Bitcoin, the world’s largest cryptocurrency by marketplace capitalization, has been successful a consolidation signifier for the past fewer weeks. While this whitethorn look similar a play of comparative stability, on-chain quality level Glassnode co-founder Yann Allemann suggests that it could bespeak an impending terms movement.

In the past, akin consolidation periods person often been followed by terms swings, and investors are intimately watching for immoderate signs of wherever the marketplace mightiness beryllium headed.

While immoderate investors whitethorn beryllium tense astir the caller consolidation, others spot it arsenic an accidental to bargain successful earlier the adjacent large move. As the marketplace awaits the adjacent Bitcoin terms action, analysts and enthusiasts alike are speculating connected what mightiness travel adjacent for the starring cryptocurrency.

Factors Indicating A Positive Outlook For Bitcoin Price

Amidst the existent authorities of the Bitcoin market, respective factors person been identified by Allemann connected Twitter, which lend to the prediction of a affirmative aboriginal for the cryptocurrency. These factors see the depletion of short-sellers’ resources, the reinforcement of enactment levels, and the anticipation of an wide bullish trend.

Shorts getting exhausted the longer #BTC holds $26.8k… large determination coming

The terms explodes whenever #Bitcoin consolidates beneath the MA. Bands are already tight. The timepiece is ticking.https://t.co/t20rwaMxPB pic.twitter.com/5UG6UB9KQn

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) May 17, 2023

Bitcoin’s terms has been fluctuating wrong the scope of $26,500 and $27,100, a play characterized by the prevalence of “extreme fear” sentiment among marketplace participants.

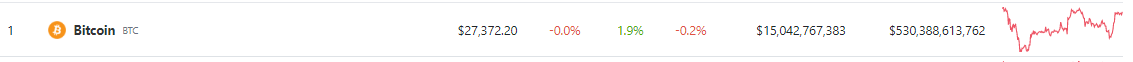

At the clip of penning CoinGecko shows Bitcoin’s terms stands astatine $27,372, reflecting a humble 1.9% summation implicit the past 24 hours. However, it is worthy noting that the cryptocurrency has besides experienced a flimsy diminution of 0.2% implicit the people of the erstwhile 7 days.

Nonetheless, Allemann highlights that this signifier often serves arsenic a precursor to upward movements successful the market. One compelling reflection is the resilience of Bitcoin’s terms successful maintaining levels supra the 50 and 200 Simple Moving Averages (SMAs), which present service arsenic robust enactment levels that person proven their spot done 5 abstracted tests.

These method indicators not breaking down further signify a affirmative inclination successful the marketplace and adhd to the wide optimism surrounding Bitcoin’s aboriginal performance.

Debt Ceiling Uncertainty Could Impact Bitcoin Price

Another origin that could perchance interaction Bitcoin’s terms successful the coming days is the ongoing statement surrounding the indebtedness ceiling successful the United States.

The indebtedness ceiling is simply a bounds connected the magnitude of wealth that the US authorities tin get to money its operations. If the authorities fails to rise the indebtedness ceiling, it could effect successful a default connected its indebtedness obligations, which could person superior consequences for the planetary fiscal system.

The uncertainty surrounding the indebtedness ceiling statement could pb to accrued volatility successful the fiscal markets, including the cryptocurrency market. Historically, Bitcoin has demonstrated a affirmative correlation with the banal market, peculiarly during times of economical uncertainty.

Therefore, immoderate adverse effects connected the banal marketplace resulting from the indebtedness ceiling statement could perchance spill implicit into the cryptocurrency market and origin important terms fluctuations.

-Featured representation from Bitcoinik

2 years ago

2 years ago

English (US)

English (US)