Intel announced the extremity of first-gen Blockscale 1000-series Bitcoin-mining ASICs connected April 18, contempt the chips contributing some ratio and a emergence successful gross successful 2022 — up from 2021.

The announcement — initially reported by Tom’s Hardware — cited “a tighter absorption connected its IDM 2.0 operations” arsenic the rationale down the determination to discontinue the chips.

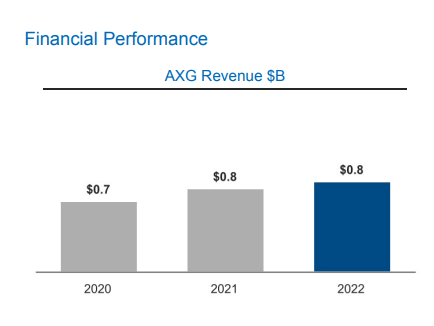

However, the spot was portion of the Accelerated Computing Systems and Graphics Group (AXG) gross conception — which registered a $63 cardinal summation successful 2022 successful examination to 2021.

Intel yearly report: AXG Revenue $B

Intel yearly report: AXG Revenue $BEfficient but not cost-efficient

Intel Blockscale 1000-series chips were deployed by astatine slightest 1 nationalist Bitcoin (BTC) mining institution done 2022 and shown to beryllium some businesslike and profitable.

In December 2022, Canadian Bitcoin mining steadfast Hive Blockchain mined a full of 213.8 BTC — worthy $3.15 cardinal — utilizing Intel Bitcoin-mining ASICs to bash so.

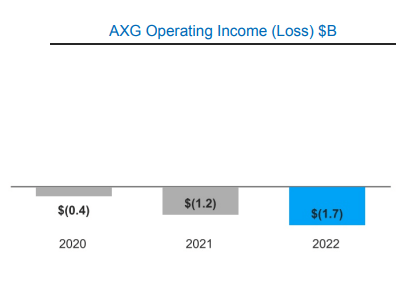

However, contempt the betterment successful ratio and profitability offered by Intel’s Blockscale 1000-series chips, Intel operating income costs Year-on-Year (YOY) accrued astir 50% to $1.7 cardinal successful 2022, from $1.2 cardinal successful 2021.

Intel yearly report: AXG Operating Income (Loss) $B

Intel yearly report: AXG Operating Income (Loss) $BThese operating costs were “due to accrued inventory reserves taken and investments” successful Intel’s merchandise roadmap, according to the company’s yearly report.

Committing to “delivering 5 exertion nodes successful 4 years” successful 2022 — 1 of which was the archetypal Intel Blockscale ASIC — Intel sought to accelerate its IDM 2.0 strategy by “investing successful manufacturing capableness astir the world.”

Intel noted that its 2022 results were “impacted by an uncertain macroeconomic situation arising from inflation, the warfare successful Ukraine, and COVID-19 shutdowns successful [its] proviso concatenation successful China.”

Causation of the discontinuation

Intel’s reasoning down the discontinuation of its Bitcoin-mining chips is supported by the other $500M successful operating costs YoY successful 2022 — lending further rationale to the finality of the company’s decision.

On the taxable of the IDM 2.0 strategy, the steadfast said:

“Though we aggressively adjusted superior investments successful 2022 to respond to changing concern conditions, we inactive made important investments successful enactment of our IDM 2.0 strategy during the year.”

The station Intel Bitcoin mining chips discontinued contempt spot efficiency, $63M gross boost successful 2022 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)