Understanding the dynamics of stablecoin supplies is simply a important facet of crypto marketplace analysis, arsenic stablecoins play a pivotal relation successful the cryptocurrency ecosystem.

Fluctuations successful the marketplace headdress of these pegged assets tin awesome shifts successful capitalist sentiment, liquidity changes, and wide marketplace health.

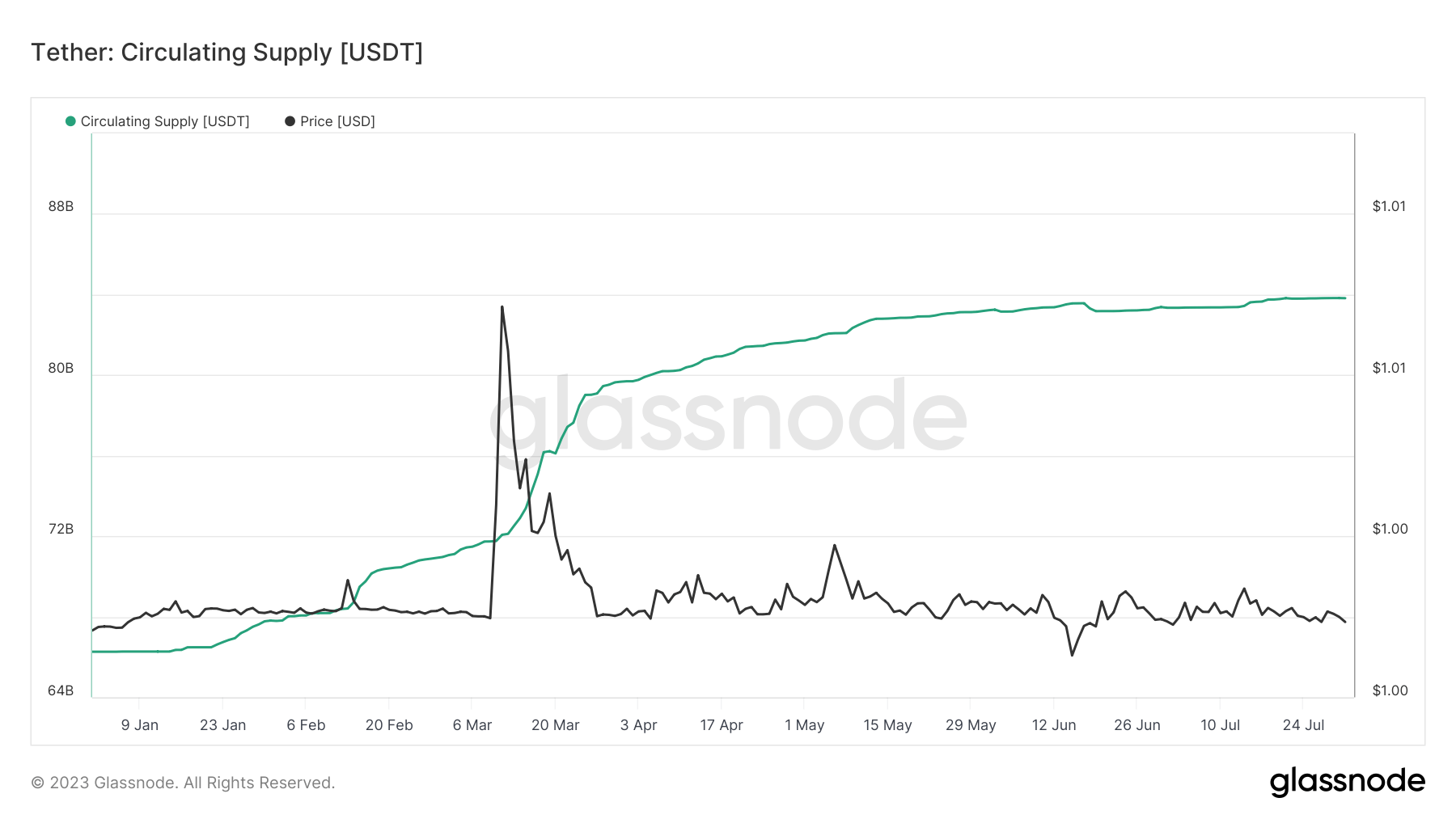

In 2023, the stablecoin marketplace witnessed a important shift, with Tether (USDT) and TrueUSD (TUSD) emerging arsenic marketplace leaders.

The proviso of USDT reached an all-time precocious of $83.81 cardinal connected July 31, surpassing its erstwhile highest of $83.16 cardinal successful May 2022. This represents a important maturation of 26.50% since the opening of the year.

Graph showing USDT proviso YTD (Source: Glassnode)

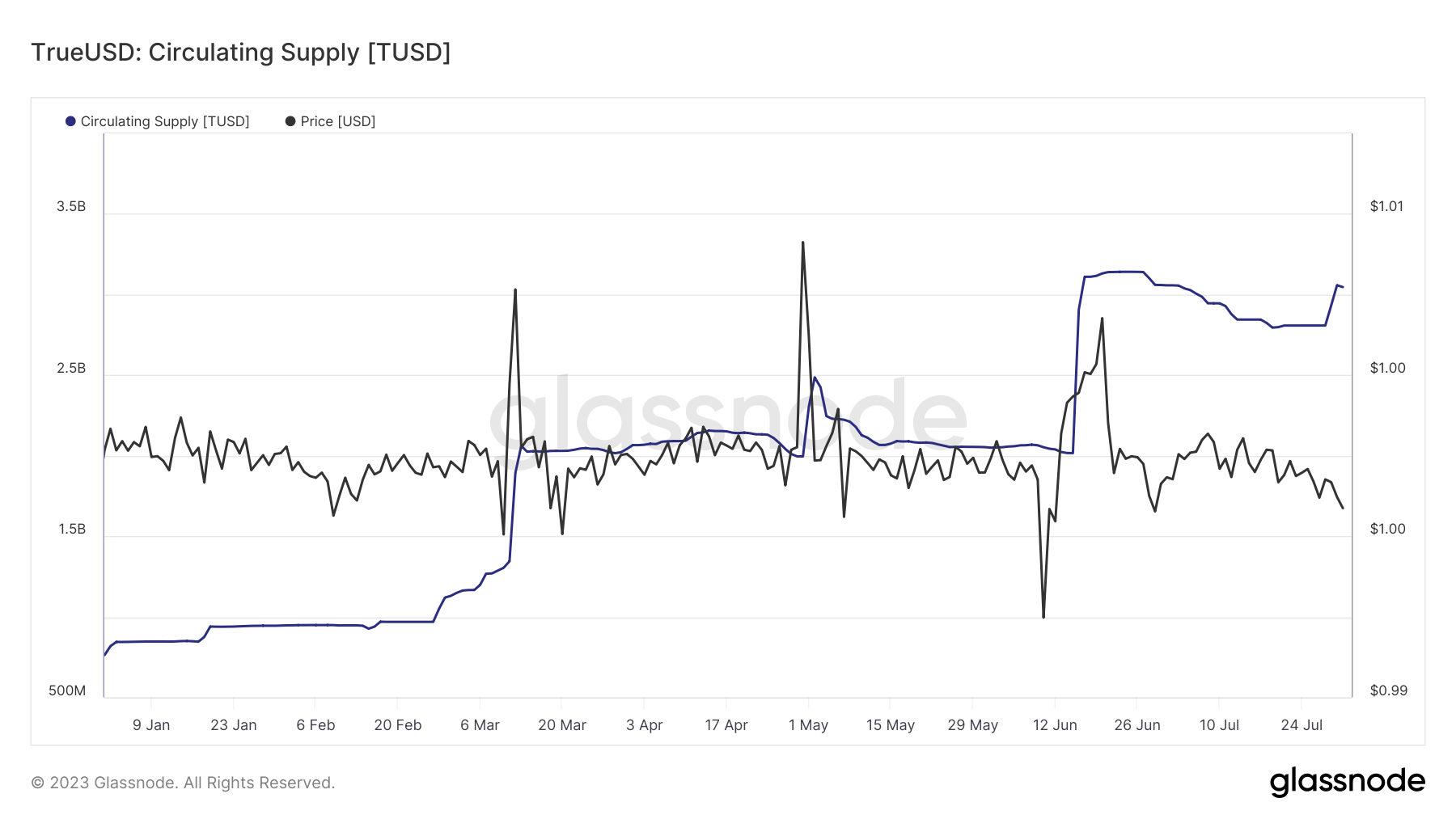

Graph showing USDT proviso YTD (Source: Glassnode)TUSD besides reached its highest connected June 26, with a proviso of $3.14 billion. The caller surge, arsenic antecedently analyzed by CryptoSlate, pushed TUSD’s proviso backmost supra $3 billion, presently lasting astatine $3.05 billion. TUSD’s proviso has grown by astir 300% since the commencement of the year.

Graph showing TUSD proviso YTD (Source: Glassnode)

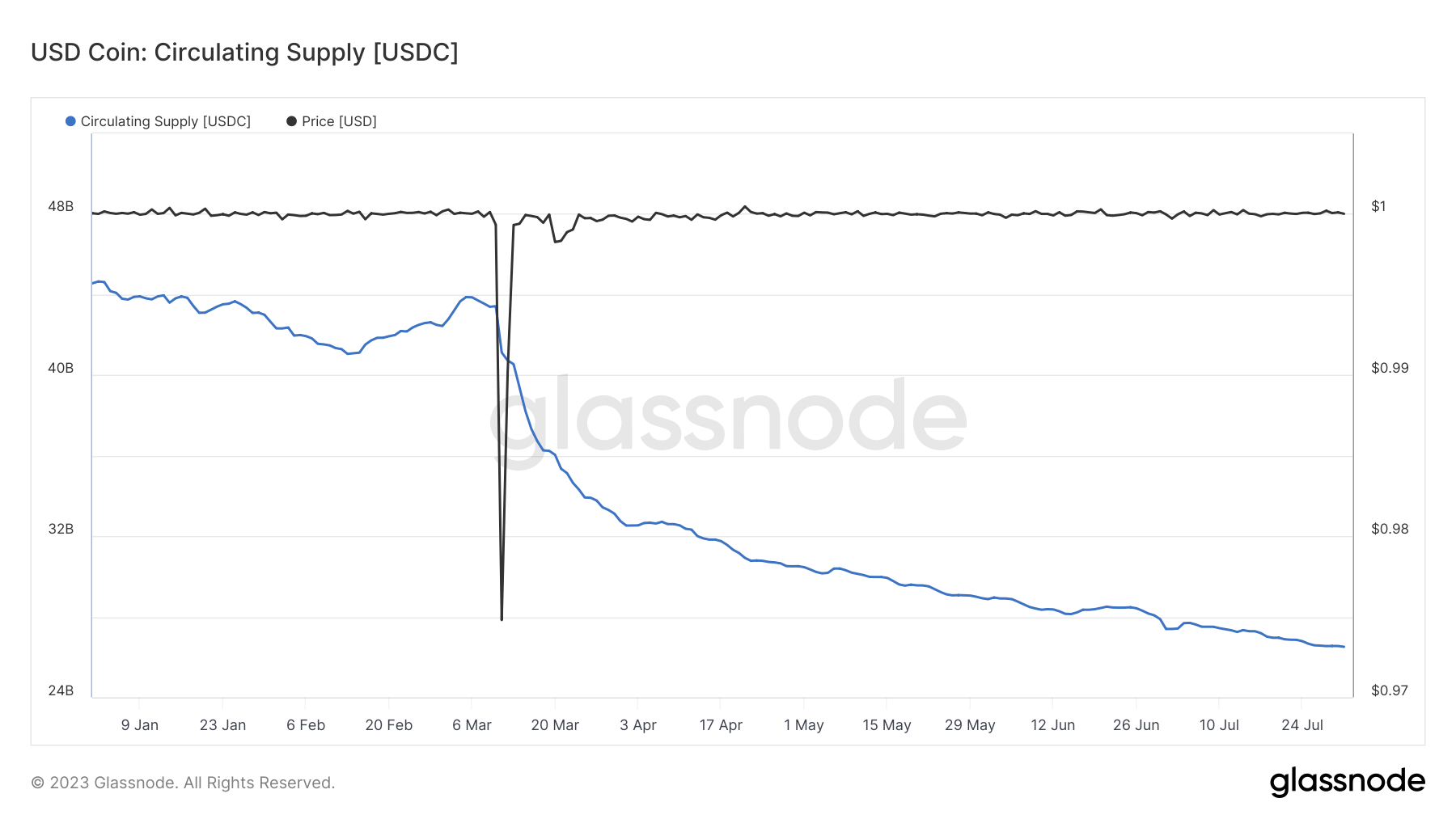

Graph showing TUSD proviso YTD (Source: Glassnode)However, different large stablecoins person experienced a crisp driblet successful their supplies. Despite a importantly higher proviso than TUSD, USDC has experienced a 40% alteration since the opening of the year, with its existent proviso lasting astatine $26.51 billion.

The driblet was exacerbated successful March erstwhile USDC concisely de-pegged, trading arsenic debased arsenic $0.97. A de-pegging event, wherever a stablecoin deviates from its pegged value, tin bespeak marketplace instability and erode spot successful the asset.

Graph showing USDC proviso YTD (Source: Glassnode)

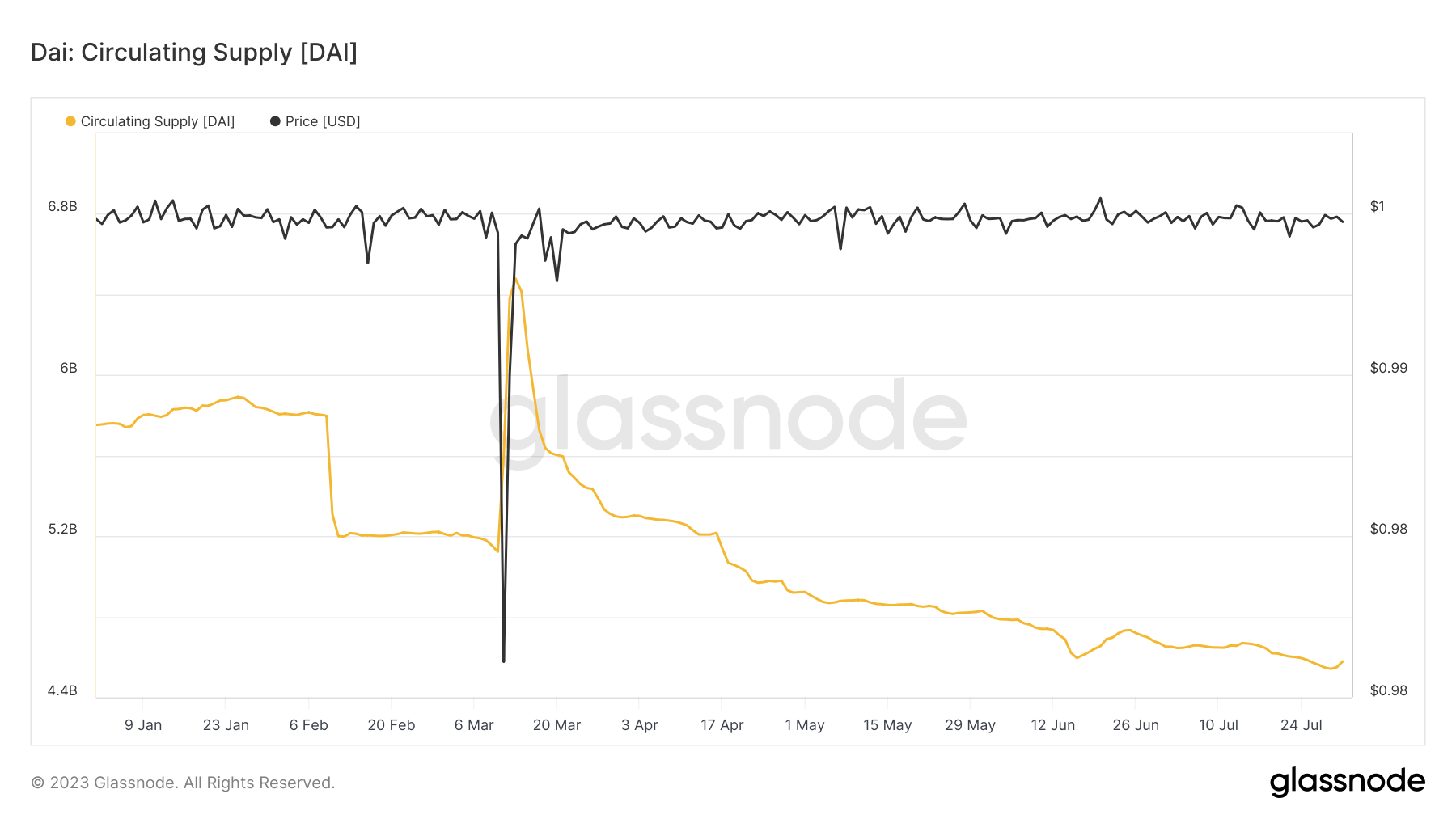

Graph showing USDC proviso YTD (Source: Glassnode)DAI, different salient stablecoin, besides experienced a de-peg astatine the aforesaid time, but its proviso initially increased. However, this summation was short-lived, and the downward inclination rapidly re-established. The proviso dropped from $5.75 cardinal astatine the opening of the twelvemonth to $4.57 cardinal connected July 31, representing a 20% decrease.

Graph showing DAI proviso YTD (Source: Glassnode)

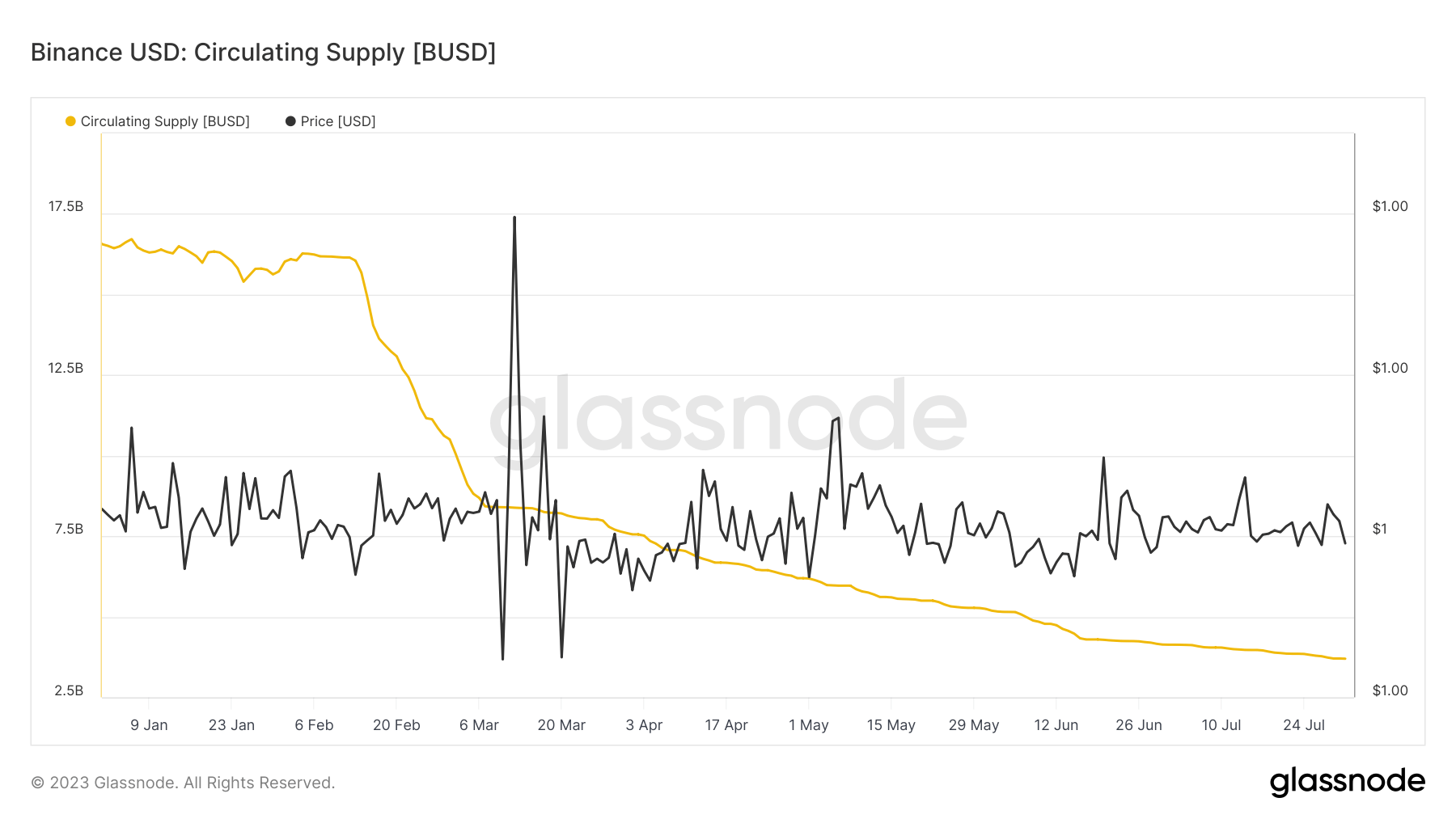

Graph showing DAI proviso YTD (Source: Glassnode)The astir important alteration successful proviso was seen successful Binance USD (BUSD), a stablecoin linked to the Binance exchange. The proviso reduced by implicit 77%, dropping from $16.50 cardinal astatine the opening of the twelvemonth to $3.69 cardinal connected July 31.

Due to a pending suit filed by the United States Securities and Exchange Commission (SEC), Paxos has stopped the issuance of the BUSD stablecoin, stating, ” Paxos nary longer mints caller BUSD, but allows customers to redeem BUSD for USD oregon person their BUSD to USDP,”

Graph showing BUSD proviso YTD (Source: Glassnode)

Graph showing BUSD proviso YTD (Source: Glassnode)These shifts successful stablecoin supplies underscore the dynamic quality of the crypto market. The emergence of USDT and TUSD, coupled with the diminution of different large stablecoins, whitethorn awesome a alteration successful capitalist penchant and trust, with much superior flowing to assets investors and traders deem safer oregon much liquid.

| 1 | Tether | USDT | $83,801,671,209 | $22,547,202,621 |

| 2 | USD Coin | USDC | $26,446,685,467 | $3,399,720,920 |

| 3 | Dai | DAI | $4,558,160,395 | $212,842,536 |

| 4 | Binance USD | BUSD | $3,667,705,148 | $1,662,534,530 |

| 5 | TrueUSD | TUSD | $3,014,429,130 | $2,937,994,931 |

The station Inside stablecoin proviso dynamics arsenic TUSD shakes up the market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)