The Bitcoin marketplace is experiencing a seismic shift, with caller information revealing fascinating trends that shed airy connected the evolving dynamics. From a important diminution successful Bitcoin inflows to a historical driblet successful proviso connected exchanges, coupled with a surge successful organization money accumulation, these developments item a maturing marketplace and changing capitalist sentiment.

Unprecedented Decline In Bitcoin Inflows and Supply

The on-chain analytics work CryptoQuant has contiguous published highly absorbing information connected the behaviour and cohorts of Bitcoin hodlers via Twitter.

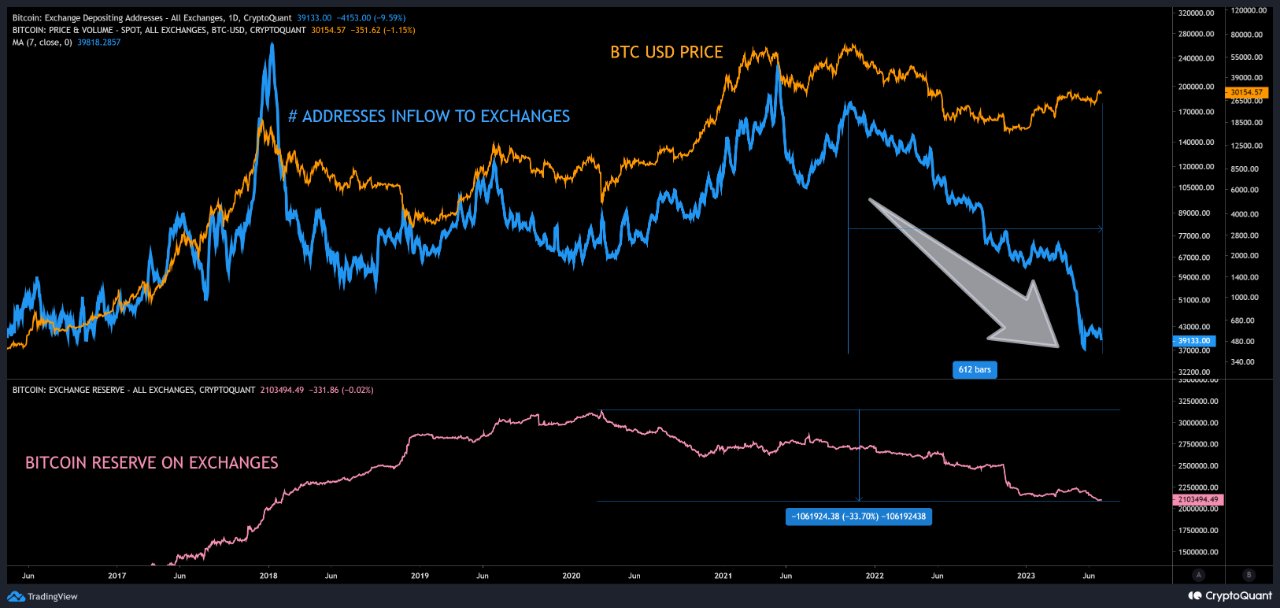

Over the past 612 days, Bitcoin has witnessed an 80% diminution successful the fig of addresses signaling inflows, which tin beryllium interpreted arsenic selling activity. This diminution reaches an adjacent higher fig of 84% erstwhile measured from the highest successful May 2021. These numbers adjacent surpass the erstwhile grounds acceptable during the 2017 parabolic top, demonstrating the magnitude of the existent trend.

Both narrowly bushed the 2nd highest diminution successful addresses associated with inflows betwixt the 2017 parabolic apical into 2018 bear, astatine 78.5%.

Largest diminution of BTC inflows and proviso successful past | Source: Twitter @cryptoquant_com

Largest diminution of BTC inflows and proviso successful past | Source: Twitter @cryptoquant_comIt is important to enactment that these figures bash not relationship for addresses that person moved to self-custody oregon differentiate betwixt miner enactment and retail investors. This suggests that the diminution successful addresses associated with inflows whitethorn beryllium adjacent much important than the information implies, perchance indicating a displacement towards semipermanent holding strategies oregon alternate custodial methods.

In a parallel trend, the wide proviso of Bitcoin connected exchanges has been steadily shrinking since March 2020, marking a play of accordant diminution that had not been witnessed earlier successful Bitcoin’s history. This diminution is not lone important successful its duration but besides successful its depth, arsenic Bitcoin reserves connected exchanges person dropped by implicit 30%. CryptoQuant’s experts further note:

March 2020 was the highest ever proviso recorded connected exchanges, and preceded by accordant 10 years of proviso growth. The 1200 days since, are the archetypal play of accordant diminution successful Bitcoin’s history. […] Retail traders and institutions are holding much Bitcoin than ever.

Bitcoin speech reserves | Source: CryptoQuant

Bitcoin speech reserves | Source: CryptoQuantThis besides indicates a large imaginable displacement from progressive trading and speculative behaviour towards semipermanent holding strategies.

Institutional Fund Accumulation Signals Confidence

As the diminution successful inflows and proviso unfolds, different intriguing inclination emerges: organization money accumulation, arsenic observed by CryptoQuant. Institutional investors, including hedge funds, concern firms, and cryptocurrency backstage funds, are presently actively expanding their holdings of Bitcoin.

This exponential summation successful money holdings demonstrates a beardown involvement successful acquiring Bitcoin, adjacent astatine its existent terms level. Institutional investors often instrumentality a much diligent and semipermanent attack compared to short-term traders who intimately show terms fluctuations.

By intimately monitoring money holdings, investors tin summation invaluable insights into marketplace sentiment and the assurance that organization investors person successful Bitcoin arsenic a semipermanent asset. And the pursuing illustration by CryptoQuant is showing conscionable that, an ultra bullish stance by institutions.

Bitcoin organization money accumulation | Source: Twitter @cryptoquant_com

Bitcoin organization money accumulation | Source: Twitter @cryptoquant_comThe affirmative improvement of Bitcoin’s cognition is astir apt further reinforced by caller developments successful the regulatory scenery and the instauration of exchange-traded funds (ETFs). Regulatory frameworks, particularly those being implemented by countries successful the European Union with MiCA, are beneficial for the organization Bitcoin adoption.

Moreover, the filings and re-filings of Bitcoin spot ETFs by large fiscal institutions, including BlackRock and Fidelity, bespeak a increasing designation of Bitcoin’s imaginable arsenic a morganatic investment. These ETFs supply a much accessible and regulated mode for investors to summation vulnerability to Bitcoin, perchance driving further organization adoption and marketplace growth.

At property time, the BTC terms stood astatine $30,716, remaining successful its scope betwixt $29,800 and $31,000.

BTC terms consolidates successful a range, 1- hr illustration | Source: BTCUSD connected TradingView.com

BTC terms consolidates successful a range, 1- hr illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)