Crypto-related concern products continued their upward trajectory, signaling inflows of $646 cardinal wrong the past week, according to CoinShares‘ play report.

This inflow brings the full for the twelvemonth to an unprecedented $13.8 billion, propelling the full assets nether absorption to a staggering $94.47 billion.

Bitcoin ETF hype moderating

Trading measurement for crypto concern products declined past week, dwindling to $17.4 cardinal from the $43 cardinal recorded successful the archetypal week of March. This suggests a imaginable moderation successful capitalist involvement successful Bitcoin exchange-traded funds (ETF) aft weeks of consecutive hype.

Meanwhile, Bitcoin remains the focal constituent for investors, maintaining its marketplace dominance since the ETF approvals successful January. During the past week, BTC-related products witnessed a important affirmative nett travel of $663 million.

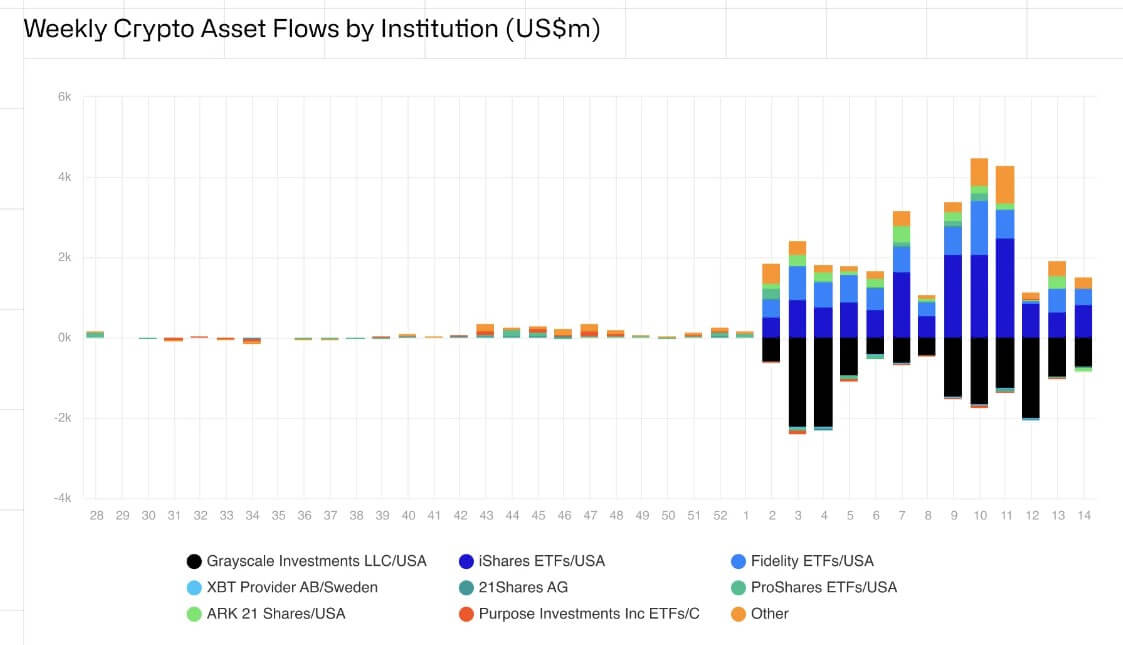

The lion’s stock of this inflow came from BlackRock’s iShares, which amassed $811 million, with Fidelity FBTC pursuing astatine $395.83 million. In contrast, Grayscale GBTC recorded $731 cardinal successful outflows.

Crypto Products Inflows. (Source: CoinShares)

Crypto Products Inflows. (Source: CoinShares)While Bitcoin products flourished, outflows from different integer assets caused the full nett travel to dip to $646 million. Ethereum witnessed its 4th consecutive week of outflows, shedding an further $22.5 million. Consequently, ETH’s year-to-date nett flows person dropped to $52 million.

Conversely, prime altcoins demonstrated resilience. Solana, Litecoin, and Filecoin attracted notable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Moreover, the existent bullish sentiment successful the marketplace resulted successful abbreviated Bitcoin products experiencing their 3rd consecutive week of outflows totaling $9.5 million. This reflects a waning condemnation among bearish investors, particularly arsenic BTC’s terms jumped by astir 4% during the past week to implicit $70,000 arsenic of property time.

Despite the “moderating” appetite for Bitcoin ETFs, the United States retained its presumption arsenic the starring market, with inflows totaling $648 million. Brazil, Germany, and Hong Kong besides witnessed important inflows of $9.8 million, $9.6 million, and $9 million, respectively.

Conversely, Canada and Switzerland experienced outflows of $27 cardinal and $7.3 million, respectively, underscoring determination variations successful marketplace sentiment.

The station Investor fervor for Bitcoin ETFs cools contempt $646 cardinal play surge successful crypto funds appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)