Bitcoin exchange-traded products whitethorn person fundamentally altered the conception of a crypto “altseason.”

For years, the crypto marketplace followed a familiar rhythm, a near-predictable creation of superior rotation. Bitcoin (BTC) surged, bringing mainstream attraction and liquidity, and past the floodgates opened to altcoins. Speculative superior rushed into lower-cap assets, inflating their values successful what traders euphorically deemed “altseason.”

However, erstwhile taken for granted, this rhythm shows signs of a structural collapse.

Spot Bitcoin exchange-traded funds (ETFs) have shattered records, funneling $129 cardinal successful superior inflows successful 2024. This has provided unprecedented entree to Bitcoin for some retail and organization investors, yet it has besides created a vacuum, sucking superior distant from speculative assets. Institutional players present person a safe, regulated mode to summation vulnerability to crypto without the Wild West risks of the altcoin market. Many retail investors are besides uncovering ETFs much appealing than the perilous hunt for the adjacent 100x token. Well-known Bitcoin expert Plan B adjacent traded successful his existent BTC for a spot ETF.

The displacement is happening successful existent time, and if the superior remains locked successful structured products, altcoins look a diminishing stock of marketplace liquidity and relevance.

Is the altseason dead? The emergence of structured crypto exposure

Bitcoin ETFs connection an alternate to chasing high-risk, low-cap assets, arsenic investors tin entree leverage, liquidity and regulatory clarity done structured products. The retail crowd, erstwhile a large operator of altcoin speculation, present has nonstop entree to Bitcoin and Ether (ETH) ETFs, vehicles that destruct self-custody concerns, mitigate counterparty hazard and align with accepted concern frameworks.

Institutions person adjacent greater incentives to sidestep altcoin risk. Hedge funds and nonrecreational trading desks, which erstwhile chased higher returns successful low-liquidity altcoins, tin deploy leverage done derivatives oregon instrumentality vulnerability via ETFs connected bequest fiscal rails.

Related: BlackRock adds BTC ETF to $150B exemplary portfolio product

With the quality to hedge done options and futures, the inducement to gamble connected illiquid, low-volume altcoins diminishes significantly. This has been further reinforced by the record $2.4 cardinal successful outflows successful February and arbitrage opportunities created by ETF redemptions, forcing a level of subject into crypto markets that did not antecedently exist.

The accepted “cycle” starts with Bitcoin and moves to an altseason. Source: Cointelegraph Research

Will task superior wantonness crypto startups?

Venture superior (VC) firms person historically been the lifeblood of alt seasons, injecting liquidity into nascent projects and spinning expansive narratives astir emerging tokens.

However, with leverage being easy accessible and superior ratio a cardinal priority, VCs are rethinking their approach.

VCs strive to marque arsenic overmuch instrumentality connected concern (ROI) arsenic possible, but the emblematic range is betwixt 17% and 25%. In accepted finance, the risk-free complaint of superior serves arsenic the benchmark against which each investments are measured, typically represented by US Treasury yields.

In the crypto space, Bitcoin’s humanities maturation complaint functions arsenic a akin baseline for expected returns. This efficaciously becomes the industry’s mentation of the risk-free rate. Over the past decade, Bitcoin’s compound yearly maturation complaint (CAGR) implicit the past 10 years has averaged 77%, importantly outperforming accepted assets similar golden (8%) and the S&P 500 (11%). Even implicit the past 5 years, including some bull and carnivore marketplace conditions, Bitcoin has maintained a 67% CAGR.

Using this arsenic a baseline, a task capitalist deploying superior successful Bitcoin oregon Bitcoin-related ventures astatine this maturation complaint would spot a full ROI of astir 1,199% implicit 5 years, meaning the concern would summation astir 12x.

Related: Altcoin ETFs are coming, but request whitethorn beryllium limited: Analysts

While Bitcoin remains volatile, its semipermanent outperformance has positioned it arsenic the cardinal benchmark for evaluating risk-adjusted returns successful the crypto space. With arbitrage opportunities and reduced risk, VCs whitethorn play the safer bet.

In 2024, VC woody counts dropped 46%, adjacent arsenic wide concern volumes rebounded successful Q4. This signals a displacement toward much selective, high-value projects alternatively than speculative funding.

Web3 and AI-driven crypto startups are inactive drafting attention, but the days of indiscriminate backing for each token with a achromatic insubstantial whitethorn beryllium numbered. If task superior pivots further toward structured vulnerability done ETFs alternatively than a nonstop concern successful risky startups, the consequences could beryllium terrible for caller altcoin projects.

Meanwhile, the fewer altcoin projects that person made it onto organization radars — specified arsenic Aptos, which recently saw an ETF filing — are exceptions, not the rule. Even crypto scale ETFs, designed to seizure broader exposure, person struggled to pull meaningful inflows, underscoring that superior is concentrated alternatively than dispersed.

The oversupply occupation and the caller marketplace reality

The scenery has shifted. The sheer fig of altcoins vying for attraction has created a saturation problem. According to Dune Analytics, implicit 40 cardinal tokens are presently connected the market. 1.2 cardinal caller tokens were launched connected mean per period successful 2024, and implicit 5 cardinal person been created since the commencement of 2025.

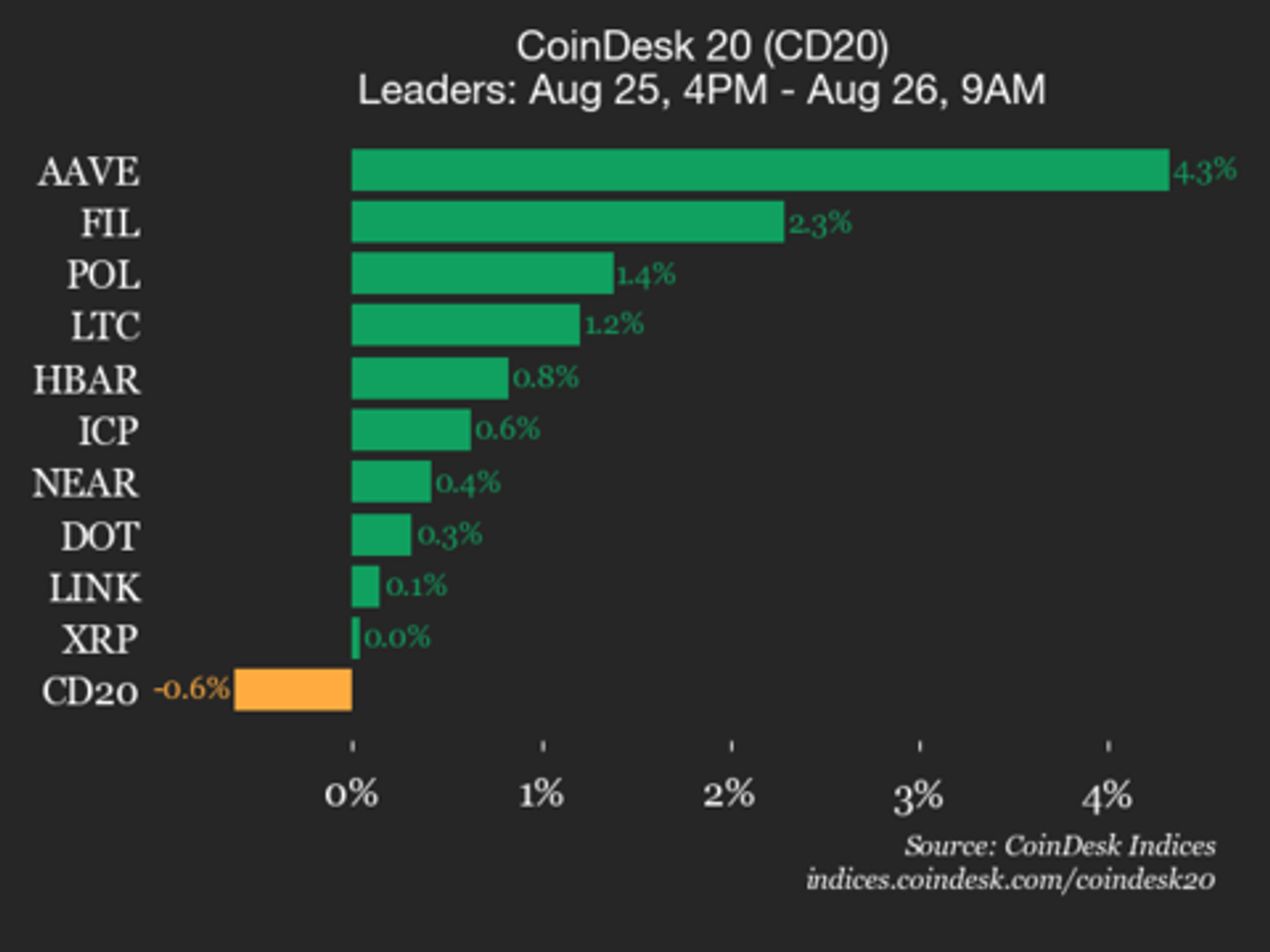

With institutions gravitating toward structured vulnerability and a deficiency of retail-driven speculative demand, liquidity is not trickling down to altcoins arsenic it erstwhile did.

This presents a hard truth: Most altcoins volition not marque it. The CEO of CryptoQuant, Ki Young Ju, precocious warned that astir of these assets are improbable to past without a cardinal displacement successful marketplace structure. “The epoch of everything pumping is over,” Ju said successful a caller X post.

The accepted playbook of waiting for Bitcoin dominance to wane earlier rotating into altcoins whitethorn nary longer use successful an epoch wherever superior stays locked successful ETFs and perps alternatively than free-flowing into speculative assets.

The crypto marketplace is not what it erstwhile was. The days of easy, cyclical altcoin rallies whitethorn beryllium replaced by an ecosystem wherever superior efficiency, structured fiscal products and regulatory clarity dictate wherever the wealth flows. ETFs are changing however radical put successful Bitcoin and fundamentally altering liquidity organisation crossed the full market.

For those who built their strategies connected the presumption that an altcoin roar would travel each Bitcoin rally, the clip whitethorn person travel to reconsider. The rules whitethorn person changed arsenic the marketplace has matured.

Magazine: SEC’s U-turn connected crypto leaves cardinal questions unanswered

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

5 months ago

5 months ago

English (US)

English (US)