Key takeaways:

Institutional flows are growing, but retail involvement and App Store rankings stay unusually low.

A weakening US dollar oregon large ETF adoption could propulsion the crypto marketplace headdress good supra its erstwhile highs.

Traders are ever anxiously awaiting the commencement of a crypto ace cycle, which is simply a deviation from the accepted four-year rhythm of gains pursuing each Bitcoin (BTC) halving.

Since 2021, a fig of analysts person suggested a caller paradigm successful which the crypto marketplace would soar 400% beyond its erstwhile highs. Take, for example, X idiosyncratic CryptoKaleo, who precocious posted astir the “real” ace cycle.

Even if the assumptions shared by X idiosyncratic CryptoKaleo beryllium accurate, it is inactive acold excessively aboriginal to reason that the marketplace has entered a crypto ace cycle. The existent full capitalization of $3.4 trillion is conscionable 29% supra the $2.65 trillion highest recorded successful November 2021.

So far, that projection remains unfulfilled, but determination are definite factors to look for that would corroborate the commencement of a ace cycle.

US Dollar weakness, Crypto ETF maturation and Strategic Bitcoin Reserves

One specified catalyst would beryllium the US Dollar Index (DXY) dropping beneath 95, a level past seen successful November 2021. Continued weakness successful the dollar against different large fiat currencies would awesome increasing capitalist discomfort with the US fiscal situation. In that case, a information of the $24.7 trillion successful US Treasurys held by the nationalist could travel into alternate assets, including cryptocurrencies.

Another large imaginable operator is the accelerated enlargement of the exchange-traded fund (ETF) industry. Despite caller momentum, the existent $190 cardinal successful crypto-related assets nether absorption is inactive negligible compared to accepted plus classes. For comparison, the 3 largest S&P 500 ETFs unsocial power a combined $2 trillion successful assets.

Despite archetypal enthusiasm, the US government’s strategic Bitcoin reserve program remains vague. Should the Trump medication accumulate astatine slightest 200,000 BTC, that could importantly displacement marketplace sentiment. A akin effect mightiness travel from firm treasury allocations by tech giants similar Google, Apple, oregon Microsoft.

Retail capitalist involvement and sector-themed hype

Retail capitalist information besides plays a captious relation successful triggering a supercycle. Search volumes for presumption similar “buy Bitcoin” and “buy crypto” person remained level for 5 months and beryllium good beneath their November 2024 highs. Likewise, the Coinbase and Robinhood apps person slipped successful US App Store rankings implicit the past 3 months.

While organization superior has taken the pb successful this cycle, retail-driven FOMO inactive serves arsenic the substance for parabolic growth. Another cardinal awesome would beryllium a resurgence successful altcoin assemblage narratives—whether driven by AI tokens, casino coins, oregon accepted meme tokens featuring cats and dogs.

Currently, the memecoin marketplace capitalization is $68.5 billion, down from the all-time precocious of $140.5 cardinal reached successful December 2024, according to information from CoinMarketCap.

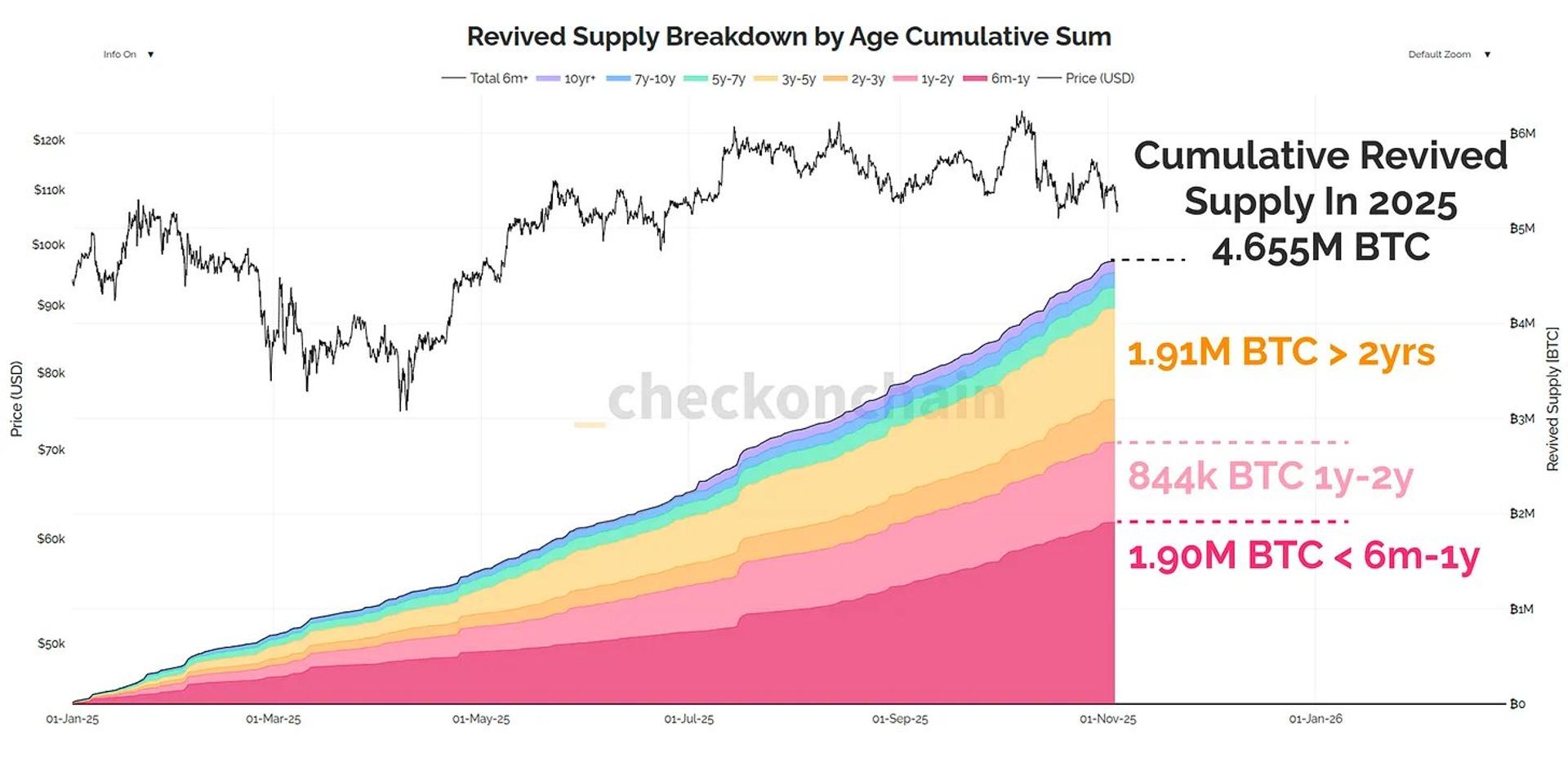

Related: Bitcoin proviso is shrinking: Will Saylor’s relentless BTC buying origin a proviso shock?

These scenarios stay speculative and hinge connected unpredictable macroeconomic and geopolitical developments, including the US Federal Reserve’s ability to debar a recession and the improvement of planetary commercialized relations.

However, the person the marketplace gets to gathering these conditions, the much apt a surge past $13.2 trillion successful marketplace capitalization becomes, representing a 400% summation implicit the November 2021 peak.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

3 months ago

3 months ago

English (US)

English (US)