Bitcoin has been trending up since hitting a section debased beneath $25,000 connected September 11th. Yesterday’s rally to $27,435 marked a 10% summation from the caller low. As NewsBTC reported, the rally was mostly led by the futures marketplace and a monolithic summation successful unfastened involvement of implicit $1 billion, much than fractional of which was flushed retired erstwhile BTC fell backmost beneath $27,000. Despite this, BTC is up astir 7.5% from past week’s low. A crushed to beryllium bullish?

Glassnode Report Sheds Light On Market Sentiment

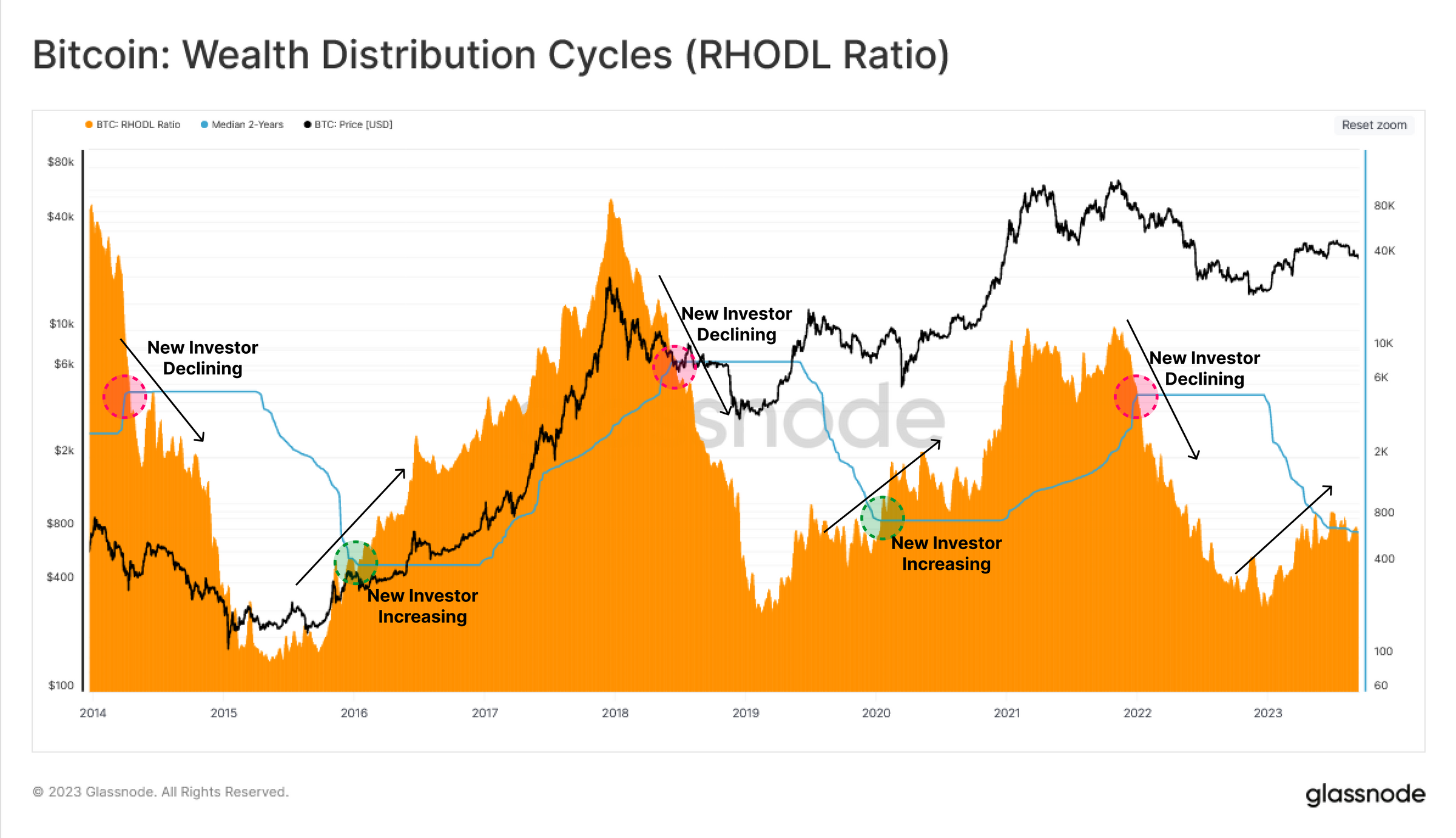

According to Glassnode, the Realized HODL Ratio (RHODL) serves arsenic a important marketplace sentiment indicator. It measures the equilibrium betwixt investments successful precocious moved coins (those held for little than a week) and those successful the hands of longer-term HODLers (held for 1-2 years). The RHODL Ratio for the twelvemonth 2023 is flirting with the 2-year median level. While this indicates a humble influx of caller investors, the momentum down this displacement remains comparatively weak.

Bitcoin RHODL ratio | Source: Glassnode

Bitcoin RHODL ratio | Source: GlassnodeGlassnode’s Accumulation Trend Score further elaborates connected this trend. It shows that the existent betterment rally of 2023 has been importantly influenced by capitalist FOMO (Fear of Missing Out), with noticeable accumulation patterns astir section terms tops exceeding $30,000. This behaviour contrasts sharply with the second fractional of 2022, wherever newer marketplace entrants showed resilience by accumulating Bitcoin astatine little terms levels.

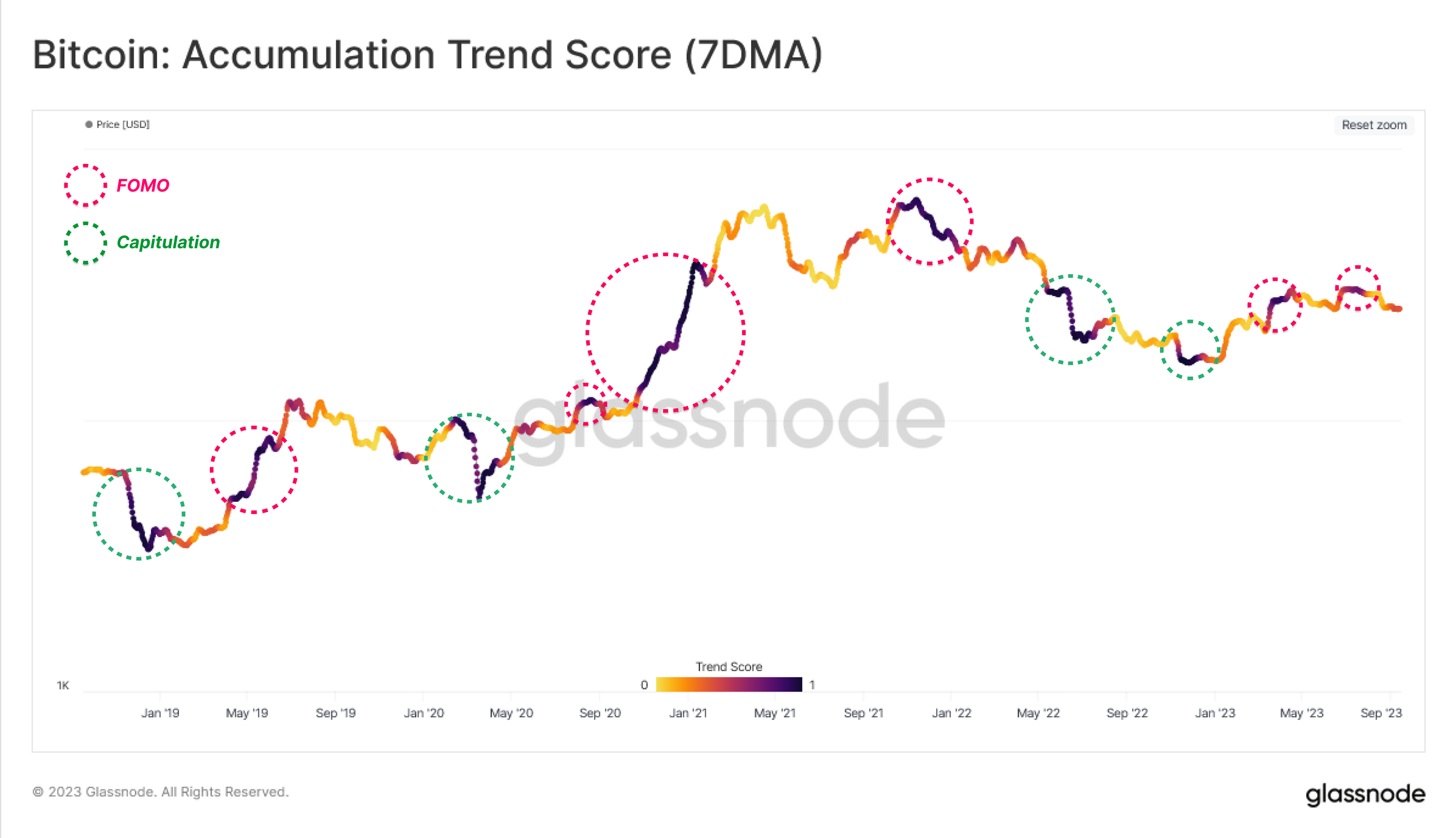

Bitcoin accumulation inclination people | Source: Glassnode

Bitcoin accumulation inclination people | Source: GlassnodeThe Realized Profit and Loss indicators besides uncover a analyzable picture. These metrics measurement the worth alteration of spent coins by comparing the acquisition terms with the disposal price. In 2023, periods of aggravated coin accumulation were often accompanied by elevated levels of profit-taking. This pattern, which Glassnode describes arsenic a “confluence,” is akin to marketplace behaviour seen successful highest periods of 2021.

An appraisal of Short-Term Holders (STH) uncovers a precarious situation. A staggering majority, much than 97.5% of the proviso procured by these newcomers, is presently operating astatine a loss, levels unseen since the infamous FTX debacle. Using the STH-MVRV and STH-SOPR metrics, which quantify the magnitude of unrealized and realized profits oregon losses, Glassnode elucidates the utmost fiscal pressures caller investors person grappled with.

Market Confidence Remains Low

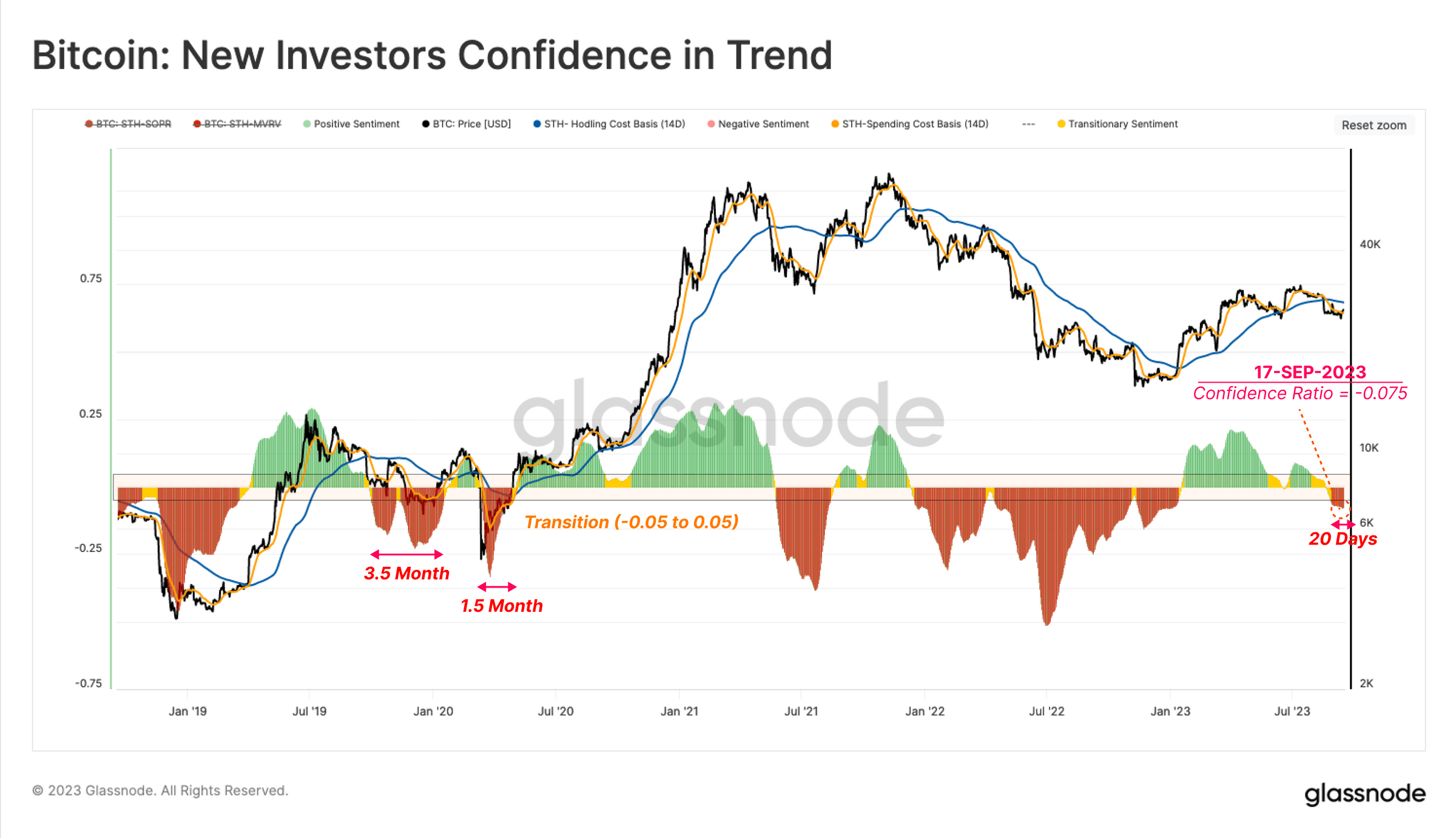

The study besides delves into the realm of marketplace confidence. A adjacent introspection of the divergence betwixt the outgo ground of 2 capitalist subgroups — spenders and holders — offers an denotation of prevailing marketplace sentiment. As the marketplace reeled from the terms plummet from $29k to $26k successful mid-August, an overwhelmingly antagonistic sentiment was evident. This was manifested arsenic the outgo ground of spenders fell sharply beneath that of holders, a wide awesome of prevalent marketplace panic.

To connection a clearer visualization, Glassnode has normalized this metric successful narration to the spot price. A important reflection is the cyclical quality of antagonistic sentiment during carnivore marketplace betterment phases, usually lasting betwixt 1.5 to 3.5 months. The marketplace precocious plunged into its archetypal antagonistic sentiment signifier since 2022’s conclusion.

Currently, the inclination lasts 20 days, which could mean that the extremity has not yet been marked by the caller rally, if past repeats itself. However, if determination is simply a sustained bounce backmost into affirmative territory, it could beryllium indicative of renewed superior inflow, signifying a instrumentality to a much favorable stance for Bitcoin holders.

New capitalist assurance successful inclination | Source: Glassnode

New capitalist assurance successful inclination | Source: GlassnodeIn conclusion, Glassnode’s on-chain information reveals a Bitcoin marketplace that is presently successful a authorities of flux. Although 2023 has seen caller superior entering the market, the influx lacks beardown momentum. Market sentiment, particularly among short-term holders, is decidedly bearish. These findings bespeak that caution remains the watchword, with underlying marketplace sentiment offering mixed signals astir the sustainability of the existent Bitcoin rally.

At property time, BTC traded astatine $26,846 aft being rejected astatine the 23.6% Fibonacci retracement level (at $27,369) successful the 4-hour chart.

BTC falls beneath $27,000 , 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC falls beneath $27,000 , 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)