Crypto expert Ali Martinez has discussed Ethereum existent terms enactment arsenic the 2nd largest crypto by marketplace headdress remains beneath $4,000. The expert outlined immoderate facts to springiness a clearer representation of whether oregon not it is the close clip to springiness up connected ETH.

Analyst Discusses Whether It Is Time To Give Up On Ethereum

In an X post, Ali Martinez outlined definite facts to find whether it is clip to springiness up connected Ethereum. First, the expert noted that ETH has been 1 of the weakest performers lately, a improvement that looks to person prompted Vitalik Buterin to shingle things up by changing the Ethereum Foundation’s enactment team.

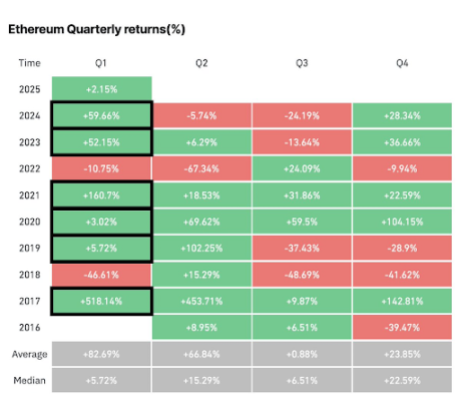

Martinez past alluded to historical data showing that Ethereum performs good successful the archetypal 4th of each year. The expert had antecedently hinted that this twelvemonth is improbable to beryllium different. Back then, helium noted that ETH delivers its strongest show successful Q1, peculiarly successful odd-numbered years, and 2025 is 1 specified year.

ETH Q1 performances implicit the years | Source: Ali Martinez connected X

ETH Q1 performances implicit the years | Source: Ali Martinez connected XGiven Ethereum’s affirmative Q1 performance, Martinez remarked that this could explicate wherefore crypto whales person accumulated implicit $1 cardinal worthy of ETH successful the past week alone. He antecedently revealed that these whales had bought implicit 330,000 ETH, valued astatine implicit $1 billion.

Furthermore, the crypto expert remarked that the buying unit is besides evident successful the exchange outflows, with astir $2 cardinal successful Ethereum withdrawn from crypto platforms implicit the past month. Specifically, 540,000 ETH, worthy $1.84 billion, were withdrawn from exchanges implicit the past month. This accumulation inclination is simply a affirmative arsenic it indicates investors are inactive bullish connected ETH.

However, for Ethereum to interruption retired bullishly, Martinez mentioned that it indispensable flooded respective cardinal absorption levels. From an on-chain perspective, the crypto expert highlighted the $3,360 to $3,450 portion arsenic the major proviso wall. This scope is the astir captious absorption level for ETH, portion the cardinal enactment portion is betwixt $3,066 and $3,160.

From A Technical Analysis Perspective

Martinez besides provided insights into the Ethereum terms enactment from a method investigation perspective. He stated that ETH appears to beryllium forming the close enarthrosis of a head-and-shoulders pattern, with a neckline of $4,000. He added that a decisive breakout supra this level could substance a rally toward $7,000.

The crypto expert besides revealed that this upside people aligns with the Ethereum 3.2 Market Value to Realized Value (MVRV) Pricing Band, which is presently hovering astir $7,000. Amid this bullish outlook, Martinez mentioned that 1 concerning motion is Ethereum’s web growth, which has slowed down. The fig of caller ETH addresses is said to person declined by 9.32%, indicating reduced adoption.

Despite that, Martinez believes that Ethereum’s outlook is inactive bullish. He told marketplace participants to support an oculus connected the $2,700 to $3,000 enactment zone. According to him, this request portion indispensable clasp to support ETH’s bullish outlook.

At the clip of writing, Ethereum is trading astatine astir $3,200, down 4% successful the past 24 hours, according to data from CoinMarketCap.

Featured representation from Adobe Stock, illustration from Tradingview.com

9 months ago

9 months ago

English (US)

English (US)