In finance, ‘smart money’ typically refers to organization oregon nonrecreational investors presumed to person greater marketplace cognition and resources. However, an intriguing signifier emerges erstwhile examining the apical holders crossed large DeFi platforms.

CryptoSlate analyzed the apical 5 wallets (excluding funds and exchanges) and the apical 5 money wallets from large DeFi platforms listed connected the on-chain information tract Cherry Pick. Platforms included Uniswap, Aave, Curve, Balancer, and 1inch.

Risk Tolerance and Diversification.

The information shows that azygous wallets linked to institutions mostly person little balances than idiosyncratic wallets. This could bespeak respective things.

Firstly, organization investors whitethorn beryllium diversifying their portfolios to mitigate risk. Traditional fiscal contented advocates diversification arsenic a hedge against volatility, and it seems this rule whitethorn beryllium carrying implicit into the processing satellite of DeFi. This is supported by funds having aggregate wallets tagged. Secondly, the little balances could suggest that institutions are inactive cautiously exploring DeFi, perchance skeptical of its semipermanent prospects oregon operational risks.

Here, ‘smart money’ appears to beryllium exercising caution by not putting each their eggs successful 1 handbasket oregon limiting their vulnerability to the DeFi abstraction altogether.

For example, the mean equilibrium successful Aave for wallets is astir $11.46 million, portion funds clasp an mean of conscionable $528,635. This stark opposition could connote that organization investors are diversifying their risks oregon are possibly inactive investigating the waters successful the DeFi arena.

Increased losses from funds.

Despite these little balances, funds grounds higher realized and unrealized losses. Uniswap’s mean realized nonaccomplishment for funds is astir $470,000, compared to the colossal mean nonaccomplishment of $68.6 cardinal for idiosyncratic wallets.

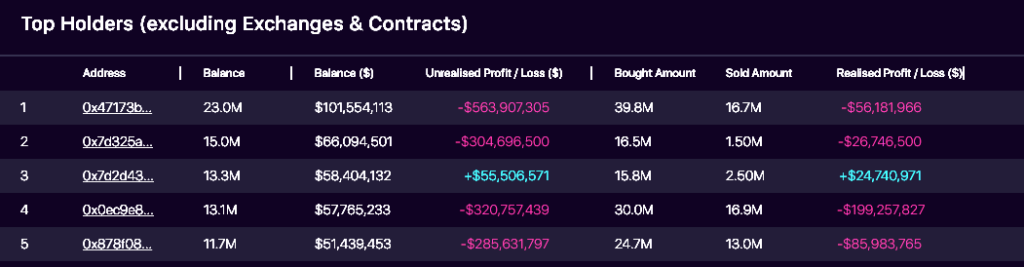

Top Holders of UNI tokens. (Source: CherryPick)

Top Holders of UNI tokens. (Source: CherryPick)Staggeringly, the apical UNI wallet has implicit $500 cardinal successful unrealized losses, with each but 1 of the apical 5 seeing nine-figure unrealized losses. Analyzing the apical wallet, it appears to beryllium a wallet linked to the protocol itself, arsenic it received 39.7 cardinal UNI successful March 2021, valued astatine astir $1.1 billion.

At Uniswap’s highest conscionable 2 months later, it was worthy astir $1.68 billion.

Top Holder of UNI (Source: CherryPick)

Top Holder of UNI (Source: CherryPick)Today, the wallet is valued astatine $101 cardinal aft sending astir 16 cardinal UNI retired of the wallet implicit the past 36 months, selling lone erstwhile for a profit.

The divergence whitethorn suggest that portion organization investors are much cautious with their capital, they are much accepting of short-term losses, perchance arsenic portion of a semipermanent concern strategy.

A changing of the guard.

Both idiosyncratic wallets and organization funds amusement a beardown inclination toward Uniswap. With an mean equilibrium of $66.9 cardinal for wallets and $104,821 for funds, it is evident that Uniswap remains a cornerstone successful retail and organization DeFi portfolios.

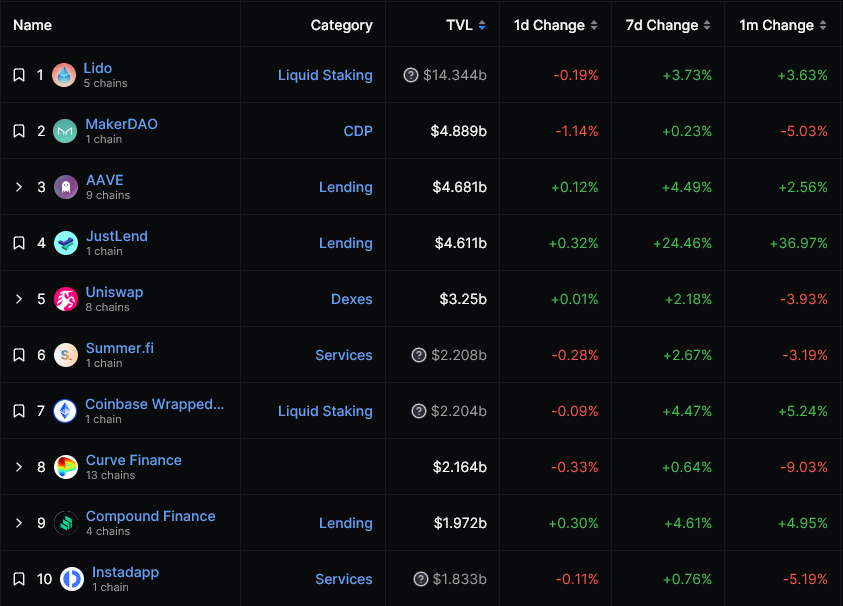

While platforms similar JustLend are making strides with a TVL of $4.611 billion, information shows that ‘smart money’ is inactive chiefly invested successful bequest platforms, with Lido, Maker, Aave, and Uniswap each remaining successful the apical 5 DeFi platforms by TVL.

Yet, the apical 10, arsenic tracked by DefiLlama, is present missing respective bequest DeFi players, specified arsenic Balancer, PancakeSwap, SushiSwap, and Yearn Finance. Instead, newer protocols specified arsenic JustLend, Summer.fi, and Instadapp person taken their spots.

List of DeFi platforms by TVL (Source: DefiLlama)

List of DeFi platforms by TVL (Source: DefiLlama)Profitability and Efficiency

One mightiness expect ‘smart money’ to flock toward platforms with higher revenues and fees. However, this is not needfully the case. For example, portion Uniswap has cumulative fees of $3.254 billion, it has not prevented ‘smart money’ from incurring mean realized losses of implicit $470,000.

Looking ahead, information from DeFiLlama reveals breathtaking trends successful TVL changes implicit time. Platforms similar JustLend person seen a 24.46% summation successful TVL successful conscionable 7 days.

While our dataset doesn’t supply a nonstop correlation, it begs the question: Is ‘smart money’ agile capable to capitalize connected these accelerated shifts?

The station Is ‘smart money’ that smart? Top 5 DeFi wallets person unrealized losses appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)