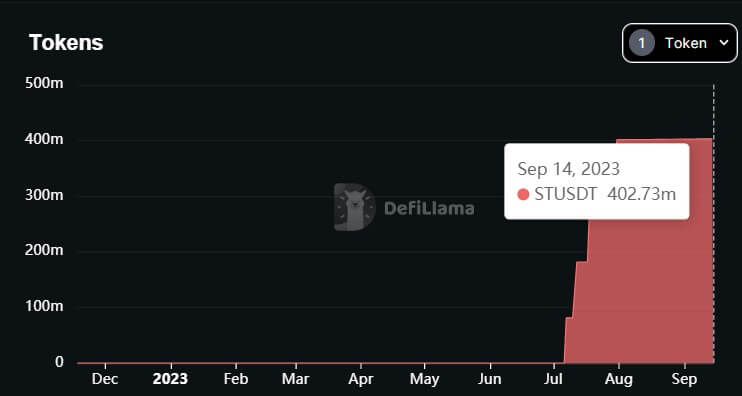

Source: DeFillamaAccording to information from DeFillama, 1 project, Staked Tether (stUSDT), stands retired arsenic the driving force down the singular maturation successful this subsector.

What is stUSDT?

stUSDT is the first RWA level connected the TRON network designed to relation arsenic a wealth marketplace fund.

According to its website, stUSDT is the receipt token users person upon staking USD stablecoins connected the platform. The protocol says it pays a output of 4.21% connected the stablecoin successful instrumentality for investing them successful real-world assets.

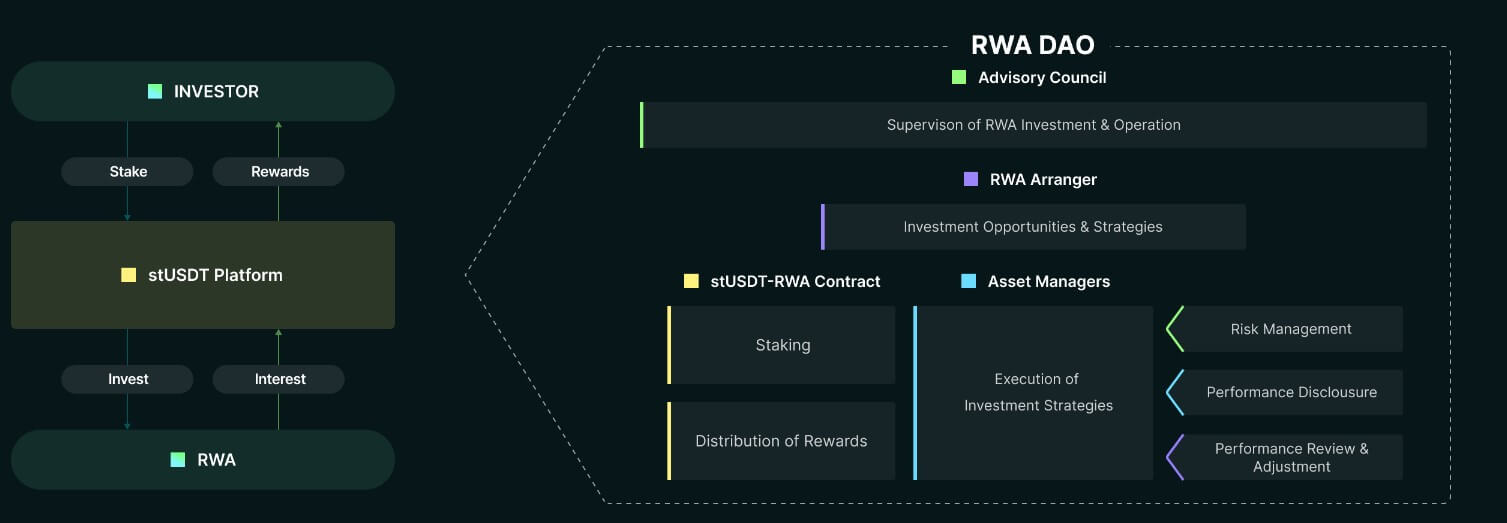

Source: stUSDT

Source: stUSDTThe protocol’s website claims partnerships with crypto projects similar Tether (USDT) and Justin Sun-linked companies similar HTX (formerly Huobi) and JustLend.

Meanwhile, stUSDT said it is governed by the Real World Asset Decentralized Autonomous Organization (RWA DAO), “offering users a transparent, fair, and unafraid transmission for RWA investment.”

Since its launch, the task has enjoyed a meteoric rise, with its TVL gradually approaching $1 cardinal successful little than 3 months. This means stUSDT accounts for much than 80% of the full worth locked successful RWA contempt being comparatively caller to the marketplace compared to rivals similar Ondo Finance and others.

Nevertheless, concerns person emerged regarding the protocol, including allegations of Justin Sun utilizing it to concern his investments.

Concerns astir stUSDT

stUSDT has travel nether scrutiny, chiefly owed to its governance and transparency. While the stUSDT website claims to put successful short-term authorities bonds, the circumstantial details regarding the types of bonds successful its portfolio stay undisclosed.

This deficiency of transparency, particularly compared to different RWA protocols similar Ondo Finance, has raised important concerns wrong the crypto community. The sole root of accusation astir the protocol’s investments has been its Daily Rebase updates connected its Medium page.

Ralf Kubli, a committee subordinate astatine the Casper Association, told CryptoSlate that portion “stUSDT is fundamentally positioning itself arsenic an reply to Alipay’s “Yu’e Bao,” a wealth marketplace money merchandise offered by Alibaba., it fails to code the underlying issues with RWAs. Kubli said:

“These existent tokenization practices inactive neglect to code the underlying contented that we’ve been talking astir clip and clip again, i.e. ensuring that each currency flows related to the RWAs are algorithmically defined wrong the plus itself.

Currently, astir tokenized fiscal products bash thing much than instrumentality a PDF of the fiscal declaration and hash it into the token. A quality inactive indispensable entree and work this explanation and process it accordingly. This is successful nary mode innovative and is surely not scalable.”

Adding to the apprehension is the governance operation of the stUSDT protocol. During its launch, it was asserted that stUSDT would beryllium governed by the RWA DAO and operated nether a custody statement with JustLend DAO.

However, CryptoSlate could not corroborate immoderate accusation connected the RWA DAO and could not corroborate the integrity of its concern with Tether.

Source: DeFillama

Source: DeFillamaBesides that, on-chain data shows that a information of stUSDT’s proviso is linked to addresses controlled by Justin Sun, and further scrutiny reveals a important beingness of stUSDT connected HTX, wherever much than $400 cardinal worthy of the plus is domiciled, per DeFillama data.

The station Justin Sun-linked stUSDT fuels RWA maturation contempt transparency concerns appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)