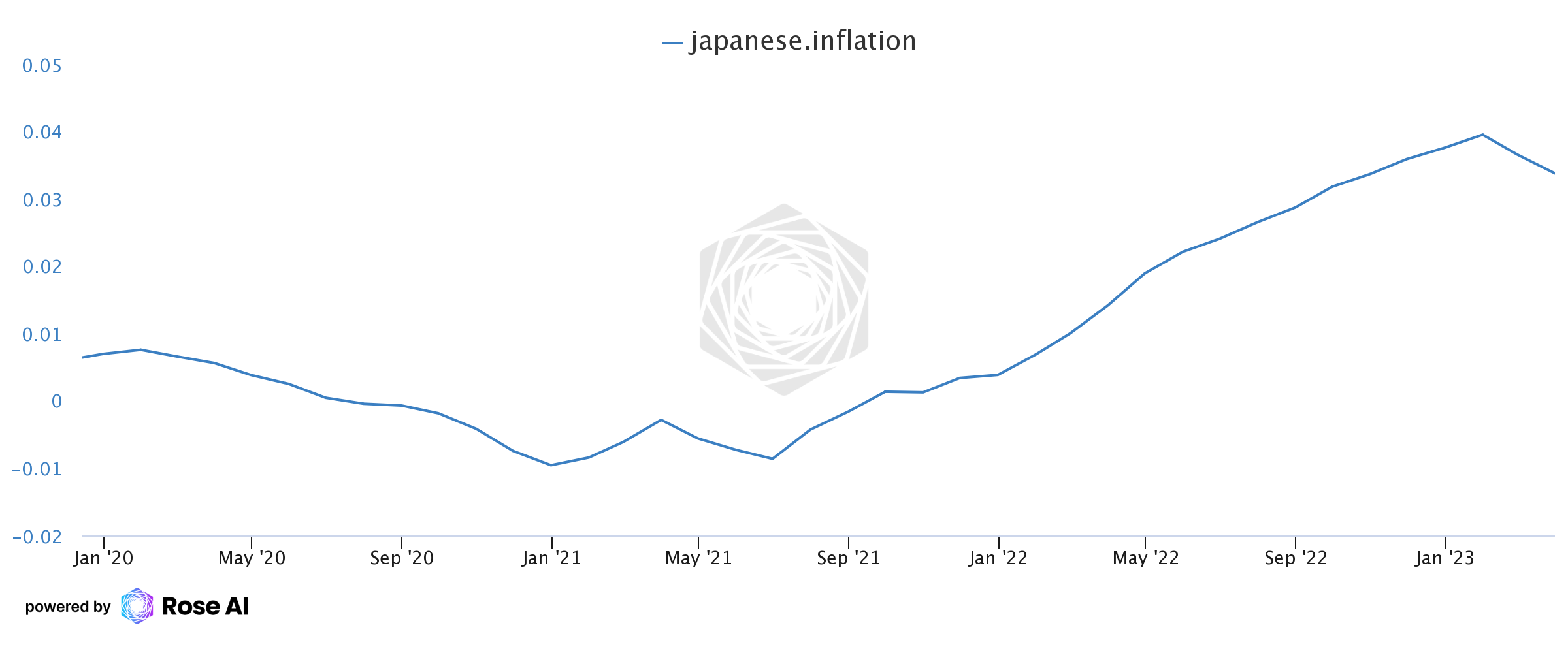

This week, the Statistics Bureau of Japan unveiled the latest halfway user terms scale (CPI) study for the country, revealing a surge to 3.5%. This fig comes arsenic a astonishment to analysts who had predicted a much humble 2.9% for the extremity of the quarter. It’s worthy noting that Japan’s ostentation has been steadily rising since June 2021. The timing of this uptick is besides notable, arsenic Kazuo Ueda has precocious assumed the relation of the 32nd politician of the Bank of Japan.

New BOJ Governor Faces Rising Inflation, Central Bank to Conduct Review of Monetary Policy Measures

In April, Japan experienced a surge successful its year-over-year ostentation complaint — excluding caller nutrient and vigor prices — which increased to 3.5%. This worsening ostentation complaint is simply a interest for the Bank of Japan (BOJ), which aims to bring the complaint backmost down to the 2% range, similar respective cardinal banks worldwide. However, the country’s system is facing important challenges, including the aftermath of the Covid-19 pandemic, which resulted successful important stimulus measures and lockdown policies.

Moreover, Japan is grappling with a shrinking workforce, which could importantly impact its quality to prolong economical growth. These challenges are compounded by the information that the BOJ has a caller governor, Kazuo Ueda, who addressed his archetypal monetary argumentation meetings connected April 27 and 28. Ueda, a Japanese economist, has opted to support involvement rates unchanged, maintaining the antagonistic complaint that Japan has held since 2016.

‘The Last and Final Source of Excess Liquidity’

The caller quality is apt to adhd unit connected the BOJ to code the country’s accelerating ostentation rate. The cardinal bank, however, stated that it has “decided to behaviour a broad-perspective review” of its monetary argumentation measures, indicating that it whitethorn research caller approaches to stabilize the economy. As the BOJ grapples with these challenges, it remains to beryllium seen however it volition navigate Japan’s economical future.

“With highly precocious uncertainties surrounding economies and fiscal markets astatine location and abroad, the slope volition patiently proceed with monetary easing portion nimbly responding to developments successful economical enactment and prices arsenic good arsenic fiscal conditions,” the BOJ announcement notes. “By doing so, it volition purpose to execute the terms stableness people of 2 percent successful a sustainable and unchangeable manner, accompanied by wage increases.”

Overall, the country’s caller CPI study highlights the challenges that Japan’s system is facing. On Friday, Hiromi Yamaoka, a erstwhile BOJ official, told CNBC’s “Squawk Box Asia” that “there remains immoderate uncertainty successful the Japanese existent economy, but astatine the aforesaid time, inflationary pressures is becoming much imminent.”

Graham Summers, an MBA astatine Phoenix Capital Research, believes that Japan whitethorn beryllium the last straw successful presumption of liquidity. On Friday, Summers wrote, “With ostentation surging successful Japan, the Bank of Japan volition soon beryllium forced to extremity its wealth printing, which means the fiscal strategy would suffer its past and last root of excess liquidity.”

Tags successful this story

What bash you deliberation the BOJ’s broad-perspective reappraisal of its monetary argumentation measures volition entail, and however bash you judge it volition interaction Japan’s economical future? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)