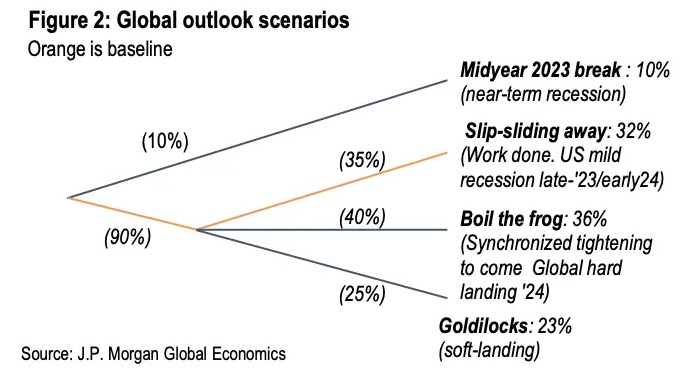

Global concern slope JPMorgan has presented 4 probable planetary outlook scenarios, with “boil the frog” recession emerging arsenic the astir apt outcome. The bank’s economists warned: “Broad-based developed-market tightening points to a much synchronized planetary downturn sometime successful 2024.”

JPMorgan’s Global Outlook and ‘Boil the Frog’ Recession

Global concern slope JPMorgan has provided an overview of 4 imaginable planetary outlook scenarios that it expects to unfold successful 2023 and 2024. The bank’s economists judge that the likelihood of the United States entering a recession outweighs the anticipation of avoiding one.

The astir apt outcome, according to JPMorgan, is “boil the frog” recession, with the U.S. slipping into recession astatine the aforesaid clip arsenic the remainder of the planetary economy. The economists assigned a 36% probability to this scenario, highlighting that it is chiefly driven by the implementation of assertive monetary tightening successful effect to persistent inflation.

“Central slope aspirations for a brushed landing person tempered the gait of tightening. However, hopes for a painless descent successful ostentation backmost to people are apt to beryllium dashed, requiring argumentation to crook sufficiently restrictive to interruption the backmost of the expansion,” they described, adding:

Broad-based developed-market tightening points to a much synchronized planetary downturn sometime successful 2024.

The second-most apt outcome, with a 32% probability, is “slip-sliding away” recession that the economists expect to hap betwixt precocious 2023 and aboriginal 2024. In this outcome, the U.S. system would acquisition a mild downturn resulting from an ongoing recognition crunch, starring to a recession, portion different economies crossed the globe would show resilience, they detailed.

Moreover, the JPMorgan economists person assigned a 23% probability for a Goldilocks brushed landing, successful which the U.S. system successfully avoids a recession. Lastly, they person identified a 10% probability of a near-term recession occurring successful mid-2023.

There is simply a wide anticipation that the U.S. system volition participate a recession. Economist Steve Hanke has warned of an impending “ugly” recession, portion golden bug Peter Schiff anticipates a “massive” recession and a terrible fiscal crisis. Bank of America is preparing for a mild recession, and Bloomberg Intelligence’s elder commodity strategist, Mike McGlone, believes the U.S. system is connected a way toward a “severe deflationary recession.” In contrast, Blackrock CEO Larry Fink does not foresee a important U.S. recession this year.

Which of the 4 scenarios outlined by JPMorgan’s economists bash you deliberation is the astir likely? Let america cognize successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)