Crypto markets person historically fallen into a four-year bull and carnivore cycles that look to revolve astir the Bitcoin halving, however, this signifier could beryllium unravelling, according to manufacture analysts and experts.

“Top 100 Bitcoin treasury companies clasp astir 1 MILLION Bitcoin,” said writer and capitalist Jason Williams successful a station connected X connected Sunday.

“This is wherefore the Bitcoin 4 twelvemonth rhythm is over.”Matthew Hougan, main concern serviceman astatine Bitwise Asset Management, made akin comments successful an nonfiction published connected Friday by CNBC.

“It’s not officially implicit until we spot affirmative returns successful 2026. But I deliberation we will, truthful let’s accidental this: I deliberation the 4-year rhythm is over,” Hougan said, echoing comments helium made successful July.

For the past 3 marketplace cycles, Bitcoin’s terms highest has travel successful the twelvemonth that follows the halving, namely successful 2013, 2017, 2021, and present owed again 4 years aboriginal successful 2025.

Game implicit for the four-year crypto cycle

“It seems much apt than not that the 4-year cycles are over,” agreed the CEO of The Bitcoin Bond Company, Pierre Rochard, successful an X station connected Monday.

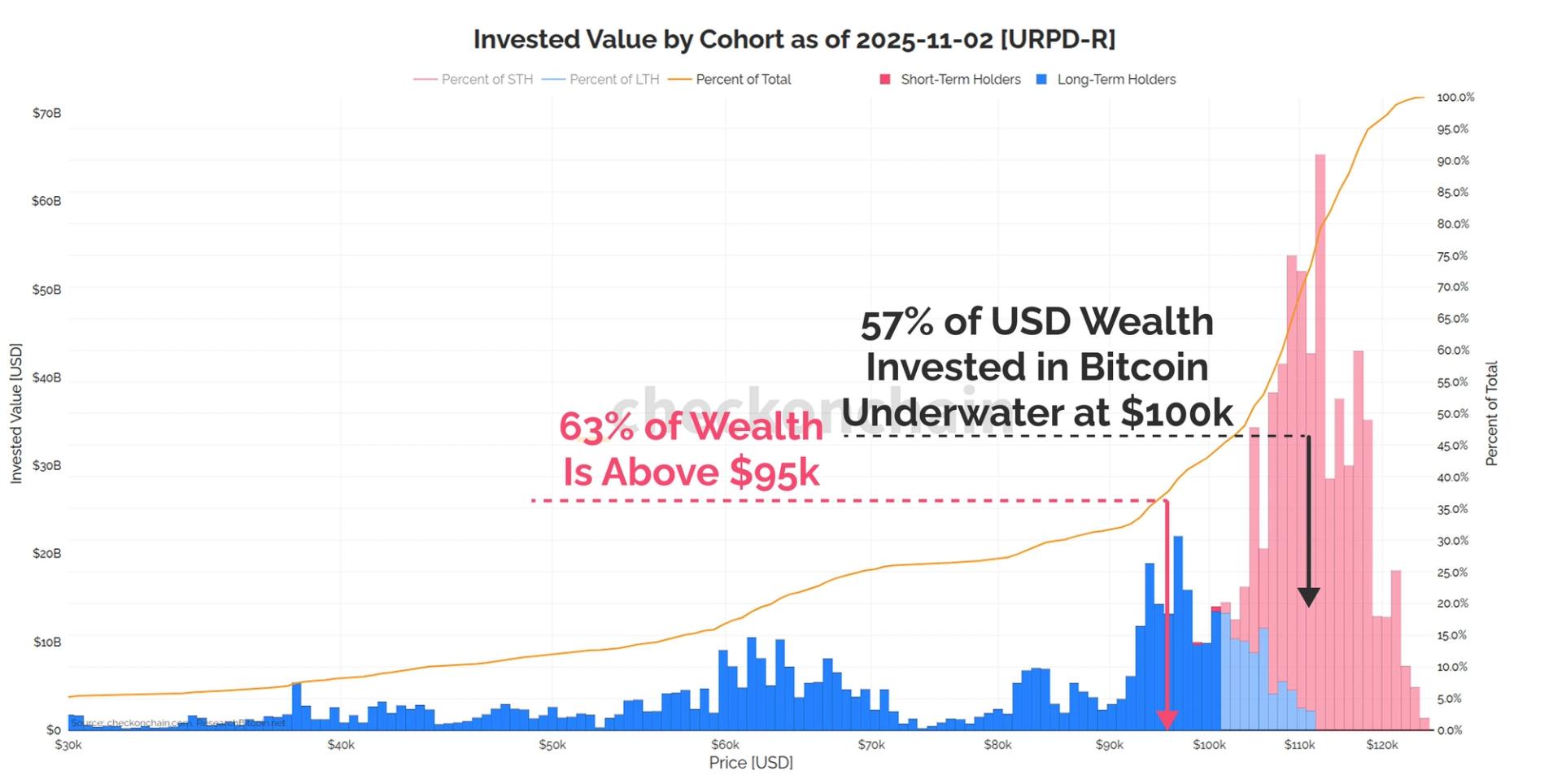

He added that Bitcoin halvings are “immaterial to trading float,” arsenic 95% of BTC has been mined and the proviso comes from “buying retired OGs,” with request coming from “the sum of spot retail, ETPs getting added to wealthiness platforms, and treasury companies.”

Related: Macro drivers volition dampen Bitcoin’s halving rhythm — Tim Draper

“The four‑year halving rhythm remains a utile notation point, but it’s nary longer the sole operator of marketplace behavior,” Martin Burgherr, Chief Clients Officer astatine Sygnum Bank, told Cointelegraph.

He added that arsenic the marketplace matures, macroeconomic conditions, organization superior flows, regulatory developments, and ETF adoption person go conscionable arsenic influential.

“In practice, the four‑year model is becoming 1 of respective inputs alternatively than the market’s cardinal script.”Crypto expert ‘CRYPTO₿IRB’ was of the other opinion, telling his 715,000 X followers connected Sunday that saying the four-year rhythm is gone is “wrong.”

He explained that ETFs person strengthened four-year crypto cycles due to the fact that accepted concern runs connected four-year statesmanlike cycles and ETFs summation the “crypto-tradfi correlation.”

“Not to notation 4-year halving cycles which simply conscionable can't beryllium cancelled arsenic they're mathematically programmed lol,” helium added, seemingly referencing Bitcoin’s halving events.

Xapo Bank CEO Seamus Rocca told Cointelegraph successful July that the hazard of a prolonged carnivore marketplace is inactive precise existent and the four-year cycles are inactive intact.

“So galore radical are saying, ‘Oh, the institutions are here, and, therefore, the cyclical benignant of quality of Bitcoin is dead.’ I'm not definite I hold with that,” helium said.

Magazine: How Ethereum treasury companies could spark ‘DeFi Summer 2.0’

2 months ago

2 months ago

English (US)

English (US)