Quick Take

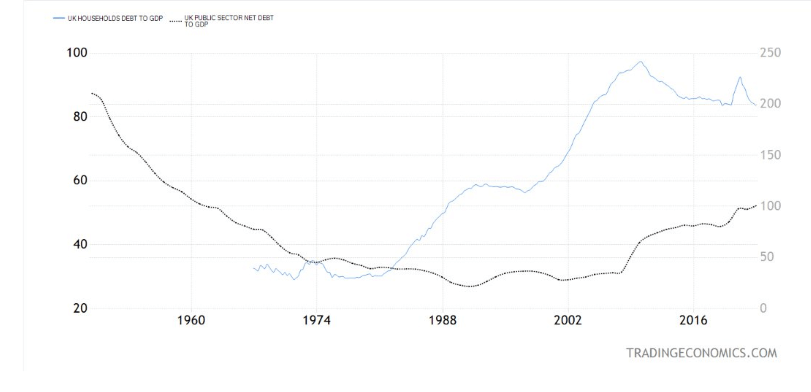

The United Kingdom is presently facing a challenging fiscal situation arsenic its household and authorities indebtedness levels emergence alarmingly. Household indebtedness has skyrocketed, reaching 200% of the country’s Gross Domestic Product (GDP), portion the authorities indebtedness has arsenic grown, constituting 100% of GDP. The impending menace of involvement complaint hikes makes these soaring indebtedness levels perchance unsustainable.

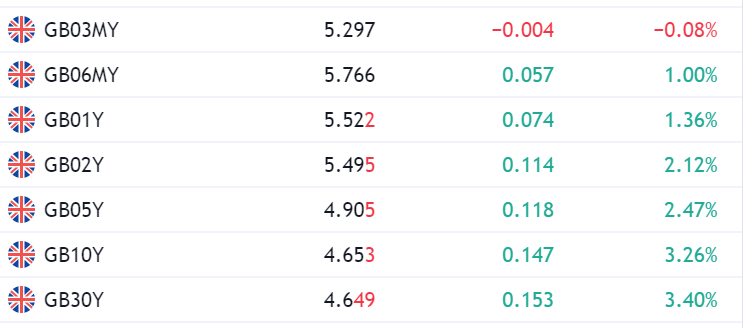

As it stands, the Bank of England’s basal involvement complaint is 5%. However, marketplace analysts foretell a important accidental – 50%, to beryllium precise – that this complaint could leap to 6.75% by aboriginal 2024. Such an summation would further elevate yields on the output curve, exceeding the rates seen during the pension situation of the past year.

Fueling this perchance volatile concern is the UK’s concerning ostentation rate. The Consumer Price Index (CPI) ostentation is presently astatine a notable 8.7%, with halfway ostentation hitting 7.1%. These figures dramatically opposition the Bank of England’s erstwhile rates of 1.75% and 0.25% from a twelvemonth and a twelvemonth and a fractional ago, respectively, highlighting the grade to which the Bank has lagged successful its response.

With these fiscal storms brewing, the UK finds itself astatine a important economical juncture. The fallout from these economical stressors volition apt power the country’s fiscal wellness for the foreseeable future. In this clime of uncertainty, the Bank of England’s aboriginal actions and their interaction connected the nation’s system are nether aggravated scrutiny.

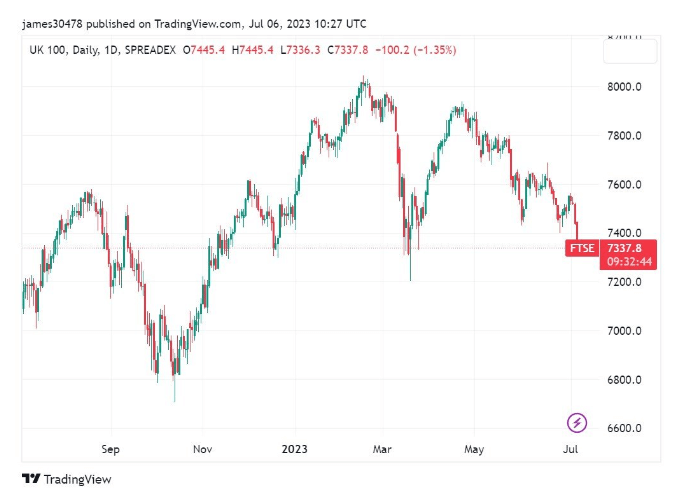

Moreover, the FTSE 100 index, representing the apical 100 UK stocks, has deed a caller debased for the year, dropping to 7286, which is much than 2% down from the erstwhile day.

Yields: (Source: TV)

Yields: (Source: TV) Debt: (Source: Trading Economics)

Debt: (Source: Trading Economics) FTSE 100: (Source: TV)

FTSE 100: (Source: TV)The station Is the UK heading towards a sovereign indebtedness crisis? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)